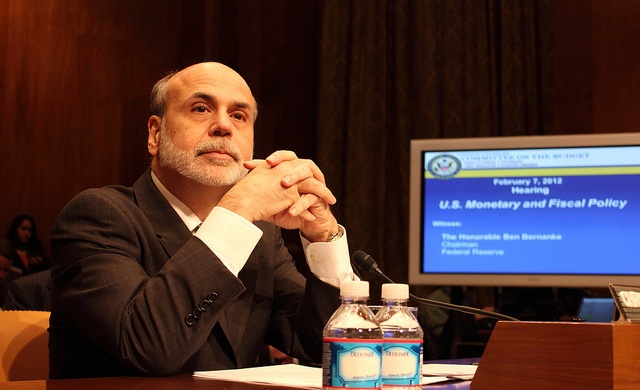

It’s almost impossible to believe how much one economy, and one man at one central bank, can affect the entire world with one short speech about his financial strategy. But Ben Bernanke got the world to play the game of “Ring Around the Rosie” by doing just that yesterday afternoon. “We all fall down.”

As of this time the FTSE 100 is down 141.01, the FTSE 250 is down 273.98, the techMARK is down 46.43, the FTSE All-Share is down 72.48, and the FTSE Small Cap is down 43.89. In fact, “every single share in the FTSE 100 fell as the stock market opened this morning.”

But wait – there’s more! China’s CS1300 was down to a six-month low. The Hang Seng Index is down to 20,382. The Shanghai Composite Index is down 2.8%. The Nikkei is down 230.0 points. The DAX is down 70.0 points. The CAC is down 33.0. It may be down more modestly, but, nonetheless, the Euronext is down. The ASX is down from 4,844 to 4,760. The Dow is down 173.00 points. The NYSE is down 113, and the NASDAQ is down 32 points.

I’m not sure I can take all this good news, can you?

It all comes down (there’s that word again) to this. The entire world was watching and waiting with baited breath to hear what Mr. Bernanke was going to say. That, in itself, portends some kind of massive reaction (a word I use advisedly, as opposed to “response”) as the world releases its collective breath. Yes, I am saying that we all agreed to play the game, so we all expected to fall down when he got to the end of the rhyme. So, what has happened in the markets today is just as much our fault as it is Bernanke’s. Here, in a nutshell, is what he said:

- The Federal Reserve Bank may begin slowing its stimulus activity sometime later this year.

- Whilst the Bank is taking no action at this time, it is considering doing so in the coming months.

- Hoping that the unemployment rate in the U.S. falls below 7% by May 2014, the Fed hopes to cease spending $85 billion per month buying bonds and mortgage-backed securities, if that goal is reached. (To see my perspective on the unemployment rate, see “All Eyes Are on U.S. Jobs Report,” published on 06 June.)

- If its projections for the economy prove to be accurate, the Fed could begin to “ease the pressure on the accelerator,” in the coming months.

- For the moment, neither the Fed’s policy nor its practices will change.

I don’t think that anyone in their right mind heard Bernanke say anything unexpected. So why the (over)reaction? It’s really a matter of investors shifting their funds in anticipation of the potential future actions of the Fed, which Bernanke at least put into a time frame yesterday. It’s a matter of being sure that you have a seat on the train before it leaves the station or looking like a fool on the platform with a ticket in your hand, watching the train pulling out in the distance.

Some would call the reactions “preparation.” I call them “anticipation.” Preparation does not make people nervous. It makes them calm. Personally, I don’t do business with anybody who is nervous or running scared, because they tend to overreact to “non-news,” which is really what Bernanke’s address was. Eventually, all of the Nervous Nellies “all fall down.”