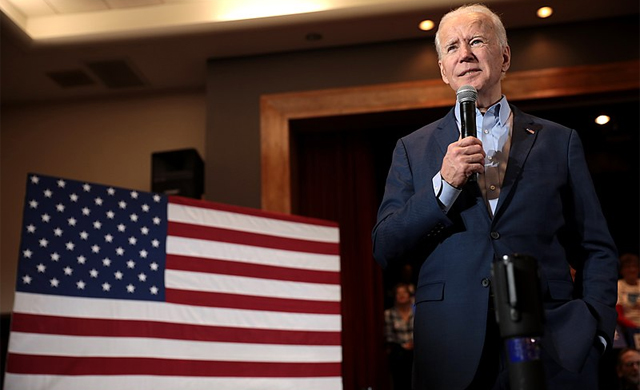

Rome has fallen, centurion! – Under pressure from his party, the current occupant of the White House has abandoned the elections due to his deteriorating health.

While this may seem like a victory for Trump, Biden was the more convenient opponent because of his weakness. Now, the former president may face a more significant challenge.

Some media have suggested that Biden’s decision to resign and endorse Vice President Kamala Harris as the Democratic nominee casts doubt on Trump’s potential victory.

This provoked an initial adverse reaction from the BTCUSD over the weekend. However, there was a rebound in hopes that Harris could also be a weak candidate.

In any case, the way things are shaping up, we could see an increase in volatility in the US market. In the meantime, let’s look at who could benefit from a hypothetical Trump victory.

According to Bloomberg, if the Republican candidate wins, the dollar is likely to strengthen, US government bond yields will rise, and banking stocks could also be boosted.

In addition, healthcare and energy stocks could perform well. Finally, a Trump victory could push up the price of gold and the value of Bitcoin, which could boost the broader market.

Shouldn’t the dollar be falling?

Indeed, Donald Trump has often claimed that the US dollar (DXY) is too strong. He believes the currency should be weaker to boost US exports and help the economy.

However, it is essential to remember that the Fed is independent. The president cannot force the Fed to change its monetary policy, which would probably lead to higher inflation.

Given Trump’s plans to tighten trade restrictions, including those imposed on China, dollar sales by importers may decline, which could strengthen the greenback.

In general, investors should now make appropriate decisions by following face-to-face election polls in addition to traditional macroeconomic data monitoring.

Hot Features

Hot Features