There is no time to pour champagne. After the fraught deal on the fiscal cliff that averted $600 billion of more taxes and spending cuts, the US Congress will have to face many issues regarding the situation of the biggest economy in the world. The Senate bill, in fact, doesn’t reduce the US national debt, nor the federal spending evoked by the Republicans. The deal freezes them until February, when a split Congress will be asked to vote on many controversial aspects that divide the two main American parties.

The risk of default

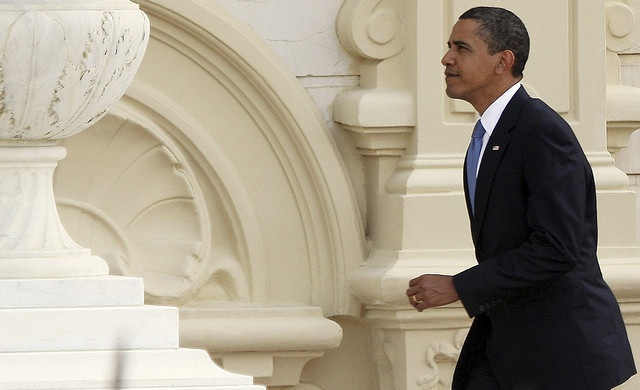

The agreement, a partial victory for the President Obama, hikes taxes on household incomes above $450,000 a year but doesn’t do anything to reduce the federal deficit. The government debt load reached the threshold of $16.4 trillion and the Congress will have to raise the borrowing limit in February if it doesn’t want to run out of money. A failure to close a deal could mean a default on US debt or another credit rating downgrade, as it happened in 2011 when S&P downgraded the country’s top-notch AAA to AA+ for the first time.

“Before we raise the debt limit we have to reduce spending,” said Dave Camp, who chairs the congressional committee overseeing tax policy. Many Republicans are less diplomatic in private and see the debt ceiling fight as a chance to get revenge both on the White House and the dealmakers within their own party for being forced into accepting a tax increase this week.

S&P said on Wednesday that governance and policymaking in the US had become, “less stable, less effective and less predictable.” On the other hand, Moody’s said in September that it would upgrade its outlook if politicians could agree on policies that “produce a stabilisation and then downward trend in the ratio of federal debt to GDP over the medium term”. The International Monetary Fund, finally, said that raising the debt ceiling would be a critical move.

Cut, cut, cut

The debate over “entitlement” programs is also meant to be difficult. Republicans will be pushing for significant cuts in government healthcare programs like Medicare and Medicaid for retirees and the poor, which are the biggest drivers of federal debt. Democrats have opposed cuts in those popular programs. In the meantime, spending cuts of $109 billion in military and domestic programs were delayed for two months.

“We haven’t even begun to address the basic issues behind this,” Peter Huntsman, chief executive of chemical producer Huntsman Corp, told Reuters. “We haven’t fixed anything. All we’ve done is addressed the short-term pain”.

Deteriorating relations between leaders of the two parties do not bode well for the fights ahead. Vice President Joe Biden and Republican Senate leader Mitch McConnell had to step in to work out the final deal as the relationship between House Speaker John Boehner and Obama unravelled. Senate Majority Leader Harry Reid also drew the anger of Boehner, who told Reid in the White House to “Go fuck yourself” after a tense meeting last week, aides said.

In Obama’s second term, Democrats and Republicans will be forced to compromise on many fields, like immigration reform, climate change, lifting domestic energy production and gun control.

The fiscal cliff deal sparked a rally on global markets, with stocks marking up their best gains in nearly seven weeks. The FTSE All World index, tracking 2,800 large and mid-cap stocks in developed and emerging markets, climbed 2.2 per cent, its best performance in more than a year.

Hot Features

Hot Features