Warren Buffett may have been wary of buying minority stakes in the Go-Go stock market of 1968-9 but he was excited by the prospect of picking up majority shareholdings in brilliantly organised businesses.

After all, he had already experienced very pleasing outcomes from the purchases of National Indemnity (Newsletters 15th – 20th Oct) and Associated Cotton Shops (17th and 18th Oct).

Now National Indemnity in particular, was throwing off cash for its parent, Berkshire Hathaway. Why not use it to buy a portfolio of companies run by first-class people?

A profitable little bank

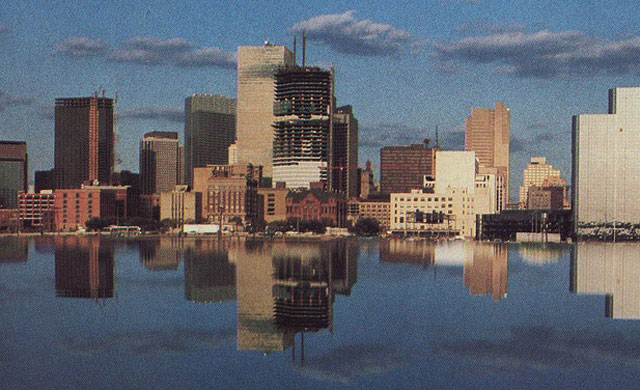

In 1931 a young man, Eugene Abegg, with only $250,000 of capital formed bank in Rockford, Illinois. It had $400,000 of deposits. Since that time, no new capital had been added to the bank by its owners.

Nevertheless, by 1969 Abegg had built, piece by piece, his creation into a bank with a $17m net worth and $100m of deposits.

It produced earnings of around $2m per year – a satisfactory return on capital employed. Ken Chace, president of Berkshire Hathaway, described such earnings being “as a percentage of either deposits or total assets, are close to the top among larger commercial banks in the country” (Letter by Ken Chace to BH shareholders 1967)

As well as high returns on both assets (2% of $100m deposits) or $2m on shareholders’ funds ($2m/$17m = 11.8%) being very good the bank was conservatively run. It achieved its returns even though it took very low risk with the capital structure, liquidity and lending policy.

In banking it is easy to make the numbers look good for a while by borrowing excessively from the financial markets to lend to high risk prospects. Everything seems fine – fine, until the luck runs out, that is

In contrast “The Rockford Bank”, as Warren often called it, borrowed only infrequently from the capital or money markets, and it had a policy of maintaining a relatively high level of liquidity (reserves of assets………To read the rest of this article, and more like it, subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features