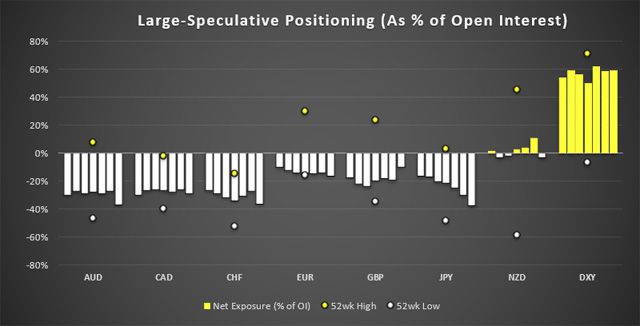

A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

- GBP traders reduced net-short exposure by 22k contracts, its largest weekly change in 9 months.

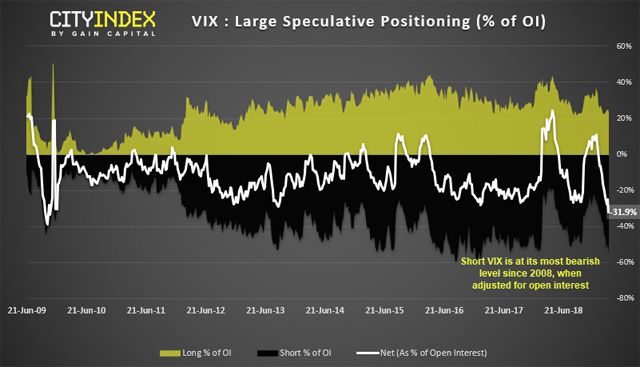

- Adjusted for open interest, traders are the most bearish on VIX since 2008.

- JPY futures rise to 7-week high, despite bears outweighing bulls by a ratio of 4:1

- After a brief hiatus, traders revert to net-short on the NZD.

DXY: Net-long exposure fell by -9.1k contracts and sits at its least bullish level since July. With -6.4k long contracts closed and +2.7k short contracts added, it could mark a notable shift in sentiment for the dollar. That said, with bond yields falling and stocks wobbling at the highs we could see US inflows as a safe-haven over the near-term.

GBP: Net-short exposure has risen to its least bearish level since June 2018. Fuelled mostly by short-covering (22k short contracts closed) it’s the largest weekly change in 9-months and sees gross short exposure fall to its lowest level since November 2015. However, bulls remain on the side-line, adding just 230 contracts.

JPY: Gross long exposure hits its lowest level since September 2014. Despite the lack of bullish interest form large speculators, the yen continues to defy bearish views and sits at an 8-week high. Given the soured sentiment across markets these past two days, we could see a pick-up of bullish interest over the near-term. And this could see bears caught off-guard, with bearish bets outweighing bullish bets with a ratio of 4:1.

VIX: Two weeks ago we flagged that ‘short volatility’ could be near a sentiment extreme, as net-short exposure was at its lowest level since 2016 (once adjusted for open interest). As of last Tuesday, short exposure to VIX was its most extreme since April 2008. With so many traders short, its plausible we could see further spikes on the VIX, like seen on Friday.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.