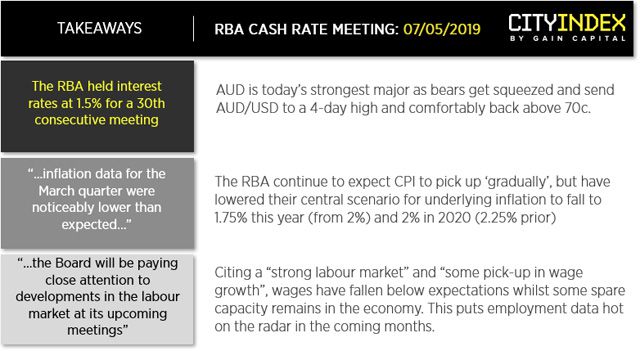

After much anticipation, the RBA opted to held rates at 1.5%, making it the 30-consecutive meeting without a change of policy since lowering rates to record lows. That doesn’t mean they’re out of the woods yet though…

Looking at the differences between the April and May statement, the RBA continue to remain optimistic over employment and for this to see wages pick-up, albeit at a slower pace than expected. As inflation was ‘noticeably lower than expected’ it’s prompted them to lower their ‘central scenario’ for underlying inflation once more to 1.75% in 2019 (2% prior) and 2% in 2020 (2.25% prior). Ultimately means the next two employment reads are of vital importance as they’ll appear ahead Q2 CPI. Citing a ‘steady unemployment rate’ and ‘significant increase in employment’, it could be the latter figure we need to watch more closely for signs of fatigue.

Summary of RBA’s ay 2019 statement:

- Risks (for global economy) are tilted to the downside

- See’s AU growth around 2¾ per cent in 2019 and 2020

- Labour market remains strong (significant employment increase)

- UE expected to decline to 4.75% by 2021

- Lowered CPI forecasts for 2019 and 2020

- CPI for Q1 noticeably lower than expected

- Paying close attention to employment at its upcoming releases

With RBA erring on the side of caution, Aussie bears got squeezed which saw AUD strengthen across the board and safely become the strongest major of the day. As noted in Monday’s COT report, bears added 10.3k fresh shorts ahead of today’s RBA meeting which dragged the net-exposure to its most bearish level since early November. Given short exposure was rising into expectations of a rate-cut, failure for RBA to do so could have resulted in a large spike higher and this is clearly what we’ve seen today.

As a result, AUD/USD is enjoying its most bullish session since the 1st February and has blown past 70c. At current levels AUD/USD appears set to close with a morning star reversal pattern back above key support and warn of yet another fakeout. A break above 0.7070 signals further upside potential with around 130 pips to the upside before we hit the 72c highs.

It appears AUD/NZD has carved out its corrective low and we now look for it to retest (and break) the 1.0732 highs. Support was found around the 50-day eMA, 38.2% Fibonacci retracement level and the 1.0545 highs and today’s bullish range expansion broke easily above the 200-day eMA. Given the clear trend structure, we suspect this one could move quite fast if RBNZ cut rates tomorrow as expected.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.