2019 – sticky bull market defies expectations

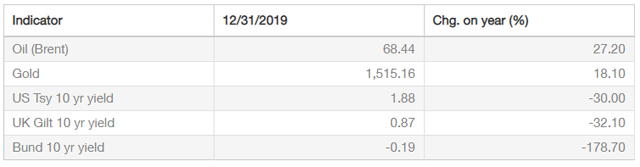

There was plenty to worry about in 2019, though this did not stop risk assets having a year that would have defied all but the most optimistic forecasters. The initial trigger came from the US, where the central bank performed a U-turn, abandoning planned interest rate increases. Gold also had its best run in years.

- The year ended with a tense stand-off between the US and Iran that served as a reminder that relative geopolitical calm should not be taken for granted. This helped to boost the price of oil.

- The UK gave the Conservative government an emphatic parliamentary majority to carry out Brexit, though many uncertainties remain. The non-election of Corbyn and the absence of a hung parliament drove flows into UK assets.

- The shine returned to technology stocks in the US while, in China, a new breed of technology companies are challenging incumbents in a manner the US has not witnessed.

For 2020, caution is still the watchword with high asset values, ongoing trade disturbances, a US Presidential election and an unclear path on Brexit lurking.

At QuotedData we:

- Launched an enhanced real estate service that includes monthly, quarterly, annual and thematic writeups – you can refer to these for news and analysis of property funds;

- Published 52 notes on investment companies, 15 more than in 2018, as well as our regular monthly and quarterly publications;

- Updated the second edition of our Independent Guide to Investment Companies (if you know anyone who is considering investing in investment companies for the first time or who wants to deepen their understanding, please do pass this on); and

- Deepened our relationship with Master Investor, the biggest UK private investor show – we’ll be at their show at the Business Design Centre in Islington on 28 March 2020, and many others around the country.

The sector at the end of 2019

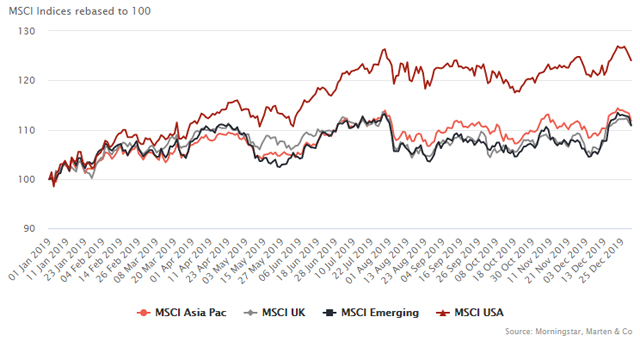

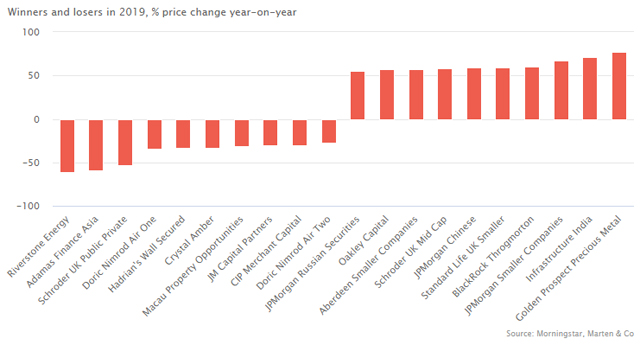

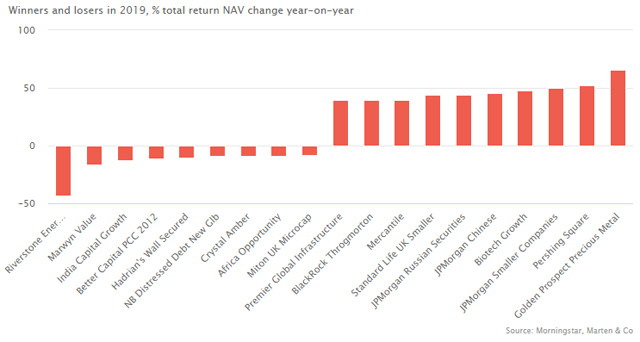

The investment companies sector generated an average price return of 14.3% in 2019, reflecting a strong year for equity markets globally (the MSCI World Index increased by 22.7% – see Figure 4).

You will notice some changes in the AIC’s list of sectors above, following a review over the first half of 2019. One of the great things about the investment companies industry is that it is constantly evolving. Whole new investment areas open up and some old investment ideas become unfashionable and wither away. It makes sense therefore to conduct a wholesale review of the sectors and classifications every couple of years. Some of the main re-classifications were in the debt and property sectors (highlighted in Figure 1) – click here to read more on the changes.

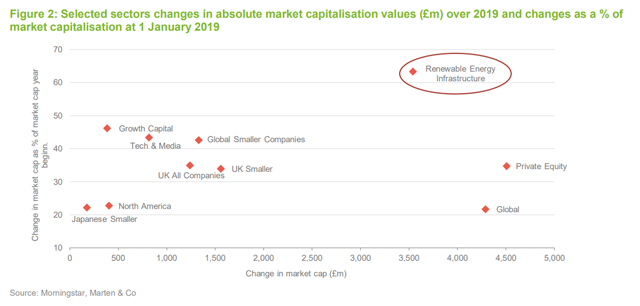

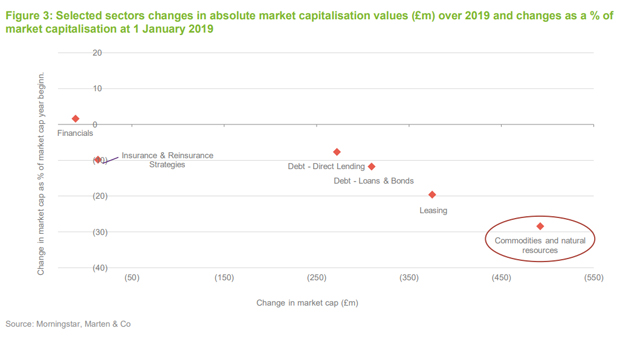

The sector grew by £29.1bn over the course of 2019, with market movements accounting for most of that. Figures 2 and 3 plot the absolute and relative changes in sector sizes – renewables energy infrastructure, private equity and global sectors grew the most in value, with renewables making the biggest leap as a percentage of market capitalisation at the start of the year. Elsewhere, the commodities and natural resources sector shrunk the most while leasing was heavily affected by Airbus’s decision to end production of A380 jets

Several renewables funds launched in 2019

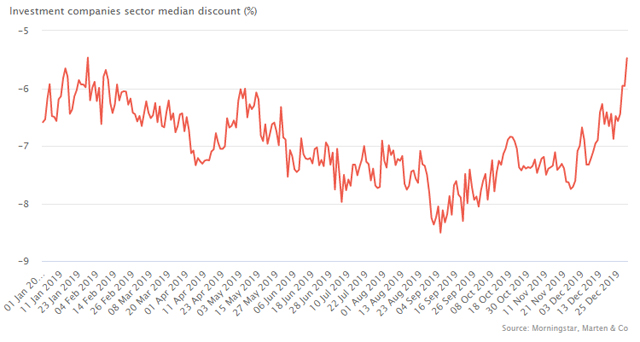

The median discount for investment companies as a whole narrowed from (6.6%) to (5.5%). This does not tell the whole story though as the discount had widened to (8.5%) at the beginning of September.

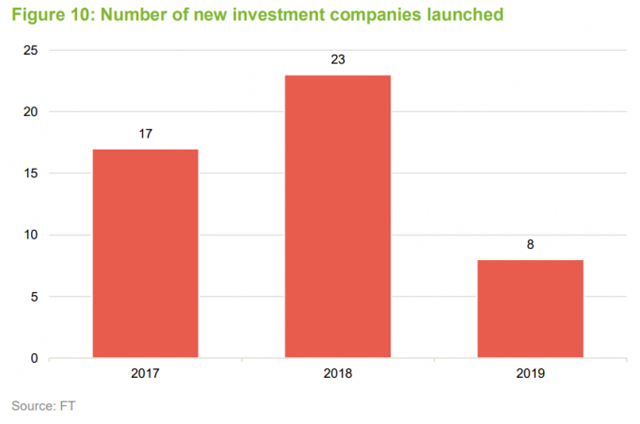

Only 8 new investment companies came to market over 2019, down from 23 the year before. The launches, which were dominated by renewables-focused strategies, brought in £1.3bn of new money. By comparison, existing funds actively brought in new capital in the secondary market, raising a record £8.6bn. In aggregate, net inflow came to £7.3bn with outflows led by several funds that bought back shares through the year as they carry out managed wind-downs.

Performance Data

The US had yet another excellent year supported by the relative strength of its economy and a renewed commitment by the Fed to continue setting very accommodative monetary policy. Elsewhere, Russia sparkled, flying somewhat under the radar, although we did draw attention to it in our most recent note on JPMorgan Russian Securities.

Russia had a phenomenal year

Brazil bounced following the election of Bolsonaro while China also had an excellent year with its thriving tech ecosystem catching the eye while a growing willingness to adopt shareholder friendly reforms helped boost Japan. India had a mediocre year with the re-election of Narendra Modi only providing a short-lived bounce. Among the underperformers, Argentina had a particularly poor year following its August debt default.

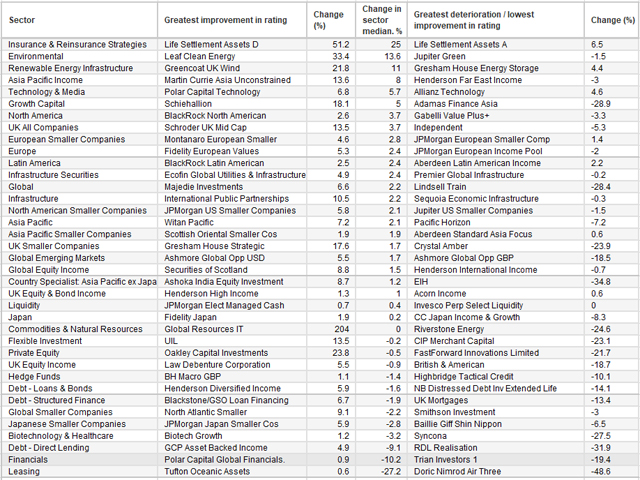

Performance by sector and fund

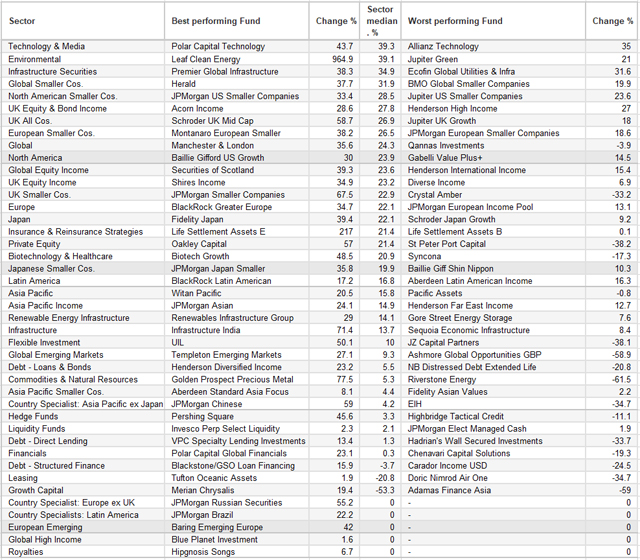

The figure below shows how the major investment company sectors performed over the course of 2019 in price terms (ranked by changes in sector medians), and the best and worst funds in each category. Compared to 2018, where nearly every sector lost money on average over the course of the year, only the debt – structured finance, leasing and growth capital did so over 2019. The Debt – Structured Finance sector had an average beta of just 0.2, indicating that its performance is very loosely related to the wider market, while the leasing and Growth Capital sectors were brought down by idiosyncratic factors, including the collapse of Woodford Investment Management, in the case of the latter.

Polar Capital Technology’s strong showing reflected the performance of mid-cap holdings like AMD, as well as the portfolio’s overweight exposure to software-as-a-service businesses. Allianz Technology also performed well with its positioning on the right-hand-side of the table reflecting the fact the technology and media sector only has two constituents.

The surge in Leaf Clean Energy shares was in response to a favourable ruling by the Delaware Supreme Court relating to a contractual dispute case with Wind LLC. Jupiter Green closed the year strongly having earlier been weighed down by its underweight allocation to the US as well as stock selection.

Infrastructure Securities also only has two constituents. Premier Global Infrastructure outperformed Ecofin Global Utilities and Infrastructure, helped by its split capital structure (which magnifies NAV returns), in what was a strong year for the sector. Both companies closed out the year strongly after the threat of a Corbyn-led government and potential nationalisation were averted.

The global smaller companies sector had an excellent year with Herald leading the way. A general market recovery and a recovery in global technology stocks were catalysts. Herald’s UK and US portfolios have both benefitted from a wave of takeover activity, allowing the trust to lock in significant gains on these positions. BMO Global Smaller Companies had less joy and its discount widened slightly.

JPMorgan US Smaller Companies had a good year as the US overcame earlier fears the bull market was about to end. Jupiter US Smaller Companies delivered strong absolute gains.

Like several UK-focused sectors, the two-company equity and bond income sector closed the year very strongly. Acorn Income, which invests in smaller companies, fixed income securities and listed investment companies marginally outperformed Henderson High Income. Acorn’s main sector exposures are to industrials and financials, while Henderson High Income’s portfolio blends household names, like Diageo and BP with smaller companies.

Going into the fourth quarter, performance wise, there was little to choose between Schroder UK Mid Cap and Jupiter UK Growth. Schroder UK Mid Cap, which focuses its research on the FTSE 250 Index, closed the year as the sixth best performing investment trust overall, with its discount narrowing considerably.

Montanaro European Smaller’s ability to unearth gems in less well researched markets, like some in Scandinavia, saw it deliver the sector’s best NAV return by a distance (and a tightening of its discount). JPMorgan European Smaller Companies fared less well, with its discount narrowing the least in the peer group.

Manchester & London led the global sector (which it moved into following the AIC’s sector review), performing consistently well through the year. Its focus on the technology sector delivered emphatically in 2019 with many of the US tech titans having strong years. Qannas Investments was the only global fund to deliver a negative market return.

Baillie Gifford US Growth has had a strong start since its launch in 2018 with its growth-focus benefitting from the prevailing sentiment. In NAV terms, Middlefield Canadian Income had the best year. The trust’s strategy allows investments into US companies too. Gabelli Value Plus+ faces the prospect of a continuation vote in 2020. Pressure from Investec, one of its largest shareholders, grew through over the year. Invested has been unhappy with the trust’s relatively high fees, lack of transparency in financial reporting and what it perceived as an unaddressed double-digit discount.

Securities of Scotland led returns in the global equity income sector with the technology, utilities and materials portfolio sectors performing best. Henderson International Income had a difficult year with some of its cyclical holdings in sectors such as energy and property weighing it down.

Shires Income had a great 2019, with its policy of augmenting income through its preference share portfolio working very well. This allows Shires to hold a higher proportion of growth companies than many of its peers. Diverse Income had a challenging year, which resulted in the shares moving to a discount.

Four funds delivered price returns of more than 50% in the UK smaller companies sector. JPMorgan Smaller Companies led price and NAV returns as flows into UK small-cap funds ramped up in the weeks leading up to the general election (as the threat of a ‘hard’ Brexit on 31 October was averted), before ramping up considerably following the convincing Conservative victory. Crystal Amber had a turbulent year that was compounded by being caught up in the Woodford crisis.

BlackRock Greater Europe benefitted from Russia’s excellent year (see Figure 4) with Sberbank a top performer in the first half of the year before it was sold. JPMorgan European has two shares classes, Growth and Income. Returns from the latter were relatively muted as the benign interest rate environment continued to benefit growth.

Japanese equities have been performing well of late. Fidelity Japan had a strong second half of the year, led by its technology holdings – it is particularly excited by the opportunity in 5G-related stocks. Schroder Japan Growth said it was frustrated by its performance over its year to July where it value-bias failed to deliver.

Oakley Capital’s discount narrowed considerably, driving the share performance. Its most recent re-rating, over December, came as it sold the server management company WebPros to CVS, making 6.7x on its investment.

Biotech enjoyed a resurgence towards the end of the year, benefitting Biotech Growth. Its near 50% price return was almost entirely driven by the portfolio with the discount only narrowing marginally. Biotech Growth was nevertheless something of a standout, with a performance that was 15 percentage points ahead of the second best performer in sector, the more pharma oriented Worldwide Healthcare. Syncona’s 50% plus premium to NAV valuation fell in the period after the Wellcome Trust charity surprisingly reduced its stake in mid-March. Over Q2, the premium came down further. Over the second half of the year, Syncona was affected by the poor performance of its investment in Autolus, which was not helped by Woodford having a major stake in it.

Indications of a growing willingness to become more shareholder friendly (including introducing dividend payments) by Japanese corporates, particularly in the small and mid-cap area, could help shape sentiment going forward. Nevertheless, JPMorgan Japan Smaller was the only trust in the sector to see its discount narrow over the year – a dividend policy enacted in 2018 is thought to have helped. Having performed extremely well over recent years Baillie Gifford Shin Nippon had an untypically poor year.

There was little to choose between BlackRock Latin American and Aberdeen Latin American Income, in an up-and-down year for the region. Momentum from the election of Jair Bolsonaro in Brazil provided impetus, which unwound as first fires in Brazil and then a debt default by Argentina, weighed on sentiment.

The only investment trust with a Pan Asian mandate, Witan Pacific, led performance in the Asia Pacific sector. This reversed an earlier period of underperformance, which led to the board indicating the company needs to beat its benchmark in total NAV terms over the financial year to 31 January 2021 or face proposals to allow shareholders to exit. Pacific Assets’s NAV return was comfortably the sector’s lowest – India, its largest exposure, fared poorly in 2019.

JPMorgan Asian led performance in the Asia Pacific Income sector once again, with stock selection in China delivering for the trust. The trust outperformed its benchmark, the MSCI AC Asia ex Japan Index, for the fifth successive year over its most recent annual results period to end-September. Henderson Far East Income’s NAV returns were not far off JPMorgan Asian’s – the main difference in price performance came from the (8.1%) differential in the relative change of the their discounts.

A 20% increase in Renewables Infrastructure Group’s premium drove shareholder returns. The sector brought in over £2.5bn in new money across new launches and secondary issuances with an attractive power price backdrop, long-dated government secured income and high yields proving compelling. It was a tougher year for battery storage-focused Gore Street Energy Storage, the minnow of the sector with a year-end market cap below £50m. The company was affected by the suspension of the UK’s capacity market mechanism in March. There was a reprieve when Ireland’s National Treasury Management Agency agreed to invest £30m in June.

Infrastructure India’s share price more than doubled in December after reporting positive results. The shares were volatile over the year though. Sequoia Economic Infrastructure, which focuses on debt investments, delivered the lowest shareholder returns but was the most active in the secondary market, raising £380m over the year.

UIL, which has an eclectic portfolio and is one of the last remaining split capital trusts, benefitted from gold’s resurgence – gold was its third largest exposure over its most recent financial year. JZ Capital Partners shares plunged after it was forced to delay publishing interim results in November. The delay was the result of the board having to secure a new valuation for its property portfolio.

Gold made a comeback after several lean years

Templeton Emerging Markets bought back nearly £270m worth of shares, though the 1.7% narrowing in the discount was relatively modest despite delivering the sector’s best NAV return. Ashmore Global Opportunities’s sterling share line was the worst performer and, among the larger funds, ScotGems had the toughest year. Performance since its launch has been disappointing with the trust failing to achieve the scale envisaged for it at the outset. ScotGems’s manager resigned in September. Over October, the board proposed changes including narrowing the trust’s focus to emerging market smaller companies (it came to market with a global mandate).

Henderson Diversified Income reaped the rewards of its managers’ contrarian calls, made in late 2018, when most observers expected US central bank to raise interest rates. The trust’s managers increased exposure to higher yielding longer duration bonds, believing low growth and benign inflation was not indicative of sustained interest rate cuts. This has delivered returns as central banks have shifted away from interest rate increases. NB Distressed Debt funds continued to return capital to shareholders as they come to the end of their investment cycles.

Golden Prospect Precious Metal was the best performing investment trust in price terms over 2019, as gold made a comeback after several lean years (click here to read an article we published on gold). Exploration, production and mid-stream-focused Riverstone Energy announced a 26% drop in its NAV over August, following commodity prices lower. Later in the year, the company also reported a $275.8m unrealised loss for the third quarter, with its Hammerhead holding (previously the fund’s largest holding) performing particularly poorly.

Returns from the three company Asia Pacific Smaller companies sector were modest, compared to other regional strategies. Aberdeen Standard Asia Focus saw results from revamps introduced in 2018, with the investment approach adapted to place a greater emphasis on a smaller number of the manager’s best ideas. Fidelity Asian Values performance only deviated from Aberdeen Standard Asia Focus towards the end of October

Among the Asia Pacific ex Japan country specialists, JPMorgan Chinese was in a league of its own with price returns of 35% more than the next best performer. Stock selection in the Information Technology and Health Care sectors contributed the most over the year to end-September. The shares found further momentum in December after it was announced the board was proposing a new dividend policy to pay enhanced dividends equivalent to 4% of NAV through the distribution of capital gains as well as net revenue. India-focused strategies had tougher years, particularly affecting India Capital Growth.

Among hedge funds, Bill Ackman’s Pershing Square had the best year. The manager runs concentrated portfolio of US companies that he believes are undervalued and where he can see a catalyst for a re-rating. One of these is Chipotle Mexican Grill, Pershing’s second largest holding. The fast-casual restaurant company had an outstanding year. Highbridge Tactical Credit (formerly Highbridge Multi-Strategy) had an eventful year. Following an EGM, shareholders approved a resolution to allow investment into a Tactical Credit Fund that is also managed by its manager.

There was little to choose between Invesco Perp Select Liquidity and JPMorgan Elect Managed Cash in the two-company liquidity sector.

VPC Specialty Lending Investments bucked the trend in a difficult year for debt – direct lending, which suffered both very low single digit returns and a widening in the sector discount. VPC Speciality invests in the alternative lending market through specialty lending platforms. Its shares recovered sharply following a sell-off during May when Woodford Investment Management was forced to sell its entire holding to meet fund redemptions. Hadrian’s Wall Secured Investments’s shares began to fall in July and this continued over the rest of the year. The market’s initial reaction was believed to be a knock-on from provisions the fund made in May (the provision then was 1.9% of NAV) against two loans to companies producing wood pellets. Some of the reaction can also be ascribed to nervousness, following Funding Circle’s decision to wind up earlier in the year.

Polar Capital Global Financials had an excellent year and it believes the banking sector remains materially undervalued. Notwithstanding the progress that share prices have made in 2019, many banks around the world are trading close to valuation lows. Chenavari Capital Solutions had the worst year with the decline in its shares entirely driven by a widening in its discount.

High yielding Blackstone / GSO Loan Financing was the outlier in a tough year for the debt – structured finance sector, as the market applied caution to strategies investing in collateralised loan obligations (CLOs). Carador Income USD is undergoing a managed wind-down.

Airbus’s announcement in February that it will stop manufacturing A380 ‘superjumbos’ in 2021 (click here to read more more) emphatically shaped the aircraft-heavy leasing sector’s performance, resulting in the median discount collapsing from +7.0% to (20.2%) over the year. Doric Nimrod Air One was the worst affected of the three Doric funds, all of whom exclusively own A380 aircraft. Doric Nimrod Air One owns just one of these planes and it is the oldest of all the A380s in Doric’s stable. Tufton Oceanic Assets had a very quiet year in comparison, delivering a very modest price return, which was enough to lead the sector.

A380 superjumbos have been popular with aircraft leasing companies

Investors have taken to the growth sector company Merian Chrysalis, following its launch in 2018. Merian was close to being 75% invested by the year-end. Adamas Finance Asia’s shares fell over the third quarter, resulting in the discount widening to 65.9% Some of the reasons behind this are thought to include relatively low transparency from the fund, its track record, an overly concentrated portfolio and the presence of a dominant shareholder (reducing liquidity in the shares). However, in early weeks of 2020, they have stormed back up after Adamas announced that one of its key positions, Future Metal Holdings, had commenced dolomite production in China.

Among the single-company sectors, highlights come from JPMorgan Russian Securities with Russia making an emphatic comeback, while JPMorgan Brazil benefitted as capital flowed in following Bolsonaro’s election. Baring Emerging Europe also benefitted from its Russia exposure, which accounts for around 55% of the portfolio. Finally, the royalties company, Hipgnosis Songs had an extremely active year of adding catalogues and fundraising. It raised £231m through a C share issue in October, which, when the shares convert to ordinary shares, will take its market cap to over £660m, having launched only 18 months ago.

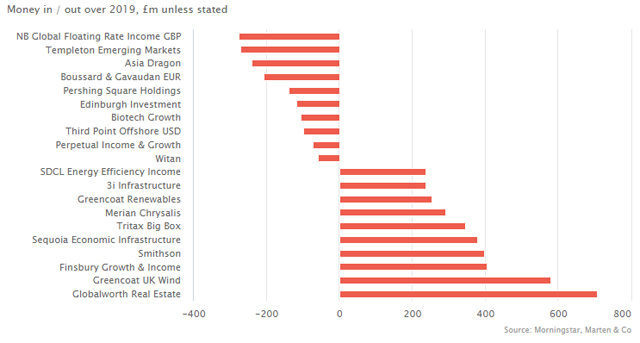

Money in and out of the sector

2019 was a low-key year for new issues, with most of the £7.3bn net new money coming from record capital raising by existing funds. Net inflows were higher than 2018 though, where they amounted to £5.5bn. At £8.6bn, fund raising by existing funds was more than £3bn greater than the year before.

Baillie Gifford’s pre-The Schiehallion Fund raised close to $480m. Baillie Gifford rolled over a pre-existing fund into a listed closed-end structure, as well as raising additional capital.

Fittingly perhaps, the renewables sector provided the year’s biggest new company launch. Octopus Renewables Infrastructure raised £350m in December – £100m above its target. It is focussing on onshore wind and solar assets in the UK, Europe and Australia. Octopus is targeting returns of 7% to 8% a year and dividends of 3% in the first year, rising to 5% in the second year.

The other renewable launches came from Aquila European Renewables Income and US Solar Fund. Aquila will provide returns through a portfolio of hydropower, onshore wind and solar PV investments across continental Europe and Ireland. US Solar launched with the aim of delivering a 7.5% annual return through pure exposure to the US solar industry.

JPMorgan Global Core Real Assets’s £149m raise was just shy of its £150m target. The fund is initially seeking exposure to core real assets through various real asset strategies, namely; Global Infrastructure, Global Real Estate, Global Transport and Global Liquid Real Assets. It is aiming for total annual returns of around 7-9%.

Riverstone’s Credit Opportunities Income fund launched as an oil and gas loan fund with a high-income mandate, targeting 8-10% yields. The fund makes loans to small-medium sized energy exploration companies, filling what it believes is a void left by traditional lenders retreating from smaller loans.

Life-sciences fund RTW Venture, raised a fraction of its $350m target with Woodford’s struggles in biotech working against it. Finally, Cameron Investors has since been absorbed by Troy Income & Growth.

Money in and out of existing funds

The chart below show the approximate value of shares issued or redeemed at 31 December 2019.

Money coming into existing funds

Globalworth Real Estate Investors is a leading investor in office space across Central and Eastern Europe, with a particularly strong presence in Poland and Romania. The company says the value of its portfolio will soon exceed €3bn.

Greencoat UK Wind had a strong year, delivering price returns above 25%. Confidence in its business model and that of wind as a powerful component in the armour of renewables-based power generation, saw Greencoat raise close to £581m.

Finsbury Growth & Income issued shares consistently through the year, regularly featuring in our monthly roundups. Its shares traded at a premium to NAV throughout the year.

Launched in 2018, Smithson, the global smaller companies sector trust, found a conducive market for its US and tech-focused strategy. Fundraising continued apace, closing the year with a market cap of £1.5bn.

The boom in demand for logistics warehouse space, particularly from e-commerce-focused businesses, saw Tritax Big Box raise close to £350m.

Merian Chrysalis has been actively investing proceeds from its shares issuances, coming close to three quarters deployment at the year-end.

The other funds to issue shares worth at least £100m were SDCL Energy Efficiency Income, Greencoat Renewables, 3i Infrastructure, International Public Partnerships, Hipgnosis Songs, Capital Gearing, Personal Assets, City of London, Tufton Oceanic Assets, BB Healthcare, Gresham House Energy Storage and HICL Infrastructure.

Money going out of existing funds

The NB Global funds buyback shares very frequently

We touched on Templeton Emerging Markets in the performance section (see page 12 in the attached pdf) while Asia Dragon (formerly Edinburgh Dragon) held a tender offer over the first quarter for 30% of its issued shares. 60.5% of its shares were tendered and so the tender was taken up in full.

Boussard & Gavaudan enacted its proposals to rollover investors, who wanted to, into an open-ended fund.

Pershing Square embarked on a major buyback programme through the year, though its discount widened despite an NAV total return of 52%.

The other funds to return more than £50m were Edinburgh Investment, Biotech Growth, Third Point Offshore USD, Perpetual Income & Growth, Witan and SME Credit Realisation.

Liquidations, de-listings and trading cancellations

Fewer funds disappeared in 2019 compared to 2018. Not including, MedicX, which merged with Primary Health Properties, we said goodbye to 8 funds, with a combined market cap of £482m at the end of 2018

Lazard World, Establishment, Sanditon, El Oro, Terra Capital, Vinaland, MedicX (it merged with Primary Health Properties), JPMorgan Global Convertibles Income and Martin Currie Asia Unconstrained.

Significant rating changes

The table below shows how discounts and premiums moved over the course of 2019. Most UK-focused sectors closed the year strongly, unsurprisingly given the relative value many see in equities. Equity and specifically growth-focused sectors saw their discounts narrow (premiums widen) while some sectors focused on income performed very well, notably renewables.

We discussed many of the trusts in the table elsewhere in this note. Out of the sectors that became more expensive in 2019, it is worth noting that while the biggest change came from the five-company Insurance & Reinsurance sector, other than Life Settlement Assets A, the other three Life Settlement funds are sub £10m in market cap. CATCo Reinsurance Opportunities’s discount peaked at over (60%) following some of the worst ever years of insured losses, before closing the year at around (17%). The discount began to narrow after the company said it would perform an orderly run-off of the portfolio over a period of approximately three years.

It is worth referencing the example of Lindsell Train, which saw its premium to NAV collapse from over 100% at one point to 12.2% at the year-end. The portfolio had an excellent year, delivering a total NAV return of 31.6%. When premiums become excessive, things get dangerous. Lindsell Train’s correction followed manager Nick Train’s warning (in the company’s annual report released in June) over the risk of buying the fund at the more than 90% premium it was at. A major catalyst that initially propelled the trust to its peak premium was a view among investors that its largest holding, its stake in Lindsell Train Limited, the asset manager, was undervalued.

Major news stories from 2019

Portfolio developments:

- Hipgnosis completed a £300m C share issuance and completed a move to the main London Stock Exchange market. It was a very busy year of growth for the trust as it went about buying several catalogues,including Timbaland and Kaiser Chiefs.The company also announced maiden results

- Amedeo Air Four Plus discussed its A380 fleet (Airbus will stop building A380s in 2021)

- Fidelity China Special Situations discussed the state-of-play in the country

- Schroder AsiaPacific said the ongoing situation in Hong Kong was concerning

- Results from BlackRock Frontiers reflected ongoing challenges across many frontier markets

- JZ Capital reported delayed interim results, warning that it might have to write-down its property portfolio

- We had inaugural results from Ashoka India Equity and US Solar

- Growth capital company, Merian Chrysalis, said it was nearly 70% invested after follow-on investments

- BioPharma Credit said would spend its $600m cash pile by year end

- 3i Infrastructure closed a deal to acquire Ionisos, the third largest cold sterilisation provider globally, for around €220m

- One of Middlefield Canadian Income REIT’s holdings was subject to a $4.7bn Blackstone bid

- Syncona sold Blue Earth Diagnostics to Bracco Imaging for $450m

- SDCL Energy Efficiency Income reported inaugural results

- QuotedData attended Civitas’ annual results

- Leaf Clean Energy won a major damages claim

Corporate developments:

- The collapse of Woodford Investment Management was probably the highest profile story. We wrote on it extensively: Woodford Patient Capital’s management contract was awarded to Schroder

- Octopus Renewables raised a whopping £350m

- JPMorgan Brazil asked investors to support continuation

- Martin Currie Asia Unconstrained offered investors a choice of cash or access to an open-end fund

- Capital Gearing returns reached 200x return since Peter Spiller took reins

- QuotedData took a closer look at gold over July as bullion returned to form with a gusto

- JPMorgan Global Convertible’s board decided against a shareholder continuation vote, preferring to press forward with proposals for an orderly liquidation

- Polar Capital Global Financials said it was exploring a continuation vehicle as its fixed-life end-date approached

- Greencoat UK Wind raised £375m; the equity capital will be used to grow the asset base

- JLEN Environmental discussed the scope for further diversification of its strategy

- QuotedData visited Bluefield Solar’s Elms farm

- Hedge fund Third Point said it wanted to narrow its discount with a US$200m buyback programme

- QuotedData took a closer look at Vietnam’s economy as it drew interest based on its own performance and its positioning in the trade war context

Managers and fees:

- Perpetual Income and Growth commented on Edinburgh Investment Trust’s management change decision

- It was announced that Martin Hudson, veteran manager of Mercantile, was retiring from JPMorgan Asset Management

- JPMorgan American proposed a change of strategy

- CatCo Reinsurance Opportunities’ manager ousted its CEO

- Seneca Global Income & Growth announced the resignation of Peter Elston for personal reasons

Outlook for 2020

Rather than us pontificating on how events may unfold in 2020, here are a few recent comments from managers and directors drawn from our latest economic and political summary that you may find interesting.

Our January economic and political roundup has much more detail and many more comments on topics as diverse as Europe, North America, Global Emerging Markets, the global healthcare sector, European property and even an in depth look at the global uranium market

On the global economy and interest rates

James Will, chairman of Scottish Investment Trust notes that “The cost of money remains too low as policy makers continue to grapple with the ramifications of the financial crisis of more than a decade ago. In August, close to a quarter of the global stock of government bonds offered negative yields, meaning that, if purchased at the prevailing price and held to maturity, the investor was guaranteed to lose money. Around the same time, a Danish bank made headlines by offering the world’s first negative interest rate mortgage. It is uncertain if this more mainstream adoption of negative interest rates will prove transient or become the norm. However, one thing that is abundantly clear is that the long-term implications are not well understood.

Alasdair McKinnon, manager, Scottish Investment Trust believes that “The yield curve offers a good indicator for the combined impact of central bank policy action and growth. Of late, the US 2year/10year curve has flattened, even though expectations that the Federal Reserve (Fed) will cut interest rates further have risen sharply. This is concerning as a steeper yield curve would indicate that the bond market was becoming more confident that near-term monetary easing will lead to better long-term outcomes. This would give equities a platform to move higher from.

The best signal for a potential recovery in earnings growth would be an indication that global industrial activity has bottomed. An improved trade war outcome would also be supportive. Here, a de-escalation is possible, and equities have responded positively when there have been better news headlines in recent months. It remains to be seen though, how much long-term damage has already been done to globalisation.

If economic data deteriorates from here, we can also expect a more aggressive central bank policy response. In Europe – particularly in Germany, where growth has completely collapsed due to its high reliance on the manufacturing industry – we could expect a fiscal package to help stimulate activity. The Fed is likely to become more aggressive with its easing monetary response too.”

On Brexit and the UK economy

Jonathan Cartwright, chairman of Blackrock Income & Growth says “It remains to be seen whether a comprehensive trade deal with the EU can be negotiated by the deadline of the end of 2020. At the same time, the UK will be free to negotiate trade deals with other countries which, although also a complex process, should be facilitated by the UK Government’s ability to present a clear position which can deliver the backing of Parliament. Overall, the higher degree of political uncertainty should be positive for the UK economy.”

The managers of Schroder UK Mid Cap note that “It would also appear that this (economic) growth is reasonably sustainable, underpinned by a strong jobs market, higher wages and tax changes. The unemployment rate is close to its lowest since the 1970s, and wages are growing at almost the fastest rate in a decade, continuing to outstrip inflation. There has historically been a close correlation between real wage growth and retail sales, and labour market data that the backdrop for wages remains supportive.

In the meantime, we are starting to see an increase in corporate activity as private acquirers take advantage of cheap sterling assets. It appears that valuations are such that acquirers are no longer waiting for a resolution to Brexit negotiations. We are also continuing to see companies using the low interest rates to make acquisitions to supplement organic growth, and it seems likely that this interest rate environment can endure.”

On China

Howard Wang and Rebecca Jiang, managers of JPMorgan Chinese say that “We acknowledge that Chinese equity markets can be volatile and subject to external shocks, such as trade disputes and geopolitics. Nonetheless, we are reassured that foreign investors have continued to be attracted to China’s domestic market, following the opening up of many of its onshore equity markets (including the financial sector) to foreign access.

We expect the Government’s personal and corporate tax cuts, together with more market-oriented reforms, to support domestic demand and private sector productivity from here. Reassuringly, Chinese equity markets remain at a reasonable level for long-term investors, close to average valuations in both price-to-book and price-to-earnings terms, so we remain broadly optimistic about finding future stock opportunities.”

Investment company notes published in 2019

- BlackRock Throgmorton Trust – Throg’s shorts shine

- Aberdeen Emerging Markets – A reversal of fortune In 2018

- JPMorgan Russian Securities – Expert access to attractively valued market

- Bluefield Solar Income Fund – Walking on sunshine

- Herald Investment Trust – Shifting sentiment

- Civitas Social Housing – Regulatory action is positive

- US Solar Fund – Making hay – IPO

- International Biotechnology Trust – Beating the odds

- Montanaro European Smaller Companies Trust – Quality businesses at sensible prices

- Aberdeen Standard European Logistics Income – Poised to expand?

- John Laing Environmental Assets Group – Life extensions to boost NAV?

- Geiger Counter – Nuclear exposure

- Premier Global Infrastructure Trust – Quick out of the blocks in 2019

- Henderson Diversified Income Trust – Death rattle for bull market

- Ecofin Global Utilities and Infrastructure Trust – Unrecognised outperformance

- Jupiter Emerging & Frontier Income – Income objective exceeded

- Seneca Global Income & Growth – Holding steady as cycle turns

- Polar Capital Global Financials Trust – Don’t fear a slowing economy

- The North American Income Trust – Time to grow?

- Standard Life Private Equity Trust – Now with co-investments

- Shires Income – Growing again

- CQS Natural Resources Growth and Income – Strong recovery potential?

- Aberdeen New Dawn – Moving up the league table

- Standard Life Investments Property Income Trust – KYT (know your tenant)

- CG Asset Management – The rewards of long-term thinking

- Seneca Global Income & Growth Trust – Going for gold!

- Strategic Equity Capital – Discounted opportunity

- BlackRock Throgmorton Trust – Impressive run continues

- CQS New City High Yield – Same as it ever was…

- Aberdeen Emerging Markets – The stars may be aligning

- JLEN Environmental Assets – Battery storage potential

- Montanaro European Smaller Companies Trust – Focus on the small picture

- Civitas Social Housing – Targeting full dividend cover

- JPMorgan Russian Securities – Outperforming and attractively valued

- International Biotechnology Trust – Healthy yield attracts investors

- Jupiter Emerging & Frontier Income – Unjustified discount?

- India Capital Growth – Discounted value

- Herald Investment Trust – “Profits are only profits when they are realised”

- Aberdeen Standard European Logistics Income – On the crest of a wave

- Retail property market – Ready for a renaissance?

- Ecofin Global Utilities and Infrastructure Trust – compelling three-year track record

- Polar Capital Global Financials Trust – Banks too cheap to ignore?

- Premier Global Infrastructure Trust – Strong income growth

- Seneca Global Income and Growth – Pausing on equity reductions

- Pacific Horizon – 2018 re-calibration paying off

- Aberdeen Frontier Markets – Significant latent value?

- Geiger Counter – Supply deficit unsustainable

- Henderson High Income – The trust that delivers

- Henderson Diversified Income Trust – Soft landing likely…

- North American Income Trust – Macro driven market is creating opportunities

- Vietnam Holding Limited – Silent revolution

- BlackRock Throgmorton Trust – Look past the short-term noise

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

Hot Features

Hot Features