It’s a period of calm in the market not that you’d think so if you read the papers. There is not a lot I fancy buying and when I go hunting I only turn up what I already own.

This is frustrating as I still have a lot of cash flouncing around wanting to find a home. Having said that, perhaps a pile of cash at this level is better than a pile of stock ready to plummet.

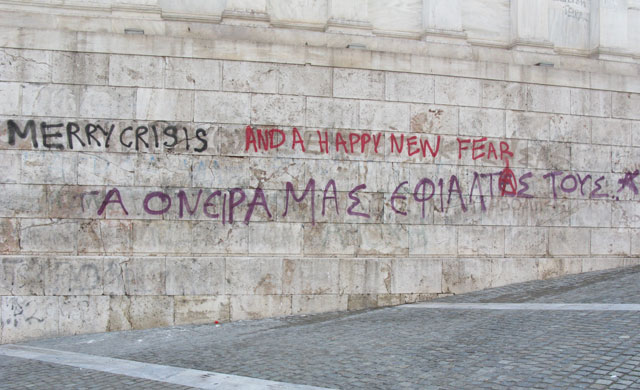

The first leg of the euro crisis is well and truly nailed, the question is does ‘part2’ kick off in Spain and Italy?

The head of the IMF worried me last week by saying “Italy was a light in the tunnel,” this kind of Freudian slip is one reason politicians should keep their lip buttoned during crisis.

However perhaps I’m the only one who thinks the light at the end of the tunnel might be an oncoming train, as the joke goes.

Legarde’s light ‘IN’ the tunnel certainly suggests the train rather than the exit and she should know as an insider of both the EU and the IMF.

The train rumble for this if part 2 was to start is the yen bouncing back from its recent fall and the yield on Italian and Spanish debt creeping higher. My eyes will be peeled.

Otherwise it’s just a wait on inflations rise. In this case equities will rally and I will park any spare cash in a FTSE track or some such other hedge. It remains the case that the big cheap caps are great value and that a broad market rise would spike them. This is a way off for now but it’s in the back of my mind.