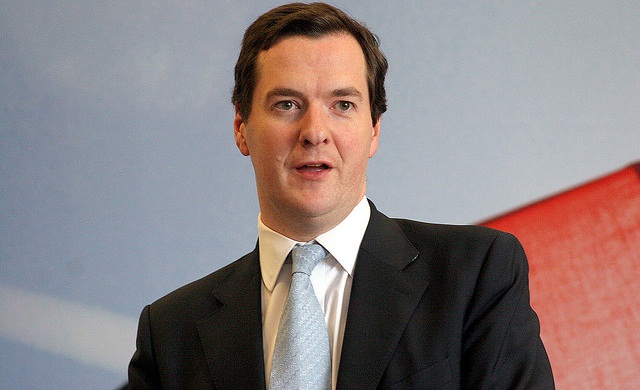

Some folks believe that George Osborne stepped a bit over a political “red line” when he gave instruction to Sir Mervyn King and the Financial Policy Committee (FPC) of the Bank of England to focus on short-term growth as opposed to financial stability. King responded to the seemingly unusual demand, saying that the FPC would “reflect carefully on your recommendation . . . and will wish to respond to you formally in due course.”

It was clear that King did not agree with Osborne’s seven-page remit, the first that the FPC has received since gained actual statutory powers in April. One could easily infer that Sir Mervyn may have been a teeny bit rankled by the Chancellor giving the FPC such clear direction and definition of the committee’s duties and responsibilities, which he already full well knows. Regardless of King’s personal feelings, I believe that the Chancellor was wise to include a review of the committee’s mandates due to the specific instructions he gave.

There is already much ado about the speculation that Osborne is instructing the FPC to sacrifice the permanent on the altar of the immediate – which is how King apparently sees it. However, the Chancellor was really saying, in effect, “This is the government’s strategy. You need to be aware of it and act in support of it.”

To be certain, there are often weighty issues that must be considered with respect to whether a short-term decision will have an adverse effect on long-term strategy. What is less often recognized is that focusing entirely on the long-term goal may cause one to fail to see the need to implement a short-term tactic in order to live another day. There are times when failing to act on a short-term tactic, even though it seems in contradiction to the long-term goal, may mean the death of the vision, such that the long-term goal will never be reached. George Osbourne clearly explain this to King when he said:

“The Financial Policy Committee’s primary objective of contributing to the Bank’s financial stability objective by identifying, monitoring and reducing risks to the resilience of the financial system and its secondary objective relating to economic growth can and, where possible, should be complementary. There may, however, be circumstances where the Committee faces a trade-off between the secondary objective of supporting economic growth in the short term and the primary objective of addressing sources of systemic risk. The materiality of any such trade-offs may vary with the precise circumstances of the financial system at different points of the economic and credit cycles. The Committee is neither required nor authorized by the Act to exercise its functions in a way that would in its opinion have a significant adverse effect on the capacity of the financial sector to contribute to the growth of the UK economy in the medium or long term. Recommendations as to the interaction between the Financial Policy Committee’s objectives.

Any such trade-offs should be managed and communicated transparently and consistently with the Committee’s assessment of the costs and benefits of its actions.”

Perhaps the single most difficult part for King to accept was the portion of Osborne’s cover letter where he laid it on the line that “It is particularly important, at this stage of the cycle, that the Committee takes into account, and gives due weight to, the impact of its actions on the near-term economic recovery.”

After outlining the four key pillars of the government’s economic strategy, Osborne said that “Returning the financial system to full health, so that it can support the wider economy, is a key element of the Government’s comprehensive economic strategy, which is designed to protect the economy, to maintain market confidence in the UK and to lay the foundations for a stronger, more balanced economy in the future.” In this context, the Chancellor is saying that the short-term objective is “returning the financial system to full health, so that . . .” It is the context after “so that” that is the long-term goal.

It would seem to me that this is not an appropriate time for the Bank, the Committee, or Mervyn King to flaunt an air of independence. Rather, they need to realize that they are accountable to the government, which means that they do not have the right or empowerment to conduct themselves in an independent manner which would, thereby, undermine the government’s strategies. The Chancellor was well within his rights and not even close to a red line in explaining this concept to the FPC.

Hot Features

Hot Features