Here’s the market outlook for the week:

EURUSD

Dominant bias: Bullish

This pair gained a minimum of 200 pips last week, thus forming a bullish signal in the short-term. Further bullish movement is supposed to bring about a strong Bullish Confirmation Pattern, even in the long-term, as more gains are made in the market. Price would continue moving upwards this week, and bulls might target the resistance lines at 1.1650, 1.1700 and 1.1750 before the end of this week.

USDCHF

Dominant bias: Bearish

This trading instrument has become bearish in the short-term (though the market remains neutral in the long-term). Last week, the market fell by over 130 pips, in reaction to the bullish effort evident on EURUSD. Should price continue dropping more and more southwards, the long-term outlook on the market itself will become bearish. Right now, the support levels at 0.9800, 0.9750 and 0.9700.

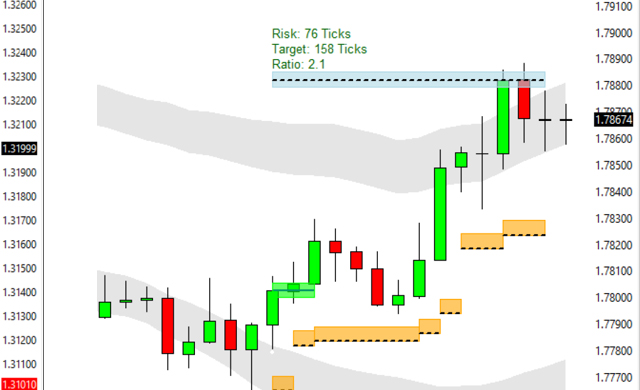

GBPUSD

Dominant bias: Bearish

Although Cable made a faint effort to rally last week, the outlook remains bearish in the long-term. On Friday, price closed on a neutral note, but a rise in momentum is expected any day (before the end of the month); and that is expected to be in favor of bulls. Nonetheless, there is a need for price to go upwards by at least, 400 pips before the long-term bias can turn bullish. Right now, price is consolidating.

USDJPY

Dominant bias: Bullish

In the long-term and the short-term, a Bullish Confirmation Pattern is present in the market. Last week, price managed to gain 140 pips, from the weekly low of 110.00. The probability of price going northwards is higher than its probability to reverse and go seriously downwards. While there may be bearish threats along the way, USDJPY is supposed to generally go northwards this week, reaching the supply levels at 111.00, 111.50 and 112.000.

EURJPY

Dominant bias: Bullish

This cross made a significant rally last week, rising from the demand zone at 126.50, and gaining about 340 pips, before closing around the price zone at 129.50 on Friday. Bulls are still intent on pushing the market upwards – that is the expectation for this week. At least, another 200 pips would be targeted this week, as price aims at the supply zones of 130.00, 130.50 and 140.00 might be reached this week.

GBPJPY

Dominant bias: Bearish

This cross is bearish in the long-term, but bullish in the very short-term. Last Monday, price consolidated, rallied on Tuesday and Wednesday, and then consolidated for the rest of the week. The outlook on the market is bullish for this week, and in case the expected bullish movement is serious enough, the long-term bias on the market should become bullish. This week, the supply zones at 143.50, 144.00 and 144.50, could be targeted.

This forecast is concluded with the quote below:

“Price action behavior in all timeframes reflects rational human behavior. Thus, whether a trade is executed on the 5 minute or the monthly chart, price action and the trading idea remains equally valid. Capital markets are fractal in nature. If you want to trade a system that preserves its’ edges over the long-run, then the low-risk idea should be based on humans’ psychological biases.” – Gabriel Grammatidis

Source: www.tallinex.com

Trading realities: http://www.advfnbooks.com/books/unlockpotential/index.html

Hot Features

Hot Features