European shares were near an 11-week high and UK markets surged as governments and businesses worldwide announced a gradual reopening following a global easing of the coronavirus-led lockdown.

The pan-European STOXX 600 rose 1 per cent in early morning trading, reaching its highest level since March 10.

The UK’s FTSE 100 surged 1.9 per cent as Prime Minister Boris Johnson announced that the country will reopen thousands of high street shops, department stores and shopping centres from June 15.

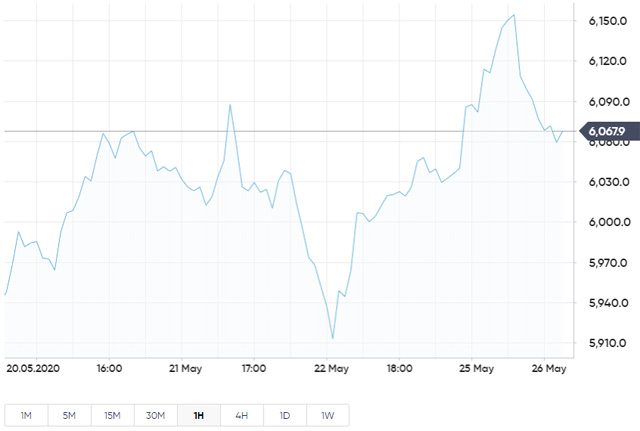

UK 100

BP Plc and Royal Dutch Shell Plc jumped 2.9 per cent and 4.3 per cent, respectively, with oil prices rising on optimism that a revival in business activity would bring back demand.

Only three stocks on the FTSE 100 were trading in the red, with early gains led by the travel and leisure, construction and banking sectors.

Aston Martin soared 24.8 per cent after the UK luxury carmaker confirmed that Tobias Moers, former head of Mercedes-AMG, would become its chief executive officer.

Wall Street futures also rallied 2 per cent, as hopes of further policy support and improving economic data raised hopes of a faster economic recovery from the coronavirus pandemic.

Paris-headquartered shopping centre operator Klépierre SA jumped 6.7 per cent after saying it had reopened 80 per cent of its European malls and hopes to reopen 90 per cent of them within 10 days.

French carmakers Renault SA and Peugeot SA rose nearly 4 per cent as President Emmanuel Macron said support for the car sector will be “massively amplified”

Hot Features

Hot Features