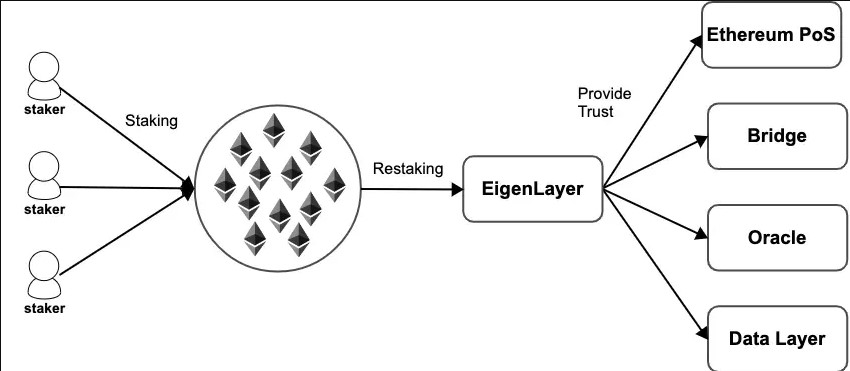

Restaking redefines what it means to stake your crypto. It’s like getting double duty out of your investment. By restaking, you can leverage your existing stake to secure multiple networks and amplify your earning potential. Imagine earning rewards on Ethereum while simultaneously contributing to the security of other promising protocols. That’s the power of restaaking!

Forget juggling multiple investments! EigenLayer’s restaaking lets you earn more on your existing Ethereum stake. Here’s the magic: You simultaneously secure other DeFi projects while validating the Ethereum network.

This means more rewards with less hassle. There is no need to tie up funds in new places. Plus, new projects benefit too, gaining security without the burden of setting up validators. It’s a win-win for everyone in the DeFi space!

EigenLayer’s Magic Trick: Turning Staked ETH into DeFi Gold

EigenLayer’s revolutionary restaaking unleashed a wave of innovation. Protocols like Ether.fi, Swell, and Restake Finance are springing up, offering users a way to hold “liquid restaking tokens.” These tokens act like magic beans: they keep your ETH staked in EigenLayer for extra rewards, but they also exist as liquid tokens you can use on other DeFi platforms to earn even more!

Adding fuel to the fire, EigenLayer’s skyrocketing TVL of $7.9 billion shows investor enthusiasm for its upcoming token launch. Restaking isn’t just about more rewards; it’s about unlocking the full potential of your staked ETH across the entire DeFi landscape. Think of it as security sharing on steroids—everyone benefits, from stakers to validators to DeFi services.

While some worry about the concentration of ETH in EigenLayer, the potential for a more fluid and scalable DeFi ecosystem is undeniable. EigenLayer might just be the key to unlocking the true power of DeFi.

Learn from market wizards: Books to take your trading to the next level.