Why struggle trying to find a winner in a downward market when you can diversify your portfolio with emerging markets?

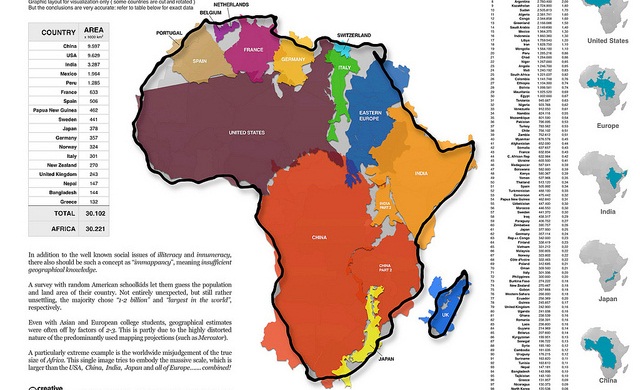

Africa’s economy isn’t the size of these economies (see pic.) combined, but surely has the potential to be. Highest rate of return on investment in Africa is the highest in the developing world.

The continent’s economic growth has ignored the outside world in respect of financial mishaps, including the 2008-09 financial crises.

The Democratic Republic of the Congo (DRC) has 70% of the worlds Coltan, a material used to make most mobile phones. Africa’s penetration rate currently stands at 78% (65% in 2011 and 73% in 2012) and expected to reach 85% by 2015. The DRC holds 30% of the world’s diamonds.

Sub Sahara Africa is currently outperforming global rates in addition to English now becoming the official language in many Sub-Saharan countries. The population’s literacy and education are also increasing across the continent. Overall, labour forces are becoming more skilled.

Trade between China and Africa has increased tenfold over the past decade and is currently US$166bn as at 2011 – of which the majority (surprisingly) being raw materials.

Although oil exporting countries do expand more strongly (as we have witnessed) than oil importing countries, Africa’s export portfolio predominantly consists of raw materials. Its export earnings are sensitive to commodity price fluctuations. But are commodity prices the sole underlying driver of all 30,220,000 Kilometres squared? The government relies on 80% of revenues deriving from oil prices.

Thanks to recent political stability announcements and resources that the continent seems to be discovering more and more of, Africa has seen reasons for growth.

Increase in prices of commodities + increase in the discovery of commodities = the perfect combination for economic growth.

Despite the decline from their peak due to weaker demand and increased supply, Africa’s supply of raw materials seems to be strong, and increasing with discovery expeditions. Prices are expected to remain at levels favourable for African exporters.

African economic growth is calculated to accelerate to 4.5% in 2012 and 4.8% in 2013.

Africa’s main obstacles in doing business consist of HIV/Aids, adult prevalent rate, low level of innovations (not including South Africa) and violations of human and workers’ rights. Not to mention, the notoriously corrupt Nigerian banking sector and the Nigerian electricity shortages; impediment to growth and investment.

Hot Features

Hot Features

Nice equation, but surely an increase in commodities will translate into a decrease in price as there is an abundance of commodities; and fluctuating commodity prices is potentially problematic not beneficial?

I am glad you are a fan….

Surely market efficiency theory states that in the long term the price of commodities will reflect the true supply and demand; whilst this may not be true in the short run (where I presume investors will be able to make large gains), one would expect the price in the long run to be efficient. True sustainable economic growth would thus coincide with the medium to long term, or am i being completely ludicrous like my good chum Frodo?

I am not denying that there is true potential in Africa, and yes in the Woodland Realm there is space for more than one theory my dear friend

I think you fail to properly recognise how significant the obstacles are: corruption, political instability, terrible human rights issues and large under-resourced parts of the continent are just to name a few. These are all issues affecting the region, making it unattractive to foreign investment; particularly compared to other emerging markets such as India, China and the Middle East.

The diagram fails to address some key economic points such as productivity per square km.

I think you are missing vital areas of investment hear; like the Australian market.

Yes Alex, you are correct in what you have responded. Having worked for an asset management company in Oz, they have yet to exploit the opportunities that lay in the African market. There is much capital in Oz to be used, and they need to utilise the facility they have.

Could you please explain to the readers why emerging markets are so great, why shouldn’t the normal investor invest where his money is safe, who is your target audience, rog traders or white collar? Are you US or UK based?

Dont forget its not just Africa which is rich in such resources, many more places which should be mentioned, as I am certain you are aware of.

Alex

It seems as if you are trying to sell an emerging market from the article to me, and as someone who reads hundreds of reports weekly I can clearly pick this up.

The Oz market needs to be appreciated to a greater extent, and ignorance towards it has to be vanished. You should be targeting the Eastern investors.

May I ask which hedge fund you are currently working at? Please upload your current material as pdf, and we can then discuss this over the phone or through email contact, as I am currently not in UK.

This article seems like it is written for rookies