Chevron Corp is to cut 10 to 15 per cent of its worldwide workforce as part of restructuring by the second-largest US oil producer.

The company previously disclosed a 30 per cent reduction in its 2020 spending and voluntary job cuts amid this year’s plunge in oil prices and lower demand for oil and gas due to the virus pandemic.

Chevron was among the first to make significant budget cuts as oil demand plummeted. The company, which has 45,000 employees, expects to remove about 10 to 15 per cent of its global staff to “match projected activity levels”, a spokeswoman confirmed.

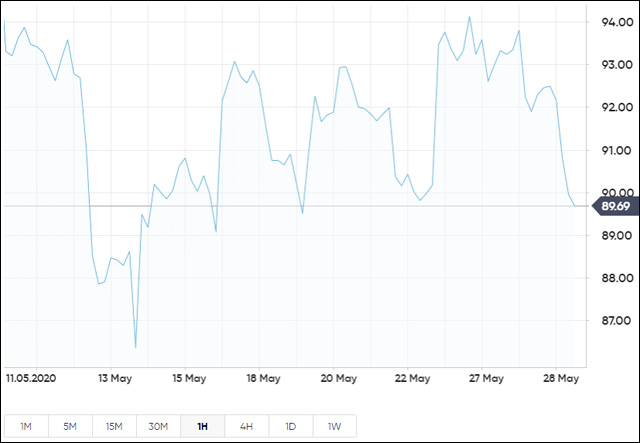

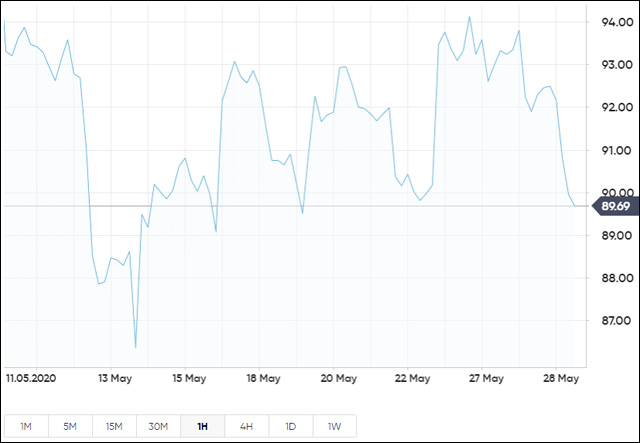

Chevron

The 4,500 to 6,750 job cuts are to “address current market conditions” with different impacts on each business unit and region. Most reductions will take place this year.

US crude oil prices have nearly halved this year to about $33 a barrel as the pandemic hurt travel demand and led to stay-at-home orders. Oil demand has been hit by as much as two million barrels per day.

Chevron said it would reduce planned US shale output by about 125,000 bpd.

On Wednesday, top US oil producer Exxon Mobil Corp said it had not yet taken steps to reduce its workforce. Exxon also cut its planned spending 30 per cent for the year.

Last year, Chevron left a takeover bid for Anadarko Petroleum Corp rather than get into a bidding war with Occidental Petroleum Corp. Chevron received a $1 billion break fee.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.