We could not find any results for:

Make sure your spelling is correct or try broadening your search.

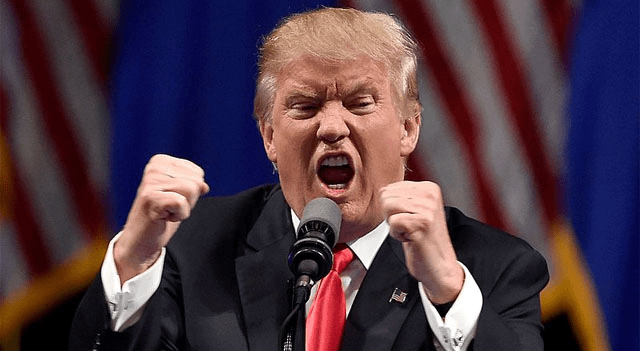

Donald Trump did not wait for the two-week deadline he had given Iran on Thursday to avoid U.S. airstrikes. Instead, just two days later, he ordered a direct attack on the Iranian nuclear facilities at Fordow, Natanz, and Isfahan, bypassing Congress altogether, prompting calls for impeachment proceedings.

Despite what appeared to be an extraordinary rally, the markets barely reacted. On Monday, the futures of the major U.S. indices — the S&P 500, the Dow Jones, and the Nasdaq — opened in positive territory, while oil prices started to decline. Even news of an attack on a U.S. base in Syria’s Hasakah province failed to unnerve investors.

The muted response reflects hope that the worst of the conflict has passed, and that Iran may have limited capacity to retaliate. As for the threat of Iran closing the Strait of Hormuz, doing so would cut off its own vital oil revenues, invite a far harsher U.S. response, and leave Tehran even more isolated in the region.

So, for now, markets do not seem to believe that the latest flare-up in the Middle East could have devastating long-term consequences for the global economy. However, should a collapse of logistics chains occur, market sentiment would deteriorate sharply, with risk assets down and defensive assets up.

The problem is that even if this particular flare-up subsides, deeper structural threats persist.

In particular, unresolved trade wars continue to drag on without significant progress, and time is running out. Meanwhile, Washington is increasing pressure on technology: the U.S. threatens to revoke exemptions that allow companies like Samsung, SK Hynix, and TSMC to run Chinese factories with U.S. technology.

Add to this the signs of a slowdown in the U.S. economy. In May, retail sales fell by 0.9% MoM, consumer enthusiasm, which had been ignited by tariffs in March and April, faded, and industrial production fell by 0.2% MoM after rising by 0.1% in April. Against this backdrop, the market’s persistent optimism seems less justified.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions