We could not find any results for:

Make sure your spelling is correct or try broadening your search.

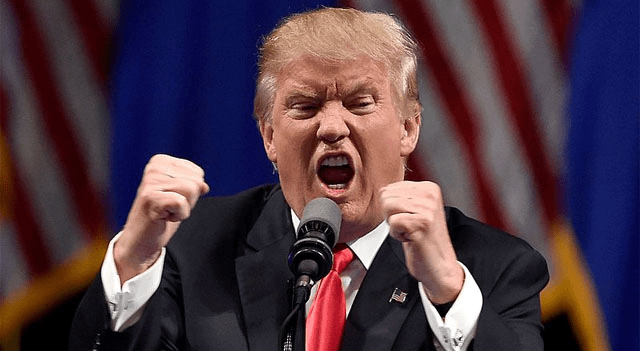

The 19th-century idea of “America for Americans” is back in the spotlight. Washington seems to be reaffirming its claim to control political and economic processes in the Western Hemisphere, drawing a clear red line against foreign powers such as China and Russia.

The first move under this renewed approach wasn’t a behind-the-scenes regime change through a so-called “color revolution,” but a military operation in Venezuela, involving the abduction of the president and his wife. And judging by Trump’s comments, interventions in Cuba, Colombia, or even Mexico could follow.

The ethics of this move remain a matter for Congress to debate, but several countries have already openly condemned it. Whether those objections matter is another question. What matters is that, historically, U.S. interventions in the region have rarely improved living standards.

What about the markets?

On the one hand, rising geopolitical tensions could boost demand for safe-haven assets, especially non-dollar assets such as gold (XAUUSD). Silver (XAGUSD), platinum (XPTUSD), and other precious metals could follow. In fact, they already opened higher on Monday.

As for the oil market, a sharp drop in prices is far from guaranteed.

Although Trump has never hidden his interest in Venezuela’s vast mineral and oil reserves — or his belief that U.S. oil companies were unfairly pushed out after the industry was nationalized — Venezuela’s oil infrastructure is largely in disrepair, and the regulatory environment remains uncertain. As a result, despite holding the world’s largest proven reserves, it is unlikely that Venezuelan oil will return to global markets in significant volumes in the short to medium term, limiting its ability to meaningfully influence global supply or ease upward pressure on oil prices.

When it comes to the stock market, assuming the U.S. has achieved its objectives and no further operations in Venezuela are planned, this could actually be a mildly positive factor for the S&P 500. Historically, however, the index’s reaction to U.S. interventions in Latin America has been relatively limited.

That said, it all depends on how the situation evolves. What would happen if China decided to intervene? Or if Latin American countries attempted a coordinated response?

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions