Exploring the world of yield farming, also known as liquidity mining, reveals an intriguing investment approach within decentralized finance (DeFi). Here, participants provide liquidity to DeFi platforms, earning rewards primarily in the form of native tokens.

Much like accruing interest on traditional savings, yield farming allows for earning potential with crypto assets.

Essentially, by staking crypto in yield-bearing “accounts,” investors supply DeFi platforms with the necessary capital to fuel their operations and enjoy various associated benefit

The Persistent Demand for Yield Farming

The allure of earning interest on crypto assets remains strong among investors, reflecting a perpetual demand for yield farming opportunities. Many seek to actively utilize their crypto holdings, mirroring the principles of traditional savings accounts.

Within the ecosystem, yield farming entities engage individual liquidity providers (LPs), leveraging their capital to fuel product functionalities.

The Evolving Landscape of Yield Farming

Traditionally, yield farming has offered attractive returns, especially amid a landscape of traditional banking with nominal interest rates.

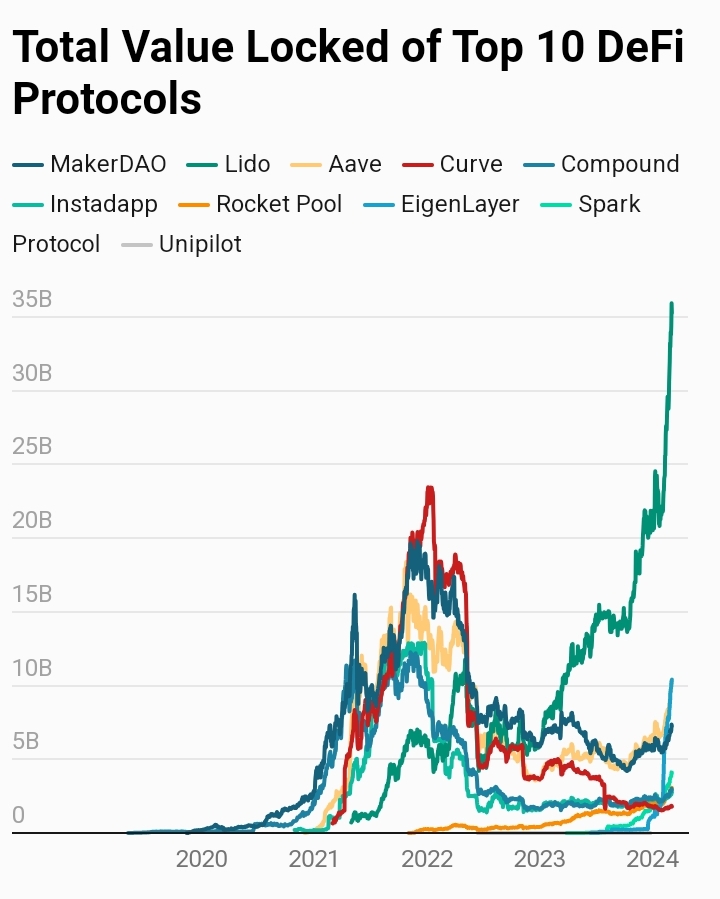

The tumultuous events of the 2022 crypto market crash saw losses exceeding $150 billion, equating to a staggering decline of over 76%. Nonetheless, post-2023 witnessed a resurgence in investor enthusiasm for crypto assets, buoyed by Ethereum’s successful shift to PoS, the emergence of liquid staking protocols, and regulatory approvals such as the SEC’s endorsement of Bitcoin spot futures.

Embracing Liquid Staking and DeFi Lending

The contemporary DeFi scene of 2024 showcases a prominent focus on liquid staking, notably within the Ethereum (ETH) realm. Early entrants like Lido capitalized on the burgeoning demand for liquid staking amid Ethereum’s transition from proof-of-work to proof-of-stake.

Simultaneously, DeFi lending emerged as a significant player, with protocols like Aave, JustLend, and Spark collectively managing nearly $20 billion in Total Value Locked (TVL).

While decentralized exchanges have slightly waned in popularity, they continue to attract crypto enthusiasts seeking optimal returns through yield farming. Leading platforms such as Uniswap, Curve, and Pancakeswap maintain their dominance in this space, boasting high median Annual Percentage Yields (APYs) in the double digits.

Top Three Yield Farming Platforms

Uniswap (UNI)

Uniswap stands out as a premier decentralized exchange within the Ethereum blockchain landscape. Established by Hayden Adams in 2018, this DEX has garnered notable investments from Paradigm, USV, and Andreessen Horowitz (a16z).

Uniswap’s architecture is tailored for ERC-20 token trading and decentralized lending, emphasizing a seamless exchange experience devoid of traditional buying or selling mechanisms. Governance over the protocol falls into the hands of UNI token holders, while Uniswap generously rewards Liquidity Providers (LPs) with a portion of the trading fees generated across the platform.

With a Total Value Locked (TVL) exceeding $6.2 billion, Uniswap maintains its status as one of the largest DEX platforms. Despite facing competition from newer protocols boasting higher median Annual Percentage Yields (APYs) and market prominence, the enduring appeal and potential of Uniswap remain undeniable in the realm of decentralized finance.

Aave (AAVE)

Aave, a decentralized platform specializing in cryptocurrency lending and borrowing, originally debuted on the Ethereum blockchain but has since broadened its reach to include other chains like Avalanche and Harmony.

Born in 2017 as ETHLend by Stani Kulechov, a law student from Finland, the project transformed in 2018, adopting the name Aave, which translates to “ghost” in Finnish. Within Aave’s ecosystem, lenders, referred to as LPs, earn interest through “aTokens,” while the protocol introduces a governance token called AAVE.

Aave’s lending mechanism requires borrowers to offer crypto-assets valued higher than the loan amount, ensuring over-collateralization to mitigate default risks. Over time, Aave has emerged as one of the leading DeFi platforms globally, boasting substantial total value. Its significance in the crypto landscape lies in providing holders with the ability to temporarily leverage their assets without selling, facilitating exposure to alternative tokens.

Curve Finance (CRV)

During its heyday, Curve Finance stood as the foremost DEX platform in terms of volume, surpassing even Uniswap. Michael Egorov introduced Curve in 2020 as a non-custodial exchange protocol with a strong emphasis on stablecoin liquidity pools.

Debuting on the Ethereum blockchain amidst the popularity of stablecoins like Tether and USDC, Curve garnered attention with its commitment to minimal fees, low slippage risks, and efficient stablecoin trading avenues, swiftly drawing in liquidity providers.

In addition to stablecoins, Curve’s liquidity pools accommodated wrapped iterations of renowned cryptocurrencies, positioning it ahead of competitors in fee structure and operational efficiency while mitigating volatility risks.

CRV serves as the platform’s native token, functioning both as a governance instrument and a yield farming incentive. Despite early promise, recent setbacks have cast a shadow over Curve’s trajectory.

Conclusion

The DeFi landscape boasts unprecedented diversity, witnessing established platforms flourishing in liquid staking, lending, and DEX yield farming, all contributing to a surge in Total Value Locked (TVL) from under $50 billion to surpassing $110 billion.

The potential influx of institutional investors holds promise for ushering in an era marked by heightened stability and transparency within DeFi. Nevertheless, regulatory pressures persist in regions like the EU and North America, casting a veil of uncertainty over the sector’s trajectory.

Given the inherent variability and ongoing uncertainties, we advocate for newcomers to exercise prudence and conduct thorough due diligence. A prudent approach involves focusing investment considerations on tokens boasting substantial user bases and elevated TVL, serving as reliable benchmarks amidst the evolving DeFi landscape.

Learn from market wizards: Books to take your trading to the next level