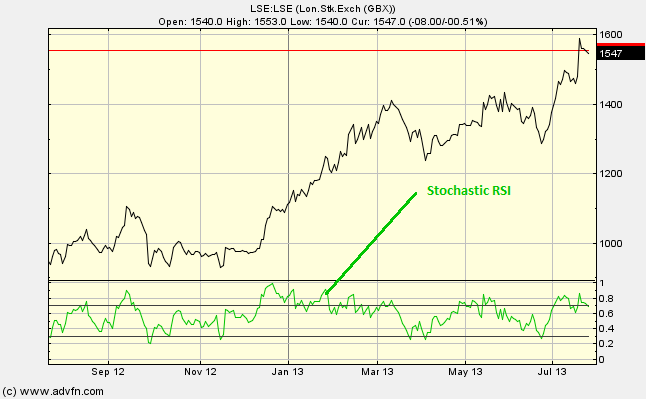

Stochastic RSI ranges from 0 to 1 and can be seen in the bottom on the chart. This chart study is used as an indicator of over-buying and over-selling. Here we use Relative Strength Index (RSI) values but with the Stochastic formula.

Parameters: Period.

For additional help on what the different parameters mean, that isn't included on this page, click here.

Stochastic RSI

Here is an example of the Stochastic RSI chart study (on a London Stock Exchange graph)

When the Stochastic RSI value drops below 0.2, this may indicate an oversold signal, and the short-term direction of the price level may be about to change.

Vice versa, when the Stochastic RSI value rises above 0.8, this may indicate an overbought signal, and could be used as a 'pullback' signal i.e. a sell signal.

Reading the study:

Here is an example of the Stochastisc RSI and the price line (of the London Stock Exchange), and what it may indicate

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions