Despite all the efforts on behalf of the Fed, the stock market is still a roller coaster. After three weeks of gains, the stock market was clearly overheated. As a result, we saw a new wave of selling, with the Volatility Index rising back to 47%. One of the possible explanations could be the fact that in the upcoming US elections we might see the reversal of corporate tax cuts introduced in 2017. Theoretically, it would hit profits and negatively affect stock prices.

In addition to that, virus cases in some parts of the US increased and the Organization for Economic Co-operation and Development (OECD) released a disappointing economic forecast. The future of the global economy depends on the magnitude and duration of national shutdowns the pace at which containment measures are eased, the impact on confidence, and the speed at which the significant fiscal and monetary policy support put in place by governments and monetary authorities takes effect.

Many businesses in the service sectors most affected by shutdowns are likely to be insolvent if sufficient capacity cannot be restored and demand does not recover, with attendant job losses. Rising unemployment is also likely to push up precautionary savings by households, and for millions of informal workers, the crisis worsens the risk of poverty and deprivation. In a world strongly interconnected through supply chains, international tourism flows and investment, all economies are affected significantly by the disruptions to demand and supply, irrespective of the strength of the national measures taken to contain the impact of the pandemic. Pre-existing vulnerabilities, such as high corporate debt and its declining quality, and trade tensions between major economies, could also deepen the downturn and slow any subsequent recovery.

Overall, it is expected that the global economy will suffer the biggest downturn in a century before it emerges next year from a coronavirus-inflicted recession. Jerome Powell, on the other hand, warned that the pandemic could create long-term challenges for the US economy.

“Amid widespread and stringent shutdowns, recent data suggest that global economic activity in the first half of the year has experienced a sharp and synchronized contraction greater than that in the Global Financial Crisis.”

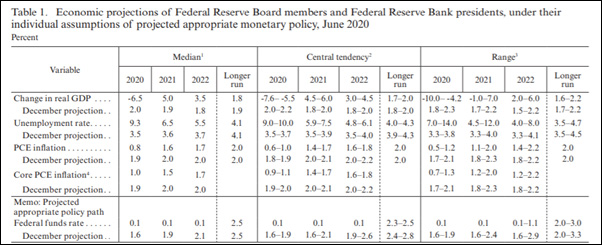

In this context, it shouldn’t be a surprise that the Federal Reserve left interest rates unchanged and mentioned its plans to keep them at zero through 2022. In addition, current pace of asset purchases will be maintained. The Fed is projecting the US economy will shrink 6.5% in 2020 but will rebound and return to positive growth in 2021 and 2022.

Developments on the Federal Reserve’s Balance Sheet

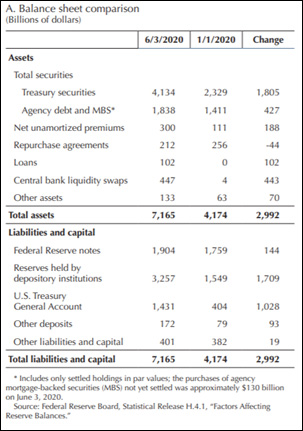

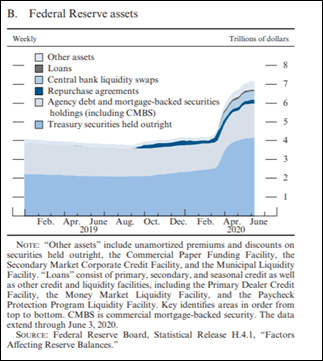

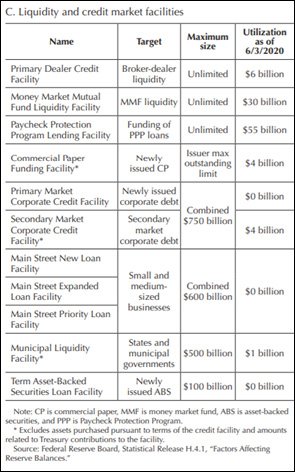

To support the smooth functioning of those credit markets that are critical for the economy, the Federal Reserve purchased Treasury securities and agency residential and commercial mortgage-backed securities (MBS), expanded repurchase agreement (repo) operations, and introduced several credit and liquidity facilities. As a result, the size of the Federal Reserve’s balance sheet increased from $4.2 trillion at the beginning of 2020, approximately 19 percent of U.S. nominal gross domestic product (GDP), to $7.2 trillion in June 2020, approximately 33 percent of U.S. nominal GDP. The $3 trillion increase in the size of the balance sheet was driven by asset purchases and other extraordinary actions.

Furthermore, to address strains in short-term U.S. dollar funding markets, the Federal Reserve Bank of New york’s Open Market Desk expanded its offerings of overnight and term repo operations. The amount of repos outstanding reached a peak of $442 billion in mid-March. Subsequently, given the improvement in funding market conditions, the Desk announced several reductions in the frequency of repo operations. As of June 3, all repos outstanding had declined to $212 billion, lower than the amount outstanding early in the year, amid substantial increases in reserves and improved funding market conditions.

The expansion of total assets from the outright purchases and other actions resulted in reserve balances of $3.3 trillion, an increase of $1.7 trillion from the beginning of the year. Additionally, several nonreserve liabilities increased.

Chart of the week

On the following images, we can see the impact of the quarantine measures: the record speed of downgrades by rating agencies, corporate debt almost in 50% in Q1 2020, whilst debt quality decreases (thus, we could see a rise in defaults). According to SP Global, the downgrades that have come are predominantly at the lower end of the rating spectrum, changing the composition of the B- cohort significantly.

Sectors with the most downgrades this year include Leisure (11.4%), Business Equipment & Services (8.8%), Industrial Equipment (7.8%), Healthcare (6.5%), Electronics/electric (6.5%), Non-food and Drug Retailers (6.1%), and Oil & Gas (5.9%).

Macroeconomic Data & Events

In the upcoming week, EU leaders could decide the future of the European recovery fund. It will be also important to keep an eye on the Bank of England’s policy meeting, in case new QE is announced (extra £100 billion in asset purchases are expected). For the Bank of Japan’s and Swiss National Bank’s meetings, no crucial changes are expected. The last piece to take into account is industrial production and retail sales for the US and China.

May 15: China industrial production/retail sales (May)

May 16: UK ILO Unemployment (Apr)/Jobless claims (May), US Retail Sales (May), BoJ announces interest rates, Zew expectations, and RBA meeting minutes.

May 17: UK inflation (May), Euro area inflation (Final, May), US building permits, housing starts (May), Russia GDP (Final, Q1), New Zealand GDP (Q1), and Brazil interest rate decision.

May 18: Bank of England meeting, Swiss National Bank (SNB) announces interest rates decision and US Jobless claims.

May 19: UK Retail Sales (May), UK Public Sector borrowing (May), and EU council meeting.

Hot Features

Hot Features