A measure of movement of the market, or of an investment within a market.

Similar, but not to be confused with, Standard Deviation. Volatility measures the degree of change of an individual investment (or market as a whole) over a set period of time. The more change, the more volatility that stock/investment/market is. This chart study looks at the volatility in the past, and we then use this to try and predict the expected future volatility.

The more volatile an investment is, the more risky it is. This can be good and bad. For example, a volatile investment will rise above the market during an uptrend, but fall below it during a downtrend. An investment with low volatility will not rise as much as the market during an uptrend, but then will not fall as much (or at all) during a downtrend.

You can adjust the number of periods that the volatility (Standard Deviation) is calculated over under 'edit'.

Parameters: Period.

For additional help on what the different parameters mean, that isn't included on this page, click here.

Volatility

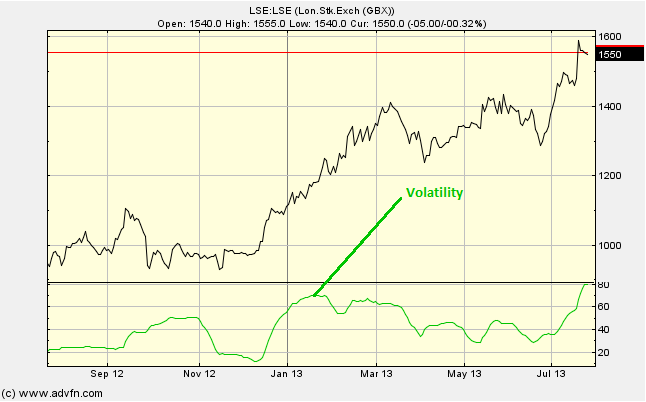

Here is an example of the Volatility chart study (on a London Stock Exchange graph)

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions