The WHO says we are at a critical juncture in the COVID-19 pandemic, particularly in the northern hemisphere. The next few months are going to be very tough and some countries are on a dangerous track, thus leaders will eventually have to act in order to turn the outbreak around.

Investors meanwhile are waiting to see whether new stimulus plans will be approved, who is going to win the US presidential elections, how is going to end up the Brexit saga, and who is going to be the first in launching a coronavirus vaccine. On the positive side, we could mention that Initial Jobless Claims in the US fell by 53,000 last week, from 842,000 to 787,000.

Democrats and Republicans still can’t agree on a new stimulus plan, but the Justice Department filed in the U.S. District Court for the District of Columbia an antitrust lawsuit against Google “for unlawfully maintaining a monopoly in general search services and search advertising.” On Oct. 28, Google Chief Executive Sundar Pichai is scheduled to testify before the Senate Commerce Committee, with the CEOs of Facebook and Twitter Inc, nevertheless the company’s stock didn’t fall because many believe Google won’t crumble under assault from federal regulators.

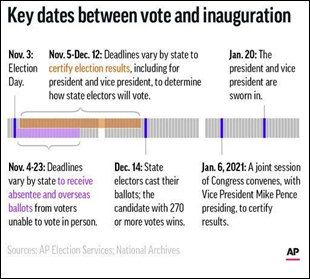

In terms of elections, Biden is keeping his lead in the polls. The question should be asked, does it really matter? Back in 2016, Hillary was also winning in the polls… The U.S. election system is fairly complicated: the winner is not merely decided by popular vote. Howbeit, that show won’t end on November 3rd. It will take over one month to know officially the 46th president. Two things to remember: Covid-19 is still present and Biden victory will be bad for the stock market at first (reason – higher taxes).

Another headache that accompanies us since 2016 is Brexit. Once again, deadlines have been pushed back. Now talks are to resume with mid-November as an end-date. Senior figures in European governments believe Boris Johnson is waiting for the result of the US presidential election before finally deciding whether to risk plunging the UK into a no-deal Brexit…

Earnings season

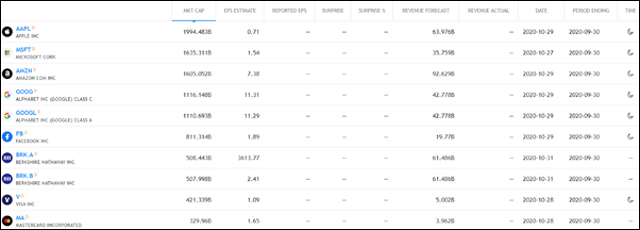

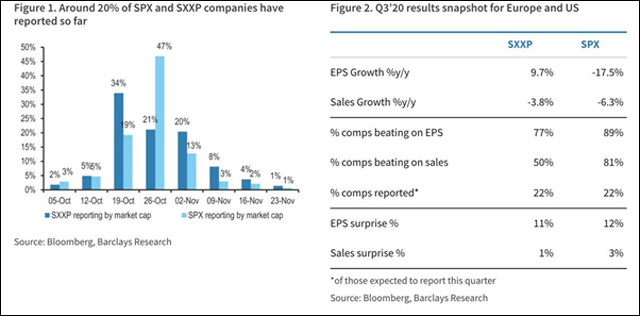

For Q3 2020 (with 27% of the companies in the S&P 500 reporting actual results), 84% of S&P 500 companies have reported a positive EPS surprise and 81% have reported a positive revenue surprise.

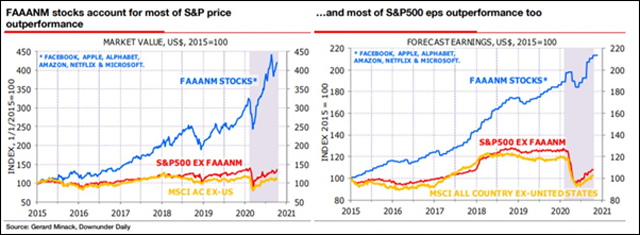

Of the 44 industries reporting (or projected to report) a year-over-year decline in earnings for the third quarter, the Airlines (-313%), Hotels, Restaurants, & Leisure (-133%), and Oil, Gas, & Consumable Fuels (-129%) industries are reporting the largest percentage year-over-year declines. Thus, clear sector bets emerge, with Technology, Biotechnology, and Healthcare remaining the top picks, while Energy bears nearly double and Financials and REITs remain in the doghouse.

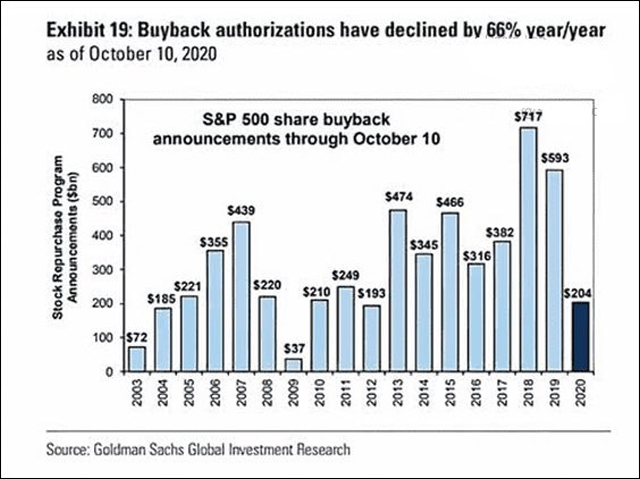

Chart of the week

Macroeconomic Data & Events

Over the next week, we will keep an eye on the major central banks’ policy meetings (ECB, Canada, and Japan), the Brexit saga continues, most of the tech companies report earning, and the preliminary estimates of Q3 GDP in the US and Europe. We should keep in mind that the ECB still has the door for more stimulus.

Another “topic of interest” will be UK-EU trade talks and the Fifth Plenary Session of the Nineteenth Central Committee of the Communist Party of China from October 26 to 29. The meeting will consider the CPC Central Committee’s recommendations on formulating the “14th Five-Year Plan” and long-term goals for 2035.

Earnings reports to follow next week: Pfizer, Merck, Comcast, Chevron, Advanced Micro Devices, Intel, Starbucks, Anheuser-Busch InBev, Alphabet, Microsoft, Visa, Shopify, Amazon, Apple, and Facebook.