We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Price levels work in cycles, with both peaks and troughs. The Detrended Price Oscillator is used to identify turning points/end of trends by isolating short-term cycles. It can be hard to see cycles in the price level and so the Detrended Price Oscillator attempts to 'filter' out the unwanted 'noise', and focus on the true underlying trend(s). Thus allowing us to locate overbought and oversold areas. The Detrended Price Oscillator looks at the variation of the price level from a Moving Average (the period of which can be changed under "edit").

Parameters: Period.

For additional help on what the different parameters mean, that isn't included on this page, click here.

Detrended Price Oscillator

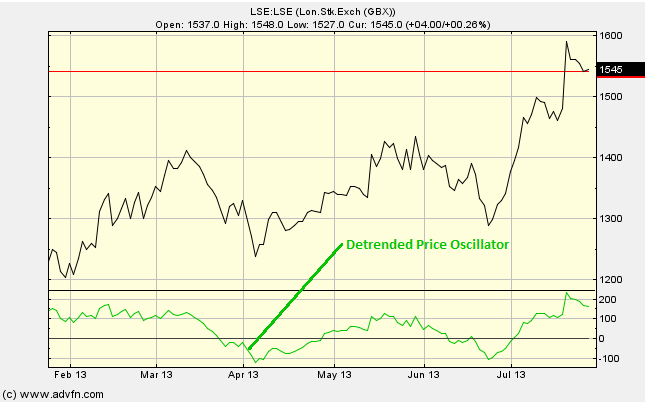

Here is an example of the Detrended Price Oscillator chart study (on a London Stock Exchange graph)

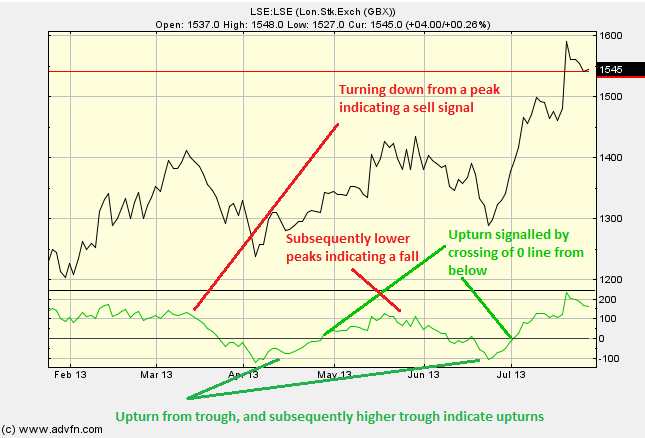

Signals are when the Detrended Price Oscillator crosses the zero line, and/or turns up from a trough or down from a peak. Oversold signals indicating to buy can be crossing of the 0 line from below and/or turning up from a trough (or subsequently higher troughs). Conversely, overbought signals indicating to a sell can be crossing of the 0 line from above and/or turning down from a peak (or subsequently lower peaks).

Reading the study:

Here is an example of the Detrended Price Oscillator and the price line (of the London Stock Exchange), and what it may indicate

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions