Final Results

Agriterra Limited, the AIM listed pan-African agricultural company, has announced its audited final results for the year ended 31 May 2015.

Chairman’s statement (In full)

Agriterra continues to centre on building a sustainable agricultural business with its portfolio focussed on beef and maize in Mozambique and cocoa in Sierra Leone. As reflected in the results, the period has been mixed in terms of success. The beef division has emerged as a solid revenue generator and a stable base from which to pursue the Group’s expansion objectives in the short to medium term, while the impact of external factors beyond our control in Sierra Leone, in particular the Ebola outbreak, caused the curtailment of investment in our operations, with our fleet and warehousing being used by the International Red Cross, World Health Organisation and World Food Programme.

Large scale agriculture projects require heavy investment in order to establish an effective operating platform that can deliver long-term and sustainable growth. We have invested significantly in building a base that the Board believes has the potential to increase our revenue generation capability and profitability moving forward. We continue to look at optimising our business and seek to maximise efficiencies across our divisions, to capitalise on revenue generation, to reduce operating expenditure and to improve margins so as to drive shareholder value.

With regards to our beef operations, we have invested in and built a valuable platform of ranches, feedlot, an abattoir, infrastructure, logistics and retail units. This division continues to show its potential to grow as a solid revenue generator, with a 31% increase in revenues to $5,366,000 from $4,081,000 in the 2014 financial year, in spite of a 6.5% fall in the average Metical to US$ exchange rate (in Metical terms, revenues increased by over 40%). This notable growth in revenue reflects the increasing volumes being moved through our feedlot and in particular the expansion of our retail units, which are the final link in Agriterra’s beef value chain, from field to fork.

Of particular note during the year has been the establishment of our butchery and distribution centre in Nampula, Mozambique’s third largest city and the central commercial hub for Northern Mozambique. We opened our doors to the public in April 2015 and, by October 2015, monthly sales (retail and wholesale) have already achieved in excess of $150,000 a month. We expect that this growth will continue, by optimising performance and utilising the full distribution capacity of our Nampula property as a staging post for the other northern retail sites, as we push on with our expansion strategy into the north of the country.

The success at Nampula has reinforced the Board’s belief in our retail expansion strategy, to further leverage the increasing demand for quality beef products and the apparent increase in activity from the LNG sector, notwithstanding the macro oil and gas environment. We now have six outlets and for the 2016 calendar year, we are targeting new sites in the north of the country in Pemba and Nacala as well as opportunities in the capital, Maputo. We expect that the additional volumes supplied from these sites, along with growth in revenues from our existing sites, will provide a material contribution to revenue growth in FY2016.

The Vanduzi feedlot continues to grow in terms of capacity and is processing cattle sourced from our own ranches as well as locally purchased animals. Overall, we feel that the beef division has now established itself sufficiently to enable expansion both in terms of wholesale and retail sales in country, as well as by exploring the potential in the export market.

Elsewhere, our maize and cocoa divisions have been impacted by external factors beyond our control. In Mozambique, political instability leading up to the presidential elections in October 2014 made transport of maize meal to the South and North of the country difficult. Further, heavy rains affected both Mozambique and Malawi in the second half of the year, temporarily cutting off the road links between the Group’s production and processing facilities in central Mozambique, and the Northern markets. These factors, in addition to a bumper maize harvest saturating the market and reducing the demand for our processed products resulted in lower revenues of $5,517,000 (2014: $9,716,000) for the year. Whilst this is disappointing, we are confident that this coming year will present a much more favourable market opportunity for the Group. In particular the current maize crop appears to have returned to more typical levels, with consequent higher sales prices of maize meal and higher absolute margins achievable per tonne of maize meal sold. Furthermore, and as a result of current exchange rates between the US$ and Metical, the price of rice – which is often seen as a substitute to maize meal – has increased significantly, further driving the demand of maize meal. With a more favourable sales and pricing environment this year, we expect to achieve a significant improvement in this division in FY2016.

The serious and prolonged Ebola crisis suffered in West Africa heavily impacted our Sierra Leone operations, which in addition to our cocoa division includes 45,000 hectares of brownfield agricultural land in an area suitable for palm oil production in the south of the country. Due to a combination of factors including the restrictions of movement imposed in the country, together with the imperative to protect our employees and the reduced international investment appetite, we have placed the further development of our Cocoa plantation on hold for the present time. During this period of “care and maintenance”, our plantation assets in country are being maintained and operations are ready to recommence when and if feasible. In order to support the country in its fight against, and recovery from, Ebola, we have leased part of our vehicle fleet and some of our warehousing infrastructure to international aid organisations. In addition we have effected food distribution for the World Food Programme in our area of operations around the Kenema region. Seedlings from our nursery, together with fertiliser and rice, have also been distributed to local farmers in partnership with a major cocoa industry player to support the region’s recovery.

Despite the slowdown in the development of our plantation, our current activities have allowed us to maintain a presence in the country during this challenging time in Sierra Leone’s history and provide a revenue stream to the Group which currently offsets most of the cash costs of the cocoa division.

Despite the challenges facing our Cocoa operations, we are now encouraged by what appears to be the end of Sierra Leone’s fight against Ebola, with the country declared Ebola free by the World Health Organisation in early November 2015. We hope that a start to Sierra Leone’s regeneration will now be possible, which will require innovative solutions to the challenges the country faces. As a first step, our Sierra Leone subsidiary company, Tropical Farms Limited (‘Tropical Farms’), has entered into a trading agreement to use its organic certification and buying networks to source and supply up to 500 Mt of Sierra Leonean cocoa beans to a leading global company focused on natural, organic and specialty foods (the ‘Offtaker’). In exchange, the Offtaker will provide Tropical Farms with pre-financing for the purchase of beans and pay a fee per tonne of beans purchased on behalf of the Offtaker. While relatively modest in scale, we hope that this first step in post Ebola Sierra Leone may lead to future opportunities.

Corporate Update

During the period, in April 2015, Euan Kay and Michael Pelham stepped down from the Board as non-executive directors in order to focus on their other interests. I would like to thank both Euan and Mike for their support and hard work for Agriterra over the years, and wish them well for the future.

Financial Overview

While we continue to build our business towards profitability, ultimately we are still in the investment phase of the Group’s development. Our results continue to reflect the significant investment and development in our infrastructure – in particular within our beef business through the development of our farms – as we expand to critical mass. In the beef division our revenues now cover all of the cash operating costs of our retail, abattoir and feedlot operations, with the increasing scale of our operations contributing to the ongoing costs of the farms. As we expand our herd numbers, we expect the farms themselves to move to profitability.

Despite the 31% increase in beef revenues to $5,366,000 (from $4,081,000 in 2014), the unfavourable market conditions in the maize division contributed to a decrease in overall revenue to $11,787,000 (from $13,797,000 in 2014).

As a result of Ebola’s detrimental impact on Sierra Leone, the Board has adopted a conservative approach and taken the prudent decision to impair all of the palm oil operations and substantially all of the cocoa assets. The resulting impairment charges of $9,860,000 (2014: $nil) are a significant component of the Group’s loss of $13,387,000 (2014: $8,016,000). Despite these impairments, we remain optimistic about the intrinsic value of these assets and remain hopeful that further value may be realised from the cocoa operations in future, through investment & development, joint venture, sale or a combination of these events.

In addition to our current operations, the Board has continued to actively pursue the realisation of value from its legacy oil and gas operations. In light of the continuing unrest in South Sudan, the Board took the view that it would be prudent to expedite settlement in respect of the claims arising from the Group’s legacy oil interests and accordingly, as announced on 17 September 2014, a successful settlement was reached in respect of such interests resulting in income of US$5,659,000 to the Group. Following the settlement, the Company and Group has no further current economic interest in South Sudan.

Going forward, we are focussed on improving cost efficiency across all divisions, and expanding revenues, to build a profitable business. We believe that our cash balances of $6,421,000 at 31 May 2015, combined with our overdraft and other borrowing facilities of 179,000,000 Metical (approximately $4,850,000 at the 31 May 2015 Metical to US$ exchange rate) for our grain operations and a further 105,000,000 Metical ($2,845,000 at the 31 May 2015 Metical to US$ exchange rate) to fund our beef operations, are sufficient for the Group to continue its development programme.

In light of the Group’s future prospects, available cash and banking facilities, and a Net Asset Value of $29,842,000, the Directors are of the opinion that the Company is currently significantly undervalued at a market cap of approximately $8,250,000.

Outlook

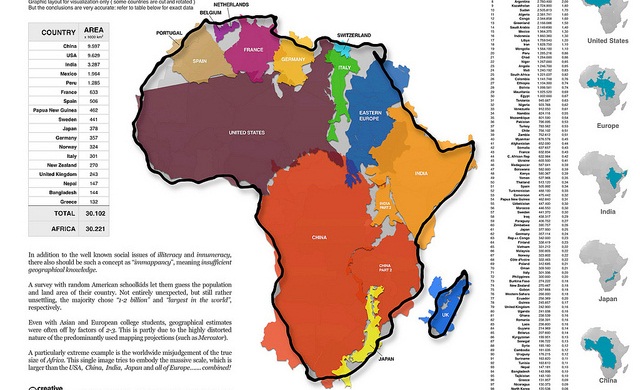

The African agriculture market remains an area of exceptional growth potential. While we are still in the development phase, the Board is confident that the progress we have made to date has created a strong and sustainable platform. We are now beginning to demonstrate the “proof of concept” in our beef operations and look forward to a transition into profitability.

I would like to conclude by thanking our team who have worked tirelessly in assisting us in the development of the business.