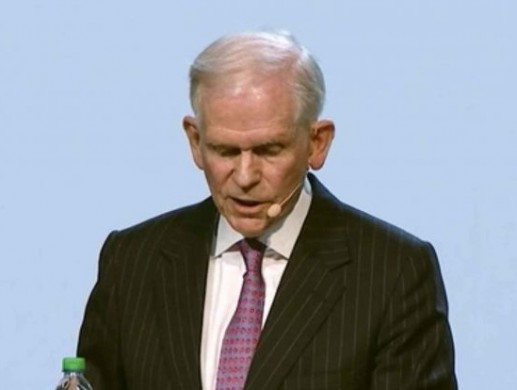

Billionaire investor Jeremy Grantham was brought up in my part of the world; a Doncaster lad who studied economics at Sheffield University (he also picked up an MBA from Harvard – wherever that is).

He is co-founder and chief investment strategist of the $118bn GMO asset manager. His particular interest is bubbles, and last week he gave his views on the position of financial markets currently in the context of the history of bubbles.

He is not positive on the equity markets. I’ll outline his current views in the next newsletter. In this one I’ll set out what his thoughts were in 1999 and in 2007.

Throughout his career he has put much emphasis on the idea of “reversion to the mean.” Assets and markets when at highs and lows will move back to – or overshoot – their historical levels.

His focus is on a long-term horizon – seven years into the future (it used to be ten). GMO may take extreme investment positions when there is a significant deviation from historical means.

Before the Dot-com bubble burst

In 1998 and 1999 Grantham refused to invest his client’s money in over-priced equities, i.e. most of the available equities. As a result, he lost 60% of assets under management as frustrated investors took their money away from him, disappointed with the performance of his funds relative to the 1998-99 market.

He reflected on this period during a 2009 Forbes interview: “We just assume that at the end, in those days, of 10 years, profit margins will be normal and price-earnings ratios will be normal. And that will create a normal, fair price. And more recently, we’ve moved to seven years, because we’ve found in our research that financial series tend to mean revert a little bit faster than 10 years

…And that’s how we do it. And it just happened from October ’98 to October of ’08, the 10-year forecast was right… And on my birthday, October the 6th, the U.S. market, 10 years and four trading days later, hit exactly our 10-year forecast of October ’98, which is worth talking about if only to enjoy spectacular luck. The P/E was a little bit lower than average and the profit margins were a little bit higher, so they beautifully offset. And given our methodology, that would mean that on October the 6th, the market should have been fairly priced on our current approach. And indeed it was.

… the magnitude of the overrun in 2000 was legendary. As historians, you know we’ve massaged the past until it begs for mercy. And we saw that it was 21 times earnings in 1929, 21 times earnings in 1965 and 35 times current earnings in 2000. And 35 is bigger than 21 by enough that you’d expect everyone would see it. Indeed, it looks like a Himalayan peak coming out of the plain.

And it begs the question, “Why didn’t everybody see it?” And I think the answer to that is, “Everybody did see it.” But agency risk or career risk is so profound, that even if you think the market is gloriously overpriced, you still have to get up and dance. Because if you sit down too quickly…

…you’re likely to get yourself fired for being too conservative. And that’s precisely what we did in ’98 and ’99. We didn’t dance long enough and got out of the growth stocks completely, and underperformed. We produced pretty good numbers, but they’re way behind the benchmark. And we were fired in droves.

I think our asset allocation, which is the division I’m now involved in, we lost 60% of our asset base in two-and-a-half years for making the right bets for the right reasons and winning them. But we still lost more money than any other person in that field that we came across, which is a fitting reminder that career risk runs the business.”

Many clients went back to GMO once they had been proved correct.

The chart below shows the movement back to a long run

………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1