The US economy is burning red-hot. Economic indicators revealed that the IHS Markit Manufacturing PMI for March rose to 55.7, from a reading of 55.3 the month before. The consensus expectation among analysts was a reading of 55.5. Based on the current figures, this is the best expansion in the manufacturing sector since 2015. The big news for March 2018 was the interest rate hike of 25-basis points.

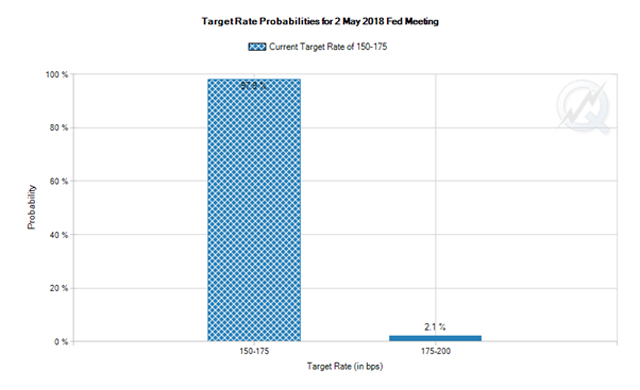

The federal funds rate is now standing at 1.50% – 1.75%, with at least 2 additional rate hikes expected in the year. This is the first FOMC meeting spearheaded by Jerome Powell – the new Fed chair. The Fed’s dual objectives are price stability and full employment. To this end, it is tailoring monetary policy in the US to achieve those joint objectives.

The reasons cited by the Fed FOMC (Federal Open Market Committee) members include an improvement in the US economy. It comes as no surprise that things are looking up, given the trifecta of factors implemented since Trump’s election:

- A massive tax overhaul which reduced corporate taxes from 35% to 21%. Personal tax deductions have doubled, and low income earners now have more money in their pocket as a result. These savings translate into greater expenditure in the retail sector, boosting the profitability of US corporations, and their stock prices.

- Deregulation of banking systems and compliance-related matters has had a massive effect on growth prospects for US companies. By requiring less paperwork – companies can get on with the business of actually producing goods, delivering services, and being profitable. Less resources need to be spent on gargantuan legal teams and departments, and more can be channeled into product development, R&D, and customer satisfaction.

- The controversial partial repeal of Obamacare. While this measure is highly divisive, companies are no longer required to pay tax penalties if they do not wish to provide healthcare for their workers, and individuals are not bound by those same constraints in terms of tax penalties if they fail to pay for healthcare. The cost savings (provided illness, or injury does not result) are dramatic, and go towards furthering economic growth prospects.

Contrarian Investment and Trading Strategies

The stock market has been the beneficiary of the improved economic situation, with the Dow Jones, NASDAQ, S&P 500 and other bourses rising. Investors and traders are also using market buoyancy to explore other options to further diversify their financial portfolios. These include Contracts for Difference, a.k.a. CFDs. Financial analyst Montgomery Smyth offered a precise CFD definition, which is perhaps best summed up as follows: A CFD is a derivatives trading instrument which allows clients to speculate on price movements of financial instruments without actually taking ownership of them.

These contracts are placed on 4 broad asset categories including currencies, commodities, equities, and indices. There are many benefits to trading CFDs over traditional stocks – for one thing they are a hedge against falling stock prices, and the outlay is significantly less, in the region of 2% – 20% for most brokers. This means that leverage is used to gain greater control over your portfolio.

A caveat is in order however: CFDs must move significantly in price to cover the spread. The spread is the difference between the buying price and the selling price. It is an unregulated financial instrument, but the brokers that provide the services in the United Kingdom are under the wing of the Financial Conduct Authority (FCA). It is best to use CFDs to protect against negative movements in asset prices. This form of hedging can be used to bolster financial portfolios and to generate profits in the process.

Hot Features

Hot Features