We could not find any results for:

Make sure your spelling is correct or try broadening your search.

A Penny Stock is a share that trades for pennies rather than pounds or dollars. The term is most commonly used in the USA, but is also applied to smaller companies on the LSE, particularly those listed on the Alternative Investment Market (AIM).

An example of a penny share in the UK is Bullabilling (LSE:BGL). The opposite of a penny stock would be a company whose shares trade for pounds or dollars. An example in the UK is BP (LSE:BP.).

| Bullabilling 1 Year Chart | BP 1 Year Chart |

One term you may hear a lot when discussing penny shares on the ADVFN Bulletin Boards is "ten bagger". This is a stock that the investors think and hope will go up 10 times in value, from 1p per share to 10p per share, for instance.

This does occasionally happen, but they are quite rare. An example of a recent ten bagger on the LSE is Gulf Keystone Petroleum (LSE:GKP) which rose from 5p per share up to 90p in the space of only 6 months back in mid 2009. It went on to hit a high of 425.25p in early 2012, but has since fallen back.

Unfortunately, for every successful ten bagger there are many unsuccessful stocks, investments that don't rise and rise, but fall and fall. The price you get into a stock has a great bearing on whether you would regard it as a ten bagger. If you bought GKP at 425.25p and were still holding you would not be nearly as immpressed as someone who bought all the way back at 5p.

| Gulf Keystone 7 Year Chart | GKP 2 Year Chart |

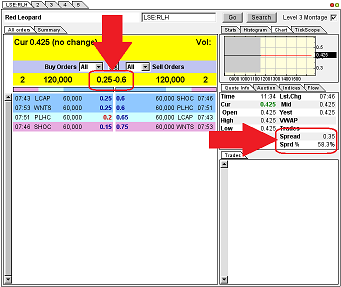

Penny shares often have wide spreads compared to other shares, meaning that the gap between the bid and offer prices are relatively wide, in percentage terms.

In the example to the right we can see the Level 2 screen for Red Leopard (LSE:RLH). It shows the Bid and Offer prices, 0.25p and 0.6p. This is a spread of 0.35p, over 58%. In contrast, at the time of writing the Bid and Offer for HSBC (LSE:HSBA) were 621.1 and 621.3. This is a spread of 0.2, but is only about 0.0003%, much smaller compared to Red Leopard.

As a potential investor in Penny Stocks the spread becomes very important to your return. From the examples imagine you buy £1,000 of each stock. That's 166,667 shares in Red Leopard and about 161 shares of HSBC.

If you bought at the Offer price and immediately sold at the Bid, your HSBC shares would get you £999.67.

If you decide to immediately sell your Red Leopard shares at the Bid price, 0.25p, you would get £416.67 from your initial £1,000 investment.

When investing in Penny Stocks always look at the Bid and Offer and take the spread into account.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions