You have got to like a company whose name is Imagination. It just . . . well . . . sparks your own imagination. That’s the case with Imagination Technologies (LSE:IMG). I just can’t help but wonder what is going on, so when they issue an interim management statement, I’m all eyes and ears.

IMG’s share price was up 6.5 pence to 536.5 during the noon hour as investors seemed to be trying to determine how much the good news outweighed the bad.

Actually there really wasn’t anything “bad” per se. It’s just that anything other than a strong positive can make investors skittish in this economy. Speaking of which, the slightly negative news from IMG was that “The continuing macro-economic volatility creates caution among our customers.” BUT, they also said, “Despite this, the licensing pipeline remains very active, although there are uncertainties over the timing of deal closures, particularly as some semiconductor companies in certain regions are undergoing structural and business changes.”

The overriding factor should be that “the momentum in the business has continued strongly (sic), following another robust financial year.”

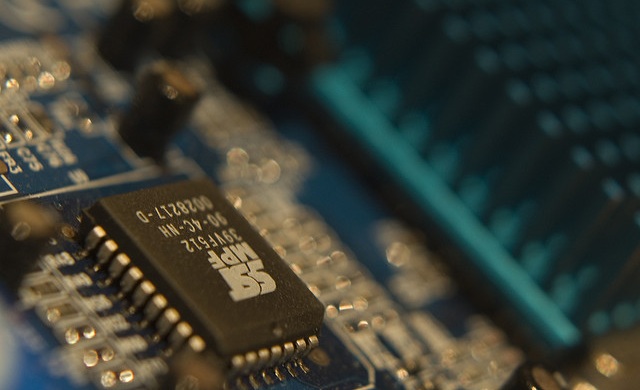

The imagination in IMG is what makes it a leader, not only for today, but for the future. Its proprietary System on a Chip (SoC) is being licensed for broadening use, which in turn is driving the need for IMG to expand its manufacturing operations in order to keep up with customer demand.

IMG announced that a number of new customers were now using IMG SoCs, including Allwinner, Altair, Ceragon, Ingenic, Intel, LG, MediaTek, Renesas, SiS, ST and TI. The crowning jewel, however, is Samsung’s incorporation of IMG’s technologies into their Exynos 5410 Octa. There’s enough reason to be mildly optimistic at the very least. But if it’s not enough to float your boat, LG and Sony are just beginning to ship new smart TVs that boast IMG’s robust graphics technologies.

The company’s commitment to providing leading-edge and market-driven technologies in a business that requires innovation and IMAGINATION should maintain its position as an industry leader. The company has announced that it has already developed and begun to ship new, programmable radio processors that will change the world of wireless. This technology will be a boon as it targets multi-standard, global markets.

IMG noted that it is not only organic growth that is powering the company, it is also strategic acquisitions, such as MIPS. They said that “the growth of open source operating systems such as Android, the trend towards heterogeneous systems/standards, and the advent of technologies that enable the efficient portability of applications across a range of CPU processors, will further drive deployment of MIPS across a wider range of markets.” Planned elements of the MIPS acquisition are expected to contribute some $10 million annually after approximately $8 million in one-off charges.

IMG expects unit shipments to exceed 500 million this year, which ends at April 30th.