We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Raspberry Pi Holdings plc (LSE:RPI) shares rallied sharply on Tuesday after Chief Executive Officer Eben Upton disclosed the purchase of additional stock in the company.

By 11:40 GMT, the shares were up 27.6%.

A regulatory filing published Monday showed that Upton bought 4,684 ordinary shares at an average price of £2.82327 each, representing a transaction worth roughly £13,224. Following the acquisition, his total holding rose to 2,591,136 ordinary shares.

The trade was carried out on the London Stock Exchange’s Main Market and reported in line with rules governing dealings by Persons Discharging Managerial Responsibilities (PDMR).

Market participants often interpret insider buying—particularly by senior executives—as a vote of confidence in a company’s outlook. Upton’s decision to expand his ownership stake appeared to fuel a strong positive reaction among investors.

The purchase was completed on February 16, 2026, according to the company’s regulatory notice. Raspberry Pi’s ordinary shares carry a nominal value of £0.0025 each.

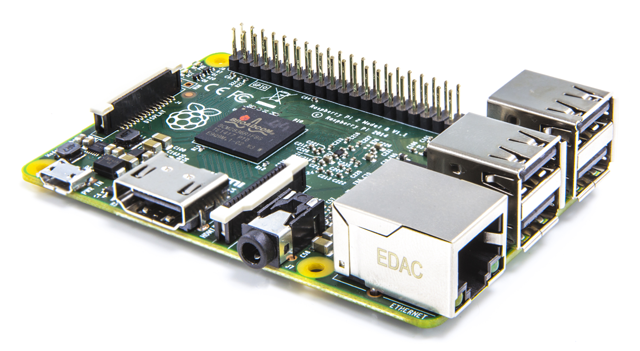

Raspberry Pi manufactures low-cost computing devices widely used by hobbyists, educators and software developers around the globe.

This article was written by the editorial team at InvestorsHub/ADVFN and is provided for informational purposes only. In some cases, editorial staff may use artificial intelligence–based tools to assist in the research, drafting, or editing of content, under human review and oversight. This article does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on publicly available information believed to be reliable at the time of publication, but accuracy or completeness is not guaranteed. Readers should conduct their own independent research and consult a qualified financial professional before making any investment decisions.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions