Donchian Channels are a volatility indicator, much like some of the other Bands/Channels, such as the Bollinger Bands and the Keltner Bands. We see an upper band, a lower band, and the centre line. The upper band is the highest high for the selected periord (period adjustable under 'edit'), and the lower band is the lowest low for the selected period. The center line is simply the average of these two bands, note it is not the Simple Moving Average.

Parameters: Period.

For additional help on what the different parameters mean, that isn't included on this page, click here.

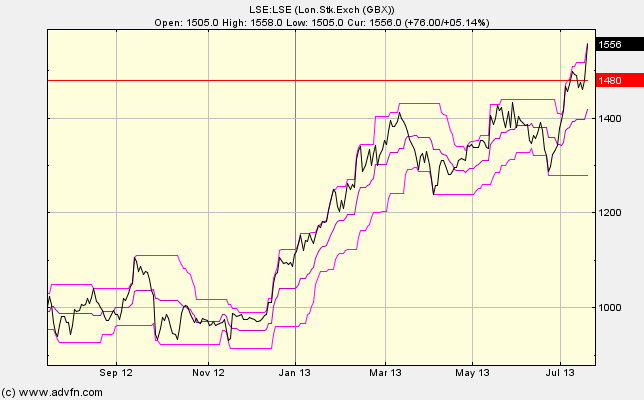

Donchian Channels

Here is an example of the Donchian Channels chart study (on a London Stock Exchange graph)

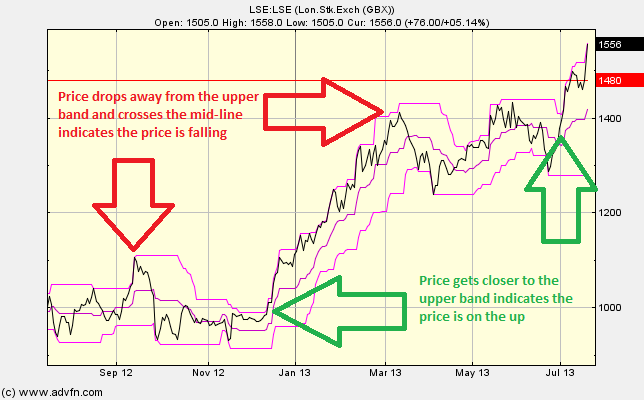

When the price line gets closer to either the upper or lower channel, then this can sometimes be a good buy/sell indicator. When the price gets closer to the upper band then this could indicate that the price is on the up, and vice versa. In addition, the mid line could be used similarly to the Simple Moving Average, when the price is below the mid line this may indicate a downtrend, and conversely while the price is above the mid line, this may indicate uptrend.

Reading the study: Donchian Channels

Here is an example of a the Donchian Channels with the price line (of the London Stock Exchange), and what it may indicate

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions