A long bullish-trending path has been recorded over a couple of sessions in Lloyds Banking Group Plc (LSE:LLOY), as the stock market drops values from around 60, tending a correction.

Since the present negotiating point is located at 56.92, the majority of market activity has been concentrated on the psychological lines of 60 and 55. Recently, a bullish candlestick formed a bottom-base trading location to the trade’s line, appearing just below the 55-line. Put differently, should the price encounter significant resistance when attempting a subsequent upward rally, it may return to the lower baseline for a simple collapse.

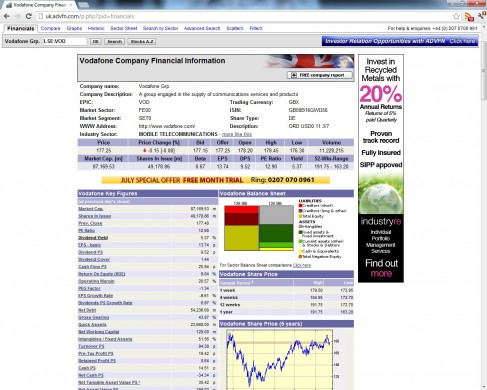

Resistance Levels: 60, 62.5, 65

Support Levels: 52.5, 50, 47.5

What part of the trending style signal has been indicated by the candlesticks of the LLOY Plc stock at this point?

The Lloyds Banking Group Plc shares firm has experienced a decline in value, indicating a potential correction.

In an effort to narrow the difference, the 50-day EMA indication’s peak has caused the 15-day EMA indicator to slant slightly downward. It’s possible that certain selling forces will win out for a while if that ultimately results in crossing to the south. It appears that the stochastic oscillators are attempting to convey that the market’s current upward momentum is unlikely to support further moves back up to the highest trades of 60. They have moved southward to a position between the oversold area and 40.

Learn from market wizards: Books to take your trading to the next