A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

As of Tuesday 11th June:

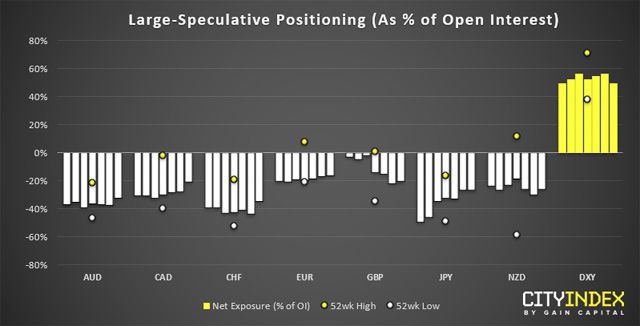

- Traders were net-long USD by $28.9 billion, down -$2.1 billion from the prior week ($32.1 billion against G10 currencies, down -$2.6 billion from the prior week).

- Traders reduced bearish exposure on commodity currencies (AUD, CAD and NZD)

- CHF futures saw its largest weekly change in 9 months, reducing bearish exposure by 11.3k contracts.

USD: Net-long exposure has fallen to a 9-week low and, at -$2.1 billion lower for the week, its fastest pace of long-covering since mid-February. However, the US dollar index (DXY) has appreciated 0.85% since this report and appears determined to retest the 2019 highs. If it fails again to break and hold above 98, then we’d continue to monitor its potential to have topped out. But, for now, the trend remains bullish and momentum currently favours the bull-camp.

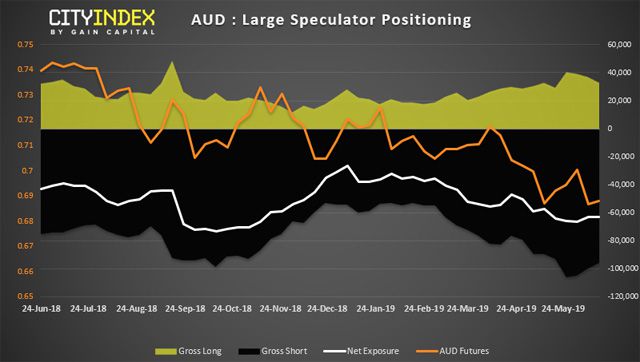

AUD: Despite calls for up to 4 cuts from RBA from some economists, it’s interesting to note that large speculators appear to be de-risking on AUD futures as both longs and shorts have been closed these past 3 weeks. The weekly change was minimal at just 65 contracts, but the past three weeks has seen -7.3k long contracts closed and -10.2k shorts closed.

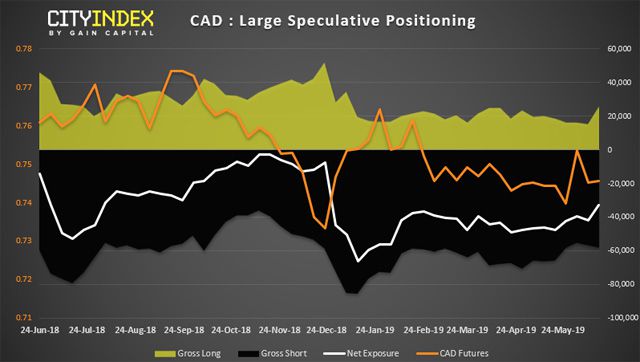

CAD: Net-short exposure has fallen to its least bearish level since mid-February. We noted in a prior report that short interest is slowly dwindling which raises the potential for a longer-term reversal on USD/CAD. However, long interest is picking up with bulls placing +10.3k new long contracts, seeing its largest weekly gain since June 2018 and gross longs at their most bullish level since early January.

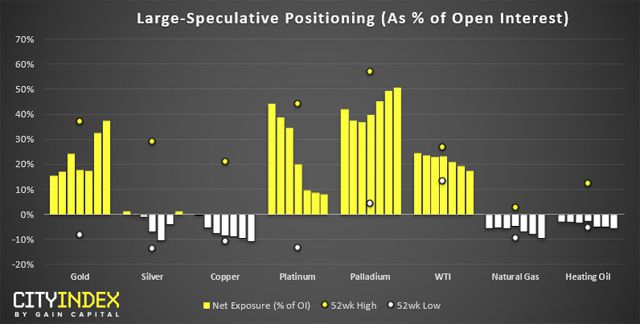

As of Tuesday 11th June:

- Traders are their most bullish on gold since April 2018

- Large speculators flipped to net-long on Silver

- WTI traders are their least bullish in 3-months

- Palladium traders are their most bullish in 10-weeks

Gold: Gold’s rise has been accompanied with a closure of short bets and increase of long bets, which is exactly what we want to see as prices rally. However, as of Friday gold has faltered at the highs and printed a prominent bearish pinbar so, whilst we remain bullish on gold overall, we suspect its not yet ready to break to new high and a correction is due over the near-term.

Silver: Traders have flipped to net-long after 5-week spell as net-short. Adding +8.6k long contracts, it’s the largest weekly increase since June 2018. Furthermore, over the past two weeks bulls have added +11.6k longs and reduced shorts by -13.5k contracts, to suggest the cycle low may be in. That said, managed funds remain net-short although at their least bearish level since mid-February.

WTI: Net-long exposure has fallen to a 14-week low and we’re seeing a steady increase of short bets and decrease of longs. Gross longs have fallen for 7 consecutive weeks and short bets have increase for the past 3. Over the past 3-weeks, bulls have closed -70.5k contracts and bears have added +56.2k contracts. Therefor we remains bearish on crude oil and prefer to sell into rallies over the near-term.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.