January’s major news stories

Portfolio developments:

- US Solar’s manager was the victim of a fraud in relation to contracted construction payments totalling £6.9m. It also announced it was acquiring approximately 177MW portfolio of twenty-two operating utility-scale solar power projects

- Syncona provided an update on its Autolus holding

- JLEN’s NAV was impacted by a fall in the power price. JLEN also made a €25m commitment to Foresight Energy Infrastructure Partners

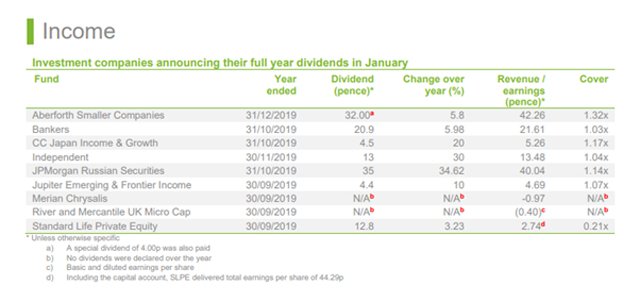

- CC Japan Income & Growth reported annual results as Shinzo Abe became the country’s the longest serving Prime Minister

- Merian Chrysalis reported inaugural annual results

- Hipgnosis acquired music catalogues from Brian Higgins, Ammar Malik and Blink-182. Hipgnosis also announced it had invested £214m of the proceeds of its C share fundraising from October 2019, representing around 95% of the net proceeds

- SQN Asset Finance discussed the problems it is having with anaerobic digestion plants

- Asia-focused Symphony International existed IHH investment with returns of 1.8x original cost

- Jupiter Emerging and Frontier celebrated a good year

- FastForward Innovations sold bond holdings in Cryptologic following the company’s pivot towards cannabis

- Augmentum Fintech invested in a bookkeeping platform

- Gresham House Energy completed a 49MW Red Scar battery storage investment

Corporate news:

- Renewable energy funds came under attack from brokers

- Invesco Income Growth faces a continuation vote

- Sequoia Economic Infrastructure announced it had committed the proceeds of its £280m revolving credit facility

- Henderson Alternative Strategies said it would seek approval for a realisation process

- A private placement by Scottish Mortgage raised £188m

- GCP Asset Backed Income’s credit facility was increased

It was a quiet month of fundraising with no major placings. Impax Environmental Markets, Smithson Investment, JPMorgan Global Core Real Assets, Bankers and City of London were the main issuers of new shares.

Pershing Square regularly leads the sector’s buyback activity. Honeycomb, NB Global Floating Rate Income GBP, Alcentra European Floating Rate Income, Biotech Growth, SME Credit Realisation and Perpetual Income & Growth were the other companies to return more than £10m.

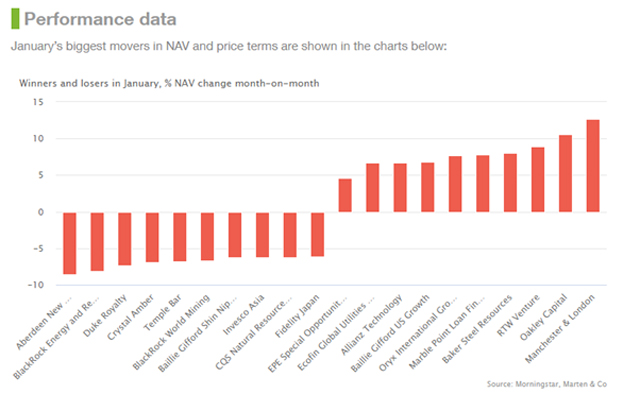

After beginning the year in the ascendancy, helped by easing tensions between the US and Iran, the outbreak of coronavirus in China pulled the breaks on risk assets, particularly hitting Asian and resource funds. Amongst the outperformers, Adamas Finance Asia’s price move stands out. It announced that one of its key positions, Future Metal Holdings, had commenced dolomite production in China.

New life-sciences fund, RTW Venture had the third best NAV return behind Manchester & London and Oakley Capital. Manchester & London’s NAV return owed to good months for tech-based holdings, including Amazon and Alphabet. This helped Allianz Technology too. Elsewhere, Standard Life Private Equity’s annual results were well received. It believes valuation in its core mid-market European focus are less stretched than in the US.

Significant selling has taken place in early February (not included in this roundup), following the end of the Chinese new year celebration. Out of the bottom 10 performers by NAV, seven were either Asian or resource-focused. Aberdeen New Thai’s NAV also declined in December, before the coronavirus outbreak. Still, a ban by China on outbound tour groups into Thailand hit all Thai assets.

BlackRock Energy and Resources Income, BlackRock World Mining and CQS Natural Resources Growth & Income were hit with demand for resources likely to slip markedly over the coming weeks and months.

Elsewhere, SQN Asset Finance Income was hit by a write-down to one of its main loan assets, leading to an exodus in the shares. The pullback in Infrastructure India’s shares came after they nearly doubled over December.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.