Canada’s inflation surprised to the upside yesterday, providing CAD with a boost and further lowering expectations for a cut. At 2% it remains at their centre band of the 1-3% target and, so far, we’ve not seen the ‘inflationary dip’ outlined in July’s MPR and policy statement, so CPI is technically outperforming their expectations for now.

Domestically I suspect it’s premature to expect a cut from BOC as their data is holding up well overall. Sure, employment has been below expectations these past two-month, yet this is not a core focus in their July statement which finishes with ‘developments in the energy sector’ and ‘impact of trade conflicts’ being worthy of ‘particular attention’. Furthermore, wages have rebounded and consumer confidence remains high, although it would be nice to see this translate to improved retail sales tomorrow.

As it stands, markets have reduced their expectations for BOC to cut this past week, with the 1-month OIS pricing in around a 15% chance of a cut in September and the 3-month around 30%. Assuming Trump doesn’t take his sledgehammer to the trade war and turn his ire back to Canada, market pricing for a cut may remain low for a while longer.

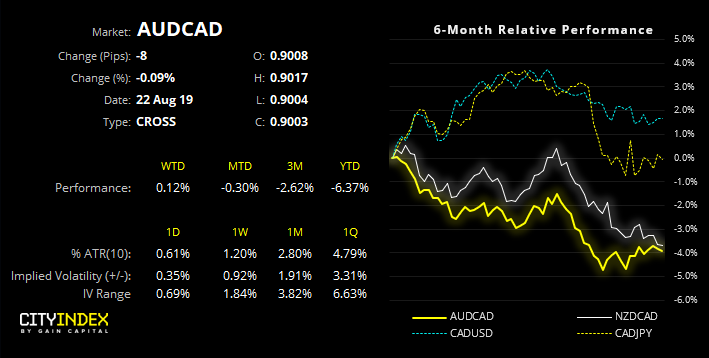

Volatility remains low in the lead up to the Jackson Hole symposium, and USD/CAD remains below key resistance outlined by my colleague Joe Perry. Whilst we wait for its next directional move, we’re also keeping close tabs on AUD/CAD and NZD/CAD.

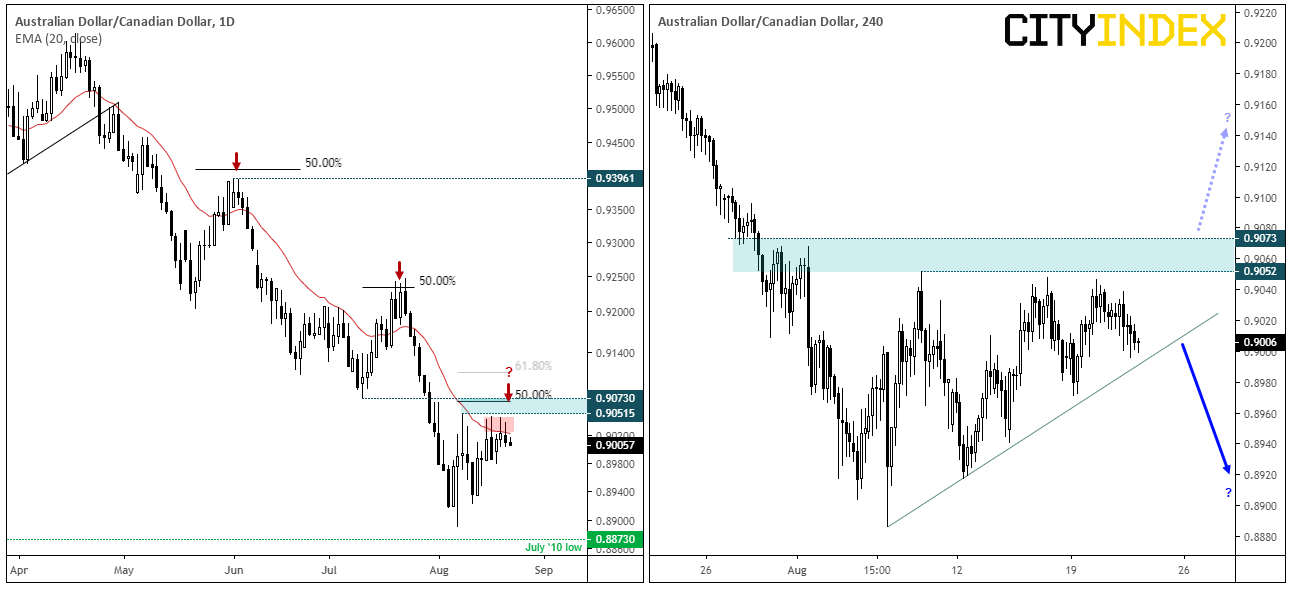

During its current downtrend, corrections on AUD/CAD have been timely and remained below the 50% retracement mark. Prices are currently compressing and we see a series of upper wicks failing to pierce the 90c level and remain below a zone of resistance.

- Given the bullish bias for CAD, we could see this head towards the July 2010 low

- Traders could look to enter a break of the four-hour retracement line, which would help one keep out of harms way should this evolve into an ascending triangle breakout

- Alternatively, bears could look to fade spikes around the 0.9051/73 zone, however this is a risker entry but, if successful, could improve the reward to risk potential.

- The near-term bearish bias could be invalidated with a break above the 0.9073 area

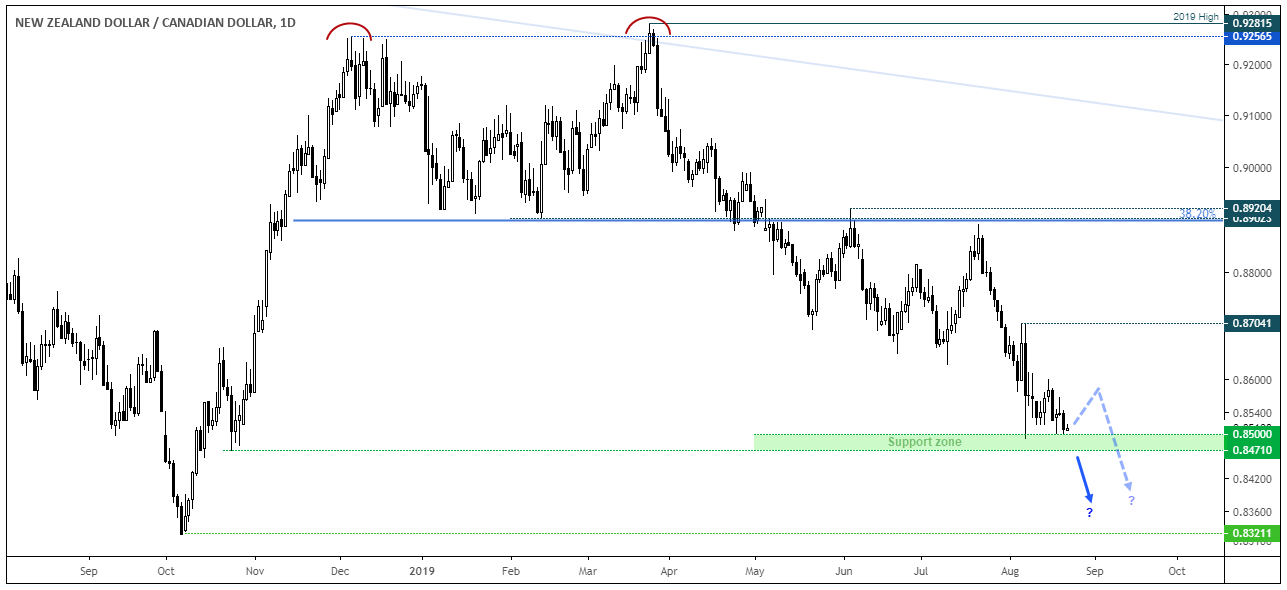

NZD/CAD hit our longer-term bearish target, projected from its double top pattern back in April. However, measured moves are generally considered as a minimum target, which allows for the move to continue.

- Overall momentum remains firmly bearish, as does the core view. However, 0.8500 is acting as support and the 0.8471 low is nearby which makes the reward to risk undesirable.

- Therefore, we’d want to see a retracement from current levels and for prices to stabilise beneath 0.8704, before reconsidering a short.

- Or wait for a break of 0.8470 before assuming trend continuation

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.