What year is it while you read this article? Are you still living on the Earth? Well, if so, we’re sorry to hear that. The last couple of years on this planet haven’t been too inspiring. But we do have some good news – this text could prove useful for you. We reviewed some companies in the space industry – and it’s looking like a win-win situation. You can either make profit, or speed up development of a technology that can take you to some other planet, or both. Let’s learn to fly.

Not only do all the companies we’ve included in our list enhance the likelihood of space tourism, but may also significantly increase in value over the next 12 months, judging by multiple analysts’ reviews.

However, it doesn’t mean that you can’t do your own rating using stock screener and sort stocks by hundreds of different criteria and indicators.

Before getting behind the wheel or strapping into a passenger seat, we need to build a route. And there are many companies ready to help us do that (and maybe even help us gain some profit). Actually, it’s not only about the route. It’s about hundreds of satellites – this is the new hot thing.

Space traditionally used to be a government-run and controlled sphere. But nowadays, there are more and more private companies having gigantic fleets of nano-satellites. These mechanical little guys are cheaper, smaller, and less cumbersome than their ancestors. It means that the data received from these satellites becomes more accessible and can be used by a greater number of businesses, researchers, governments, journalists, etc.

Making mention of ESG won’t go amiss. After all, it’s just as capable of influencing as business development. Satellites give access to photos of Earth and processed data, which can help us monitor changes happening on our planet. And that’s what might be useful to individuals when it comes to investing – it comes in handy when controlling compliance with ESG standards.

The first in our list is Spire Global. These guys introduce themselves as the space company focusing on the future of Planet Earth. In other words, Spire makes low-earth multi-use receiver nano-satellites that collect various data and help to forecast weather conditions, track planes and ships, etc. Companies can get this data through a subscription – yep, it’s almost like Netflix, but instead of Tim Burton’s latest creation you get to see very expensive photos coming directly from space.

In the third-quarter 2022 report, Spire has shown record revenue – increasing by more than 110% in relation to the same period of 2021. Also, revenue has grown quarter-by-quarter. It’s happening as a result of steady growth in the number of new clients and volume data for long-established ones. At the same time, Spire Global has reported losses per share that are lower than market expectations.

As you can see, the stock has its own pros and cons. But most analysts consider SPIR to have a great future. The average forecast is up to a 222% gain in the next 12 months. Looks skyrocketing, right? Pardon the pun. But this stock might be volatile, so it’s worth proceeding with caution. You could also try to make profit in the short-term by looking at after hours movers in the American market.

The other owner of a nano-satellite armada is Planet Labs. It’s got more than 200 devices in space taking pictures of different parts of Earth – giving tourists at the tower of Pisa a run for their money. These images help to find insights into the daily rate of change on Earth and can be used in agriculture, forestry, mapping, government, and other industries.

Analysts around the world believe that Planet Labs could be a pretty promising investment. The average forecast is about 106% in the next year.

Another company bearing a title of one of the world’s leading satellite owners and operators is SES. We are not going into details, because the only thing one should know is that there is actually something to look forward to. The forecast for SES is albeit a little bit less impressive than the previous company has — yet still up to 53% in the next 12 months looks rather impressive.

Of course, that doesn’t mean that Spire Global or Planet Labs will show better results. You might have already realized that the satellite industry is very competitive. Therefore, you need to do your own research on each company before investing in one of them.

Now we know the data that is used to find out more about Earth and its immediate surroundings. So, we need a rocket – a cool red rocket with Wi-Fi, a powerful audio system and an AI operating system that can talk to you with Scarlett Johansson’s voice from Her. To be honest, we’re not sure that modern spacecraft manufacturers are developing something like that, but we’re not giving up hope.

For that dream to come true, Rocket Lab would probably be the company to do it. They are engaged in the development of rocket launch and control systems for the space industry (including the defense sector).

This company’s revenue in the third quarter is ten times bigger than at the same period of 2021. It’s a record result for Rocket Lab, but the company is still unprofitable. What could change this situation? Satellites, of course! Yep, Rocket Lab has joined the club.

Additionally, many experts consider Rocket Lab stock to be undervalued right now. Especially if we keep in mind that the papers dropped by about 70% this year. Maybe that’s the reason why average forecast for the next 12 months are +170%.

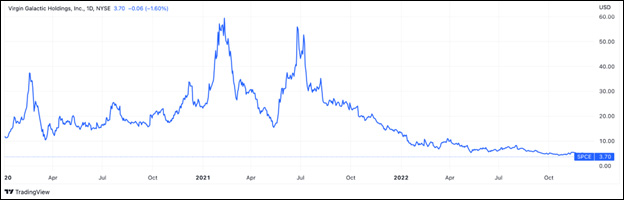

And, of course, this article couldn’t be written without mention of Virgin Galactic. The company used to be the big dog of the market several years ago and it had a fair few highlights. The founder Richard Branson even flew to an altitude of nearly 90 km (56 miles) above the Earth in the autumn of 2021. But when we look at the chart of the Virgin Galactic stock, we can see that it didn’t really help to turn the scale.

It’s hard to say what will be the next movement. On the one hand, the company’s financial reports have been far from perfect. On the other, if the company reaches its goal and launches tourists to space, it might reach a new all-time high.

Also, we shouldn’t forget that this stock might be volatile, so it presents an opportunity for profit. Analysts’ opinions prove this statement because their expectations vary a lot, ranging from –18% to +224% in the next year. The average forecast however is 57%.

So, there you have it. Now you have a whole bunch of spacecraft manufacturing companies (a disclaimer: we didn’t include in this list the companies participating in the space race like Boeing or Amazon as it’s not their main line of business). But please don’t forget to do your own research before buying any papers. And be sure to check your passport expiry date before that flight to Mars.