Escalated trade tensions saw AUD/JPY hit its lowest level since January’s flash crash, yet dominant forces likely point lower still, without a trade deal in sight.

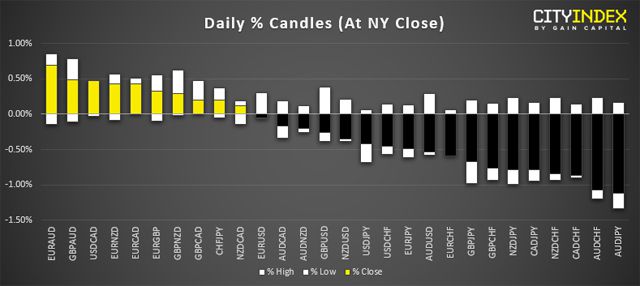

China’s retaliation kept sentiment on the back ropes, seeing USD/JPY hit a 3-month low and FX traders flock back to the yen. AUD/JPY was the largest FX mover of the day, plummeting -1.3% at the low and closing -1.1% on its third most bearish session this year. Whilst NZD also feels the weight from trade wars, the AUD is taking the bigger hit as Australia is the bigger trade partner with China. Furthermore, continued weak domestic data (in particular the housing market) and the growing expectation for RBA to cut rates adds to a short-bias, whereas RBNZ cut rates last week yet provided no further easing bias, which has made AUD the better short of the two. Case in point, AUD/NZD has shed -1.5% since last week’s high.

We can see on the four-hour chart that AUD/JPY continues to trend lower, although we’re seeing signs of consolidation at the lows. Given the negative sentiment and strong bearish trend, we’d expect bears to sell into rallies around key resistance levels. That said, RSI(2) is oversold and we’ve tested the lower band of the regression channel, so a rebound form current levels would be nice before looking for areas of weakness.

As we saw large moves overnight and the calendar is quiet today, it could allow for prices to pause for breath. Perhaps China’s plunge protection team can give markets a little boost and help provide a timely retracement. Yet with US and China remining in tit for tat trade war, we doubt it will turn the tide, so downside risks remain whilst trade tensions continue to escalate.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.