This month will be remembered in the stock market’s history as “Black March”. In a matter of days, indexes fell from 20 to 35%, triggering some regulators to ban short selling in order to calm the markets. In particular, Spain’s regulator said the ban would apply to 69 stocks, including all liquid shares whose price fell more than 10% on Thursday, and all illiquid shares that fell by more than 20%. In Italy, the ban will apply to 85 stocks.

Overall, S&P 500 lost 8,79%, Nasdaq Composite fell 8,17%, Industrial Dow Jones downgraded 10,36%, UX 100 Index went down by 16,97%, DAX registered a 20,01% lose, following Euro Stoxx 50 Index movement (-19,99%). Nikkei 225 rested 15,99%, while Hang Seng Index finished the week with an 8,08% fall. Finally, the Russian Moex Index and Spanish Ibex 35 lowered 17,76% and 20,85% correspondingly.

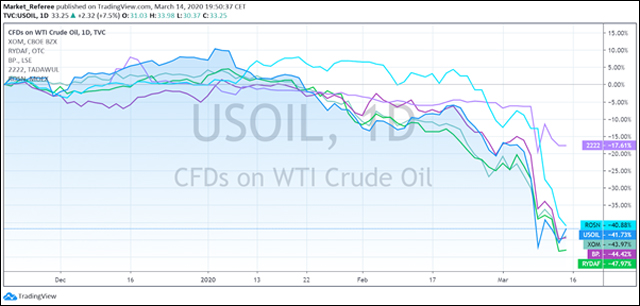

Part of the fall can be also contributed to the oil-price war between Saudi Arabia and Russia that eventually could cause energy bankruptcies. Over the last week, “the black gold” prices have lost 32%, to about $34 a barrel. Morgan Stanley estimates if oil prices remain at low levels, it could shave 0.15 to 0.35 percentage points off of US gross domestic product in the first quarter. Only five shale drillers, including Exxon, Chevron, Occidental, and Crownquest, can drill new wells at a profit at $31 per barrel of West Texas Intermediate. The rest may have serious problems in the future…

For the past 30 years, the energy sector has been funded by banks with very cheap financing. Even though, according to Shaia Hosseinzadeh of Onyxpoint Global Management, banks have been losing money on these loans for five years, and they may not be willing to tolerate the low energy prices. “A lot of those banks we think could be calling those loans in at precisely the worst time,” Hosseinzadeh said. Of course, it is unlikely to happen and President Donald Trump proved it by directing the U.S. Department of Energy to purchase crude oil for the Strategic Petroleum Reserve.

Macro data from the U.S.

- Jobless claims fell 4000from 215k to 211k.

- Home mortgage apps rose 6.0%

- Home refinance apps rose 79.0%

- CPI rose 0.1%

- NFIB Small Business Optimism Index came in at 104.5 for Feb.

- The core annual rate of inflation increased from 2.3% to 2.4%, with core consumer prices improving by 0.2% in the month.

- Core producer prices fell by 0.3%, with producer prices falling by 0.6% in February.

- Import prices fell 0.5%

- Export prices fell 1.1%

- Consumer Sentiment Index is at 95.9 for March

- PPI-FD fell 0.6%

Economic calendar

If markets continue to fall, stimulus and central bank’s intervention could be expected. Meanwhile, it would be recommended to pay attention to the BOJ and the FOMC meetings this week.

Monday 16 March

- 00:00 Eurogroup Meeting

- China: Fixed Asset Investment (YTD) Jan-Feb

- China: Industrial Production Jan-Feb

- China: Retail Sales Jan-Feb

Tuesday 17 March

- 07:00 EcoFin Meeting

- 10:00 ZEW Survey – Economic Sentiment (Mar)

- 10:00 Labor Cost (Q4)

- 10:00 Construction Output w.d.a (YoY) (Jan)

- 10:00 Construction Output s.a (MoM) (Jan)

- Australia: RBA Meeting Minutes

- UK: Claimant Count Change (Feb)

- Germany: ZEW Economic Sentiment Index (Mar)

- US: Retail Sales (Feb)

- US: Industrial Production (Feb)

- US: Capacity Utilization

Wednesday 18 March

- 10:00 Trade Balance n.s.a. (Jan)

- 10:00 Consumer Price Index (MoM) (Feb)

- 10:00 Consumer Price Index – Core (YoY) (Feb)

- 10:00 Consumer Price Index – Core (MoM) (Feb)

- 10:00 Consumer Price Index (YoY) (Feb)

- 10:00 Trade Balance s.a. (Jan)

- Germany: 30-Year Bund Auction

- Canada: Inflation Rate (Feb)

- US: FOMC Interest Rate Decision and Economic Projections

Thursday 19 March

- Australia: Employment Change (Feb)

- Japan: BoJ Interest Rate Decision

- US: Philly Fed Manufacturing Index (Mar)

Friday 20 March

- 09:00 Current Account n.s.a (Jan)

- 09:00 Current Account s.a (Jan)

- 20:30 CFTC EUR NC Net Positions

- Canada: Retail Sales