ASX200: Bullish Outside Day Hints At A Swing Low | Equity Technical Scan

The index snapped a 3-day losing streak as bulls try to carve out a new low. Whilst the jury is still out for a rebound, we’ve filtered and ranked equities which have outperformed the sector for consideration.

The ASX200 remain in a clear uptrend, and a bullish engulfing candle as formed suggest a swing low could be in place. If bullish momentum returns, we could finally be headed for 6,800 or perhaps the all-time high.

However, prices have appeared hesitant to make a run for 6,800 and there’s been a subtle change of momentum in recent weeks, with recent upswings diminishing before failing to test 6,800.

Furthermore, we may be in for a lacklustre open judging from price action in the US session at the time of writing, unless sentiment can be given a much-needed boost.

Ultimately, we remain bullish above the 6,606 low, but price action over the near-term remains key

- A potential bullish wedge is forming as a continuation pattern, which projects and initial target at the 6,769.6 high. However, we could find resistance around the 6,769.60 – 6,600 zone a tough nut to crack initially

- A clear break above 6,800 brings the all-time high into focus

- However, also keep an eye on the potential for a topping pattern. If bullish momentum wanes and prints a lower high, prices could begin to carve out a head and shoulders top

- A break below the 6,600 area after a lower high would suggest a deeper correction could be playing out

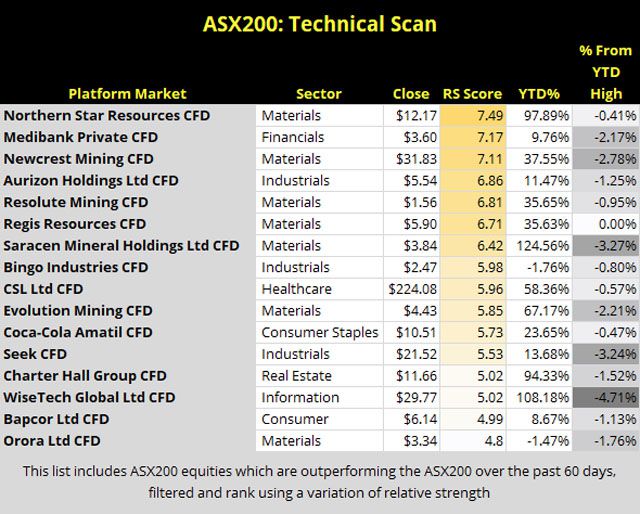

As for the technical scan, we filtered ASX200 equities which have outperformed the index over the past 60 days, using a variation of relative strength. Ranked in order form strongest to weakest, they can be used as an initial point in your analysis to identify potential candidates for breakouts or pullbacks.

Keep an eye on AU employment data at tomorrow 02:30am GMT (11:30 am AEST), as a miss here would see further calls for RBA to ease and likely support the equity markets.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.