We could not find any results for:

Make sure your spelling is correct or try broadening your search.

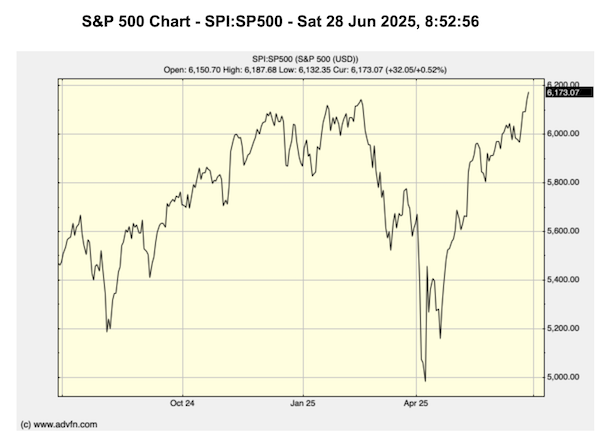

The U.S. stock market closed at record highs on Friday, marking a dramatic recovery since early April when fears of a bear market loomed.

The S&P 500 rose 0.5% to end at 6,173.07 — its first all-time high since February 19. The Nasdaq Composite also climbed 0.5%, notching its first record since December 16. The smaller Nasdaq 100, heavily weighted with tech giants, had already set a record earlier in the week.

Friday’s rally nearly stalled late in the session after President Donald Trump announced the suspension of trade talks with Canada over a newly implemented digital services tax. He also signaled a new tariff on Canadian goods would be announced within a week. While that briefly rattled investors, markets regained momentum in the final hour of trading.

The Dow Jones Industrial Average finished the day up 432 points, or 1%. Despite the gain, the index remains about 1,200 points, or 2.7%, below its own record high. Losses from major components like UnitedHealth (down 39% year-to-date), Apple, Merck, and Nike have weighed on the index.

Still, all three major indexes — the Dow, S&P 500, and Nasdaq — posted their biggest weekly gains in six weeks.

The S&P 500’s path back to record territory has been anything but smooth. From its February 19 high to the April 8 low, the index lost nearly $9.8 trillion in market value. Few expected it to fully recover just 80 days later.

Much of the market volatility was tied to escalating trade tensions. President Trump’s tariff announcements, particularly the April 2 “Liberation Day” proclamation, saw tariffs spike to as much as 50% on dozens of countries. U.S. tariffs on Chinese goods reached over 145% on some products, effectively cutting off trade with the nation.

However, market sentiment began to shift on April 9 when the administration announced a 90-day pause on those tariffs in response to warnings from financial markets. More recently, progress on trade agreements with the U.K. and China has helped restore investor confidence.

“This was a self-inflicted crisis,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “The sell-offs were unnecessary.”

Investor sentiment also improved on Friday after China signaled it would reopen its rare earth exports to the U.S. The announcement followed word from the White House that a trade deal had been reached — a breakthrough after weeks of negotiations.

Despite a 10% across-the-board tariff still in effect, along with sector-specific tariffs — 50% on steel and aluminum, 25% on autos and parts — markets have largely shifted their focus away from trade disputes.

Treasury Secretary Scott Bessent said Friday that the U.S. aims to finalize trade agreements with as many as 10 to 12 key partners by Labor Day. He indicated negotiations are ongoing with 18 countries, though he did not name them.

Much of the recent surge in stocks has been driven by enthusiasm around artificial intelligence. Explosive demand for Nvidia’s AI chips and efforts by Republicans to deregulate the industry have powered tech stocks higher. Hopes for interest rate cuts from the Federal Reserve, supported by solid economic data and subdued inflation, have also buoyed the markets.

Even after concerns emerged from the House passing Trump’s sweeping tax cut and domestic policy bill, demand for Treasury bonds has remained robust — a sign of ongoing confidence in the U.S. economy.

“Investors get it now,” said Hogan. “You’re going to hear something wild on Air Force One or on Truth Social, but everyone knows to take it with a grain of salt.”

While markets are currently riding high, risks remain.

If Congress fails to pass the domestic policy bill — which includes raising the debt ceiling — the U.S. could face a potential debt default. Additionally, if no further trade deals are reached, tariffs could rise again after the current pause expires on July 9.

Geopolitical tensions also linger. A fragile truce between Israel and Iran remains at risk, and existing tariffs may contribute to rising prices, threatening economic growth.

There are subtler threats as well. Stock valuations are now stretched: the S&P 500’s price-to-earnings ratio has surged past 23, indicating that shares are expensive relative to earnings.

Investors celebrated Friday’s milestone, but with challenges on the horizon, the market’s rally may face turbulence in the weeks ahead.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions