The much-awaited Bitcoin halving event means that the reward for unlocking a ‘block’ has been cut from 12.5 new coins to 6.25

Bitcoin has gone through its third “halving“, reducing the rate at which new coins are created.

The digital currency relies on “miners“, who run software that races to solve complex maths puzzles in return for Bitcoins.

The halving event on Monday, May 11 means that the reward for unlocking a “block“ has been cut from 12.5 new coins to 6.25.

It happened as the 630,000th block was mined, triggering a 50 per cent reduction in the reward miners receive.

The final Bitcoin block with a subsidy of 12.5 BTC is said to have contained the message “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue“. This text was written in the coin base transaction, where the miner sends themselves the reward.

This isn’t the first time that a political statement has been put inside a Bitcoin block. The first ever Bitcoin block, known as the Genesis Block, also contained a message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.“

Bitcoin inventor, Satoshi Nakamoto, included this message from a Times newspaper article on the day the block was produced.

This is the third halving – which happens roughly every four years – since Bitcoin’s creation in 2009. The first took place in November 2012; the second in July 2016. The next halving is due to take place in May 2024.

Bitcoin’s code also means that rewards to miners will continue to halve every 210,000 blocks until they reach zero in around two decades’ time. As digital currencies have no central banks to regulate their supply, this will limit the total number of Bitcoins that will ever exist to 21 million.

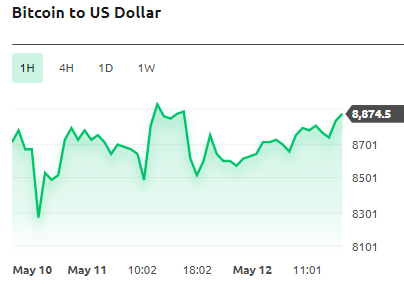

The price of Bitcoin closed at $8,601 yesterday. That’s a 1.75 percent decline in 24 hours, or -$153.74. It was the lowest closing price in twelve days.

It is still 57 percent below Bitcoin’s all-time high of $20,089 (December 2017).

However, the price of Bitcoin also saw declines during the first two halvings. The halving, in July 2016, saw the price of BTC decline from $1,100 to $600 and similar in 2012.

The reason for Bitcoin price increases is the principle of supply and demand. If the supply suddenly drops but demand stays the same, the price will inevitably rise.

May’s bitcoin halving comes in the middle of a global economic meltdown, though it is not yet clear whether collapsing markets is driving money away from traditional assets into cryptocurrency.

The digital currency has gained more than 20 per cent since the start of this year, touching $10,000 (£8,100, €9,200) last week.

For more news go to currency.com