The end of the bear market?

Market noise finally decreased, returning to normal after weeks of panic due to the coronavirus. Now, this can be explained by two facts:

- The beginning of clinical trials of experimental drug to treat COVID-19 in Europe and the U.S. In the case of the first, it includes the trial of antiviral drugs Remdesivir (used to treat Ebola), Lopinavir/Ritonavir (used to treat HIV/AIDS) and hydroxychloroquine (used to treat malaria).In the U.S., the state of New York acquired 70,000 doses of hydroxychloroquine, 10,000 doses of zithromax and 750,000 doses of chloroquine. Russia’s Federal Biomedical Agency on Saturday said it has developed a drug for the treatment of COVID-19.Hopefully, these drugs will actually work and we see a decline in the mortality rate. Still, it is worth reminding that an actual vaccine to treat COVID-19 is estimated to be at least a year away, and no drug has been approved to treat the virus yet.

- The Senate on Wednesday approved a historic, $2 trillion stimulus package in order to save the economy from falling further. The plan would provide up to $1,200 in a paycheck for American adults, create a $500bn lending program for businesses, cities, and states and a $367bn fund for small businesses. Besides that, $130bn will be directed to hospitals and expands unemployment insurance.

The Italian government also announced big spending plans. With this fiscal stimulus, countries aim to provide a boost to the economy by putting more cash in peoples’ hands or taking less money from them, by cutting taxes.

In this context, it shouldn’t be a surprise that last week, S&P 500 grew 10,26%, Nasdaq Composite gained 9,05%, Industrial Dow Jones improved 12,84%, UX 100 Index went up by 6,16%, DAX registered a 7,88% increase, whereas Euro Stoxx 50 Index finished the week in +7,07%. Nikkei 225 skyrocketed 17,14%, while the Hang Seng Index grew 2,98%. Finally, the Russian Moex Index increased 2,98%, whilst Spanish Ibex 35 was up 5,19%.

Unfortunately, countries’ ratings weren’t so lucky. By implementing fiscal policies and spending massive amounts of money and lending plans, some of them saw an adjustment in credit ratings… Curiously, despite the $2trillion stimulus plan, credit rating for the US haven’t changed yet. Mexico sovereign rating, in turn, saw a downgrade from S&P to BBB, from BBB+. Italy may be the next country to see rating adjustment.

The UK’s credit rating has been also downgraded, to AA- from AA due to the budget impact of the coronavirus outbreak and Brexit uncertainty. Credit rating agency Fitch has forecast that the UK’s economic output would drop by almost four percent for the year.

South Africa has been also downgraded to junk status. According to Moody’s, the move reflects “continuing deterioration in fiscal strength and structurally very weak growth. Unreliable electricity supply, persistent weak business confidence, and investment, as well as long-standing structural labor market rigidities, continue to constrain South Africa’s economic growth.”

Multiple companies can also see credit rating downgrades soon. So far, it happened to Delta Airlines and Ford, whose bonds are now officially junk-rated.

Regarding data. The PMIs confidence indices suffered a sharp drop, especially in the services sector, which is worrying since they do not contemplate a whole month of restrictions. The most important data was that the number of unemployment claims in the US has multiplied by 11 with 3.3 million more unemployed.

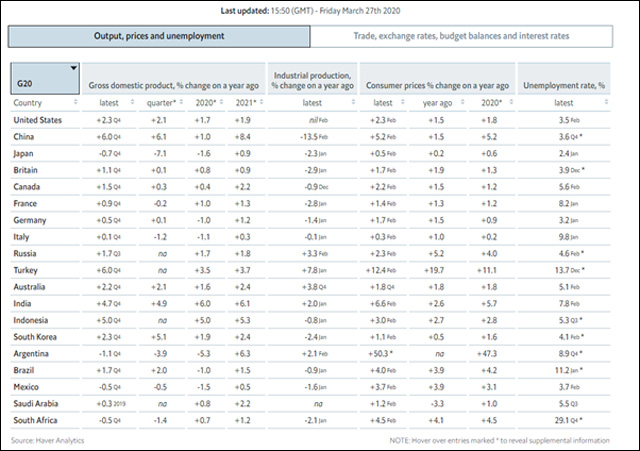

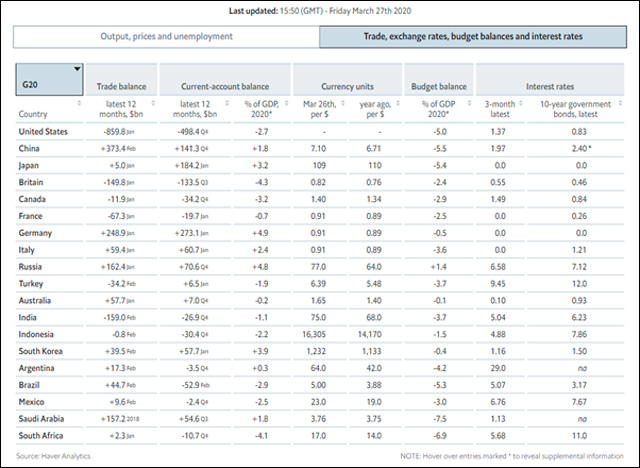

Macroeconomic data

According to Russellinvestments, the equity markets that have been hardest hit by the COVID-19 crisis should be those that benefit the most from the eventual rebound. U.K. and Eurozone equities are attractively valued. Europe’s high weighting to cyclical stock should help it outperform in the recovery.

Hot Features

Hot Features