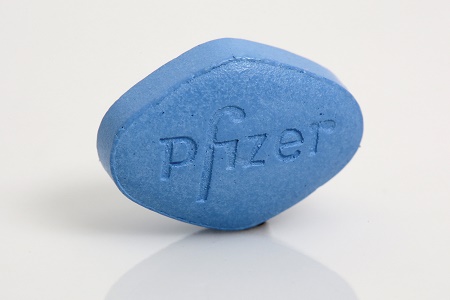

It took less than 24 hours, most of which, I assume, AstraZeneca’s (LSE:AZN) chairman, Leif Johansson spent getting a good night’s sleep, to resoundingly reject Pfizer’s (NYSE:PFE) latest and final takeover offer of £55.00 per share. AZN share price has dropped by more than 11% to £42.75.

Pfizer made it abundantly clear yesterday, 18 May, that £55.00 per share, a total package of £70 billion, would be its final offer. The offer came after AZN had rebuffed the previous bid of £53.50 per share, saying that it would accept an amount no less than £58.85.

The more I have studied the rhetoric on both sides, the more I realize that this debate is just simple negotiating dressed up and ready to play at Royal Albert Hall.

Pfizer says, “Your company is worth this much.”

AstraZeneca says, “It’s really worth much more than that.”

Pfizer says, “We’re already paying you more than it’s worth, but we’ll increase our offer just to make you feel better.

AstraZeneca stands its ground. That’s a great tactic when you have something that someone else seems desperate to buy. Let’s face it, everything is for sale, regardless of the award-winning performance that AZN is giving. All of us should know by now that the best time to sell something is when someone wants to buy it. The seller has the leverage.

I just can’t buy into AZN’s altruistic party line, because I know that, at the end of the day, the bottom line is the bottom line. I also know that the AZN shareholders are going to get a bit upset that the board is keeping them from a windfall. Perhaps that’s why the share price has dropped more that £50 per today. Do ya thin

It may have been Johansson whom Shakespeare had in mind when he said, “Methinks he protesteth too much.”

Johansson said, “From our first meeting in January to our latest discussion yesterday, and in the numerous phone calls in between, Pfizer has failed to make a compelling strategic, business or value case. Pfizer’s approach throughout its pursuit of AstraZeneca appears to have been fundamentally driven by the corporate financial benefits to its shareholders of cost savings and tax minimization.”

Despite Pfizer’s assurances to continue on to completion of the AZN R&D facility in Cambridge and other commitments to not eliminate jobs, AZN continues to say no. But it is not about jobs. It never has been. The cow has come into the barn and AZN is trying to milk it for all it is worth.

A representative of one of the largest institutional investors in AstraZenica underscored my point when he declared that, “We are disappointed the board of AstraZeneca has rejected Pfizer’s latest offer so categorically. They should have at least engaged in a constructive conversation with Pfizer.” Yet another, one of the top ten funds invested in AZN said, “We do not think the Astra management have done a good job on behalf of shareholders.”

Pfizer has said that the £55.00 per share offer is final. Only time will tell. If it is, we might expect a shareholder uprising for the company’s failure to act in a manner that is to their benefit.