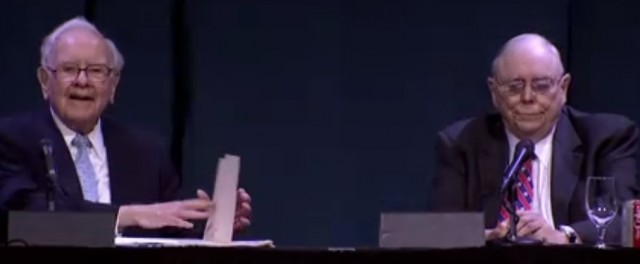

Ten days ago I was in an auditorium in Omaha with 60,000 other people hearing, among other things, a discussion between Charlie Munger and Warren Buffett on the subject of whether there are fewer opportunities to find bargains today than there were in past decades.

Charlie Munger took the pessimistic view, but Warren Buffett thought that human nature had not changed so there were still plenty of opportunities to exploit Mr Market and buy bargains.

Charlie: “I think value investors are going to have a harder time now that there are so many competing for a diminished bunch of opportunities. So my advice to value investors is to get used to making less.”

Warren: “Charlie has been telling me the same thing the whole time we’ve known each other [they met 1959]. We get along wonderfully….

Charlie: “We are making less.”

Warren: “That’s mostly I think because we’re larger. We never thought that we could manage $508bn. I would argue that there are going to be plenty of opportunities.

“The tech doesn’t make any difference, if you look at how the world’s changed in the years since 1942 when I started, I was a kid that doesn’t know anything about aeroplanes, I didn’t know anything about engines and cars, and I didn’t know anything about electricity and all that….new things coming along don’t take away the opportunities.

“What gives you opportunities is other people doing dumb things. (Laughter) (Applause) Well, the 58 years we’ve been running Berkshire, I would say there’s been a great increase in the number of people doing dumb things. And they do big, dumb things, and the reason they do it to some extent is because they can get money from other people so much easier than when we started.

“You couldn’t get the money to do some of the dumb things that we wanted to do, (Laugh) fortunately. And so, I think that investing [as opposed to speculation] has disappeared so much from this huge capitalistic market that anybody can play in, but that the big money is in selling other people ideas.

“It isn’t outperforming. And I think if you don’t run too much money, which we do — but if you’re running small amounts of money, I think the opportunities will be greater. But then Charlie and I always differed on this subject. He likes to tell me how gloomy the world is, and I like to tell him, “We’ll find something.” And so far, we’ve both be kind of right. (Laugh) Charlie, would you budge an inch on that, or not? (Laughter)

Charlie: “There is so much money now in the hands of so many smart people, all trying to outsmart one another and out-promote one another, getting more money out of other people. And it’s a radically different world from the world we started in. And I suppose it will have its opportunities, but it’s also going to have some unpleasant episodes.

Warren: “But they’re trying to outsmart each other in arenas that you don’t have to play…

…“the world is overwhelmingly short-term focused. And if you go to an investor relations call, they’re all trying to figure out how to fill out a sheet to show the earnings for the year. And the management is interested in feeding them expectations, so we’ll slightly be beaten.

“I mean, that is a world that’s made to order for anybody that’s trying to think about what you do that should work over five, or ten, or 20 years.

“And I just think that I would love to be born today, and go out with not too much money, and hopefully turn it into a lot of money. And Charlie would too, actually. (Laugh)

He would find something to do, I will just guarantee you. And it wouldn’t be exactly the same as before, but he would have a big, big, big pile.

Charlie: I would not like the thrill of losing my big pile into a small pile. (Laughter)

Warren: But we might —

Charlie: I like my big pile just the way it is. (Laughter)

Warren: We agree on that, incidentally.

Charlie: Yes, we do. (Laughter) You’re one of the most extreme lovers of the big pile.” (Laughter)

Professor Glen Arnold now offers a Managed Portfolio Service at Henry Spain Investment Services under which clients’ portfolios contain the same shares as his (write to Jackie.Tran@henryspain.co.uk)

Risk Warnings: Past performance is no guarantee of future results. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your initial investment. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. Opinions constitute our judgement as of this date and are subject to change without warning. Neither Henry Spain nor any connected company accepts responsibility for any direct or indirect or on sequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon any information contained in this Leaflet. Before contemplating any transaction, you should consider whether you require any advice from a financial adviser which we would be happy to provide. The Managed Portfolio Service will be a fully advised process and advise charges will apply. This is a financial promotion. Henry Spain is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No. 7118506. Registered Office: 49a High Street, Market Harborough, Leicestershire, LE16 7AF

Hot Features

Hot Features