The week that changed everything

Oil market

This past week, we learned that oil futures can be negative, meaning people are willing to pay to avoid receiving the delivery of the black substance. Undoubtedly, in the short term, cheap oil will negatively affect energy companies. No surprise that Royal Dutch Shell has postponed final investment decisions on the Gulf of Mexico, North Sea energy projects. The U.S. oil major last month cut its 2020 project budget by $4 billion and suspended share buybacks to save cash.

There are two problems that oil companies face: 1) The deepest fall in demand in 25 years and 2) There is simply no storage where to put all the physical oil. According to the U.S. Energy Information Administration, U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 15.0 million barrels from the previous week. At 518.6 million barrels, U.S. crude oil inventories are about 9% above the five year average for this time of year.

Storage at Cushing is on track to be fully in use by mid-May, threatening similar price drops if buyers can’t find alternatives.

The world normally produces 100 million barrels of oil a day. With the current lockdown, the daily demand could fall as low as 70 million barrels. Global onshore storage facilities totaling 4.4 billion barrels are currently about 65% full, according to Antoine Halff, chief analyst at Paris-based commodities-analysis company Kayrros.

By the way, the reason for the May WTI contract crashing to -$40 was mainly the lack of place to store the hundreds of thousands of barrels of deliverable oil. The same problem could potentially emerge when the June contract settles, unless OPEC, including the US, finds a way to cut supply before the date.

For now, some oil producers have re-drafted their contracts to stop their prices from going negative. The question is, will it actually help as the CME has allowed not only oil future to trade negative but permitted negative option strikes.

Optimism on Markets

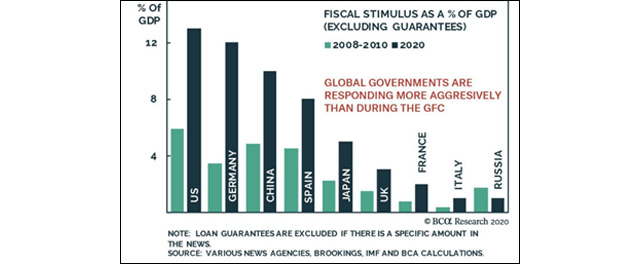

Markets are expecting the economy to re-open, while governments in Canada and the U.S. announced additional stimulus packages. In particular, President Trump signed into law the fourth coronavirus relief bill, totaling $484bn that includes additional funds for small businesses and hospitals. Thus, it shouldn’t be a surprise that the stock market has risen more than 25% in the past month, the strongest bear-market rally in the past 90 years.

ECB and bonds

In the case of the ECB, we are still observing the lack of communication from the Eurogroup. In three or four weeks’ time the Commission must come up with a new proposal, so it may be a long time before it arrives. The only positive thing about the meeting was Italy’s reaction to a possible activation of the ESM that could unblock the ECB’s purchase of short-term debt.

In this context, both Italian and Spanish bond yields widened versus core bonds. Meaning that both countries will have difficult time funding the massive debt load, unless some sort of common burden-sharing mechanism is introduced in the Euro area.

It is also worth mentioning that Fitch Ratings has placed four Spanish and two Italian SME CDO tranches on Rating Watch Negative (RWN) and revised the Outlooks on one Spanish and one Italian tranche to Negative from Stable due to the anticipated effects of the coronavirus pandemic on the securitized portfolios.

S&P Global Ratings, in turn, said it did not downgrade Italy’s credit rating, keeping it at BBB, a relief to bondholders who were largely expecting S&P to cut the country’s credit rating to below-investment-grade, or “junk” status.

The spread relative to German debt, which is seen as free of default risk, has widened to around one-year highs. Spreads on Spanish, Portuguese and Greek debt have moved in lockstep with Italy’s. In this context, many expect the probability of Eurobonds greater than ever before. By the way, Hungaryʼs government issued a six-year EUR 1 billion Eurobond and a 12-year EUR 1 bln Eurobond this week to secure financing for growing expenditures on pandemic defense.

Macroeconomic data of the week

- 26 million Americans file for jobless benefits, with 1 in 6 workers forced out of job by the pandemic. The Congressional Budget Office said Friday that Unemployment around the U.S. will surge to 16% by September as the economy withers under the impact of the outbreak.

- FHFA house price index rose 0.7% m/o/m, above the expected increase of 0.4%.

- Kansas City Mfg Index is at -30 in April, above the expected -33.

- Consumer sentiment is at 71.8 for April, above the expected 68.0.

- Durable goods orders fell 14.4%, below expectations;

- Existing home sales fell 8.5% m/o/m

- New home sales fell to an annual rate of 627k from 741k.

- Same sale stores fell 6.9% w/o/w

Macroeconomic Data & Events

It will be another busy week, full of important economic data and events. First thing first, the Bank of Japan, Fed and ECB will decide whether to apply any policy change and disclose the impact of the recent actions. Besides that, we will get GDP figures from the US. In the case of earnings, the data will come from the UK, Europe, and the US, providing some information on how companies are dealing with the pandemic.

It would be also recommended to follow the US response to the fallen oil price. These may include: 1) tariffs on foreign, 2) block foreign oil from entering the U.S., 3) bailout shale companies, or 4) make the Fed help a suffering oil market.

April 27: Dallas Fed Manufacturing Activity

April 28: BoJ interest rate decision, Riskbanken interest rate decision, Japan unemployment (March), US consumer confidence (April)

April 29: US interest Fed rate decision, US Gdp QoQ, Australia CPI (Q1), EU business confidence (April), German CPI (April, preliminary), the US pending home sales (March), US EIA crude inventories, FOMC decision

April 30: ECB interest rate decision, EU GDP QoQ, Japan consumer confidence (April), German unemployment (April), US initial jobless claims, US Chicago PMI

May 1: US ISM mfg index (April)