Increasing pressure on UK Chancellor after Moody’s downgrade and sterling concern.

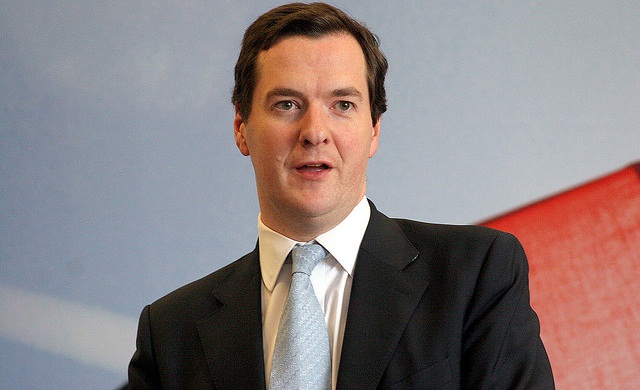

The UK’s senior economics minister George Osborne has said the government will “redouble its efforts” to reduce the country’s debts after rating’s agency Moody’s downgrade the UK from AAA to Aa1.

Speaking in a House of Commons debate Mr Osborne argued that the rating decision was “a warning to those who do not want to deal with debt”. Citing the stable performance of London market following the downgrade the Chancellor said the government would maintain its central policy of economic policy of austerity to reduce its financial deficit.

“Ultimately that is the choice for Britain: we can either abandon our efforts to deal with our debt problems and make a difficult situation very much worse, or we can redouble our efforts to overcome our debts”, the Chancellor stated.

Following the downgrade the pound has come under increasing pressure, falling to a two-and-a-half year low against the US dollar and a 16-month low against the euro. During 2013 the pound has lost 7% of its value against both the dollar and euro.

Mr Osborne stated that the national situation would be “much worse” if the government, comprised of a coalition between the Conservatives and Liberal Democrats, implemented the policies advocated by the opposition Labour Party.

Shadow Chancellor Ed Balls argued during the debate that the government was in “complete denial” about situation.

The commons debate follows remarks by the Business Secretary, Vince Cable, who argued that Moody’s downgrade was “largely symbolic” and that there “positive” signs for the UK economy, including falling employments figures and increased exports.

“In terms of the real economy, there is no reason why the downgrade should have any impact” said Dr Cable.

Announcing their decision to downgrade the UK’s credit rating Moody’s said that following slow growth and increasing national debt that it believes “the risks to the growth outlook remain skewed to the downside”.

Whilst noting that it had “considerable structural economic strengths” Moody’s said in a statement that there was “increasing clarity” that the UK’s economic growth “will remain sluggish over the next few years”.

The downgrade marks the first time since 1978 that the UK has not had a AAA rating from both Moody’s and Standard and Poor’s.

Hot Features

Hot Features