Philip Fisher is the leading light of growth investors. There is a common misconception that growth investors overlook whether the share is selling at a value price. While some growth investors are careless in this regard, Fisher was always insistent that the growth share was selling at a value price.

Even high growth potential companies can be over-looked or fall out of favour and sell for less than their underlying worth from time to time. These companies are rare because the vast majority of companies with fast earnings growth are well recognised and selling at high prices – but they are well worth seeking out (Microsoft, a few years ago, was selling on a low PER, for example)

What you can learn from Fisher is that you can out-perform the market, but only by having a laser-like focus on a particular industry or a small group of industries. There’s no point in trying to understand a wide range of industries because this will not allow you to develop the depth of insight needed to succeed in a focused area.

Considerable dedication and experienced judgement needs to be brought to bear on the task of understanding all the firms in an industry; what drives their strategies and the calibre of the managers.

Philip Fisher teaches us to:

- Use the business grapevine to gain knowledge about companies and their managers

- Evaluate the competitive position of the company

- Assess the research and development capability of a company

- Judge the quality of management – especially marketing

- Examine the most important financial data

- Exploit the irrationality of other players in the stock market

You will also have some appreciation of the need for patience when buying true growth companies.

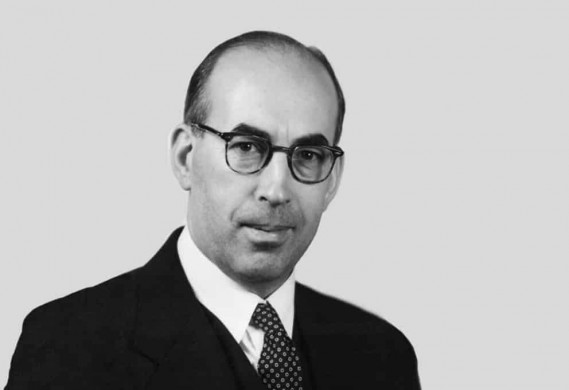

Fisher was born in 1907 and enjoyed an incredibly long 74 year career in the investment world, before retiring at the age of 91. He came from a large family, and his mind was opened to the world of investment at an early age, when he heard a conversation between his grandmother and an uncle, discussing her investment stocks. He was intrigued and excited at the possibility of buying a share in the future profits of any one of hundreds of companies.

His grandmother was concerned that he might have been bored by the subject of the conversation, but, on the contrary, this brief glimpse of the world of stocks and shares ignited a lifelong interest.

In his teenage years he began . To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1