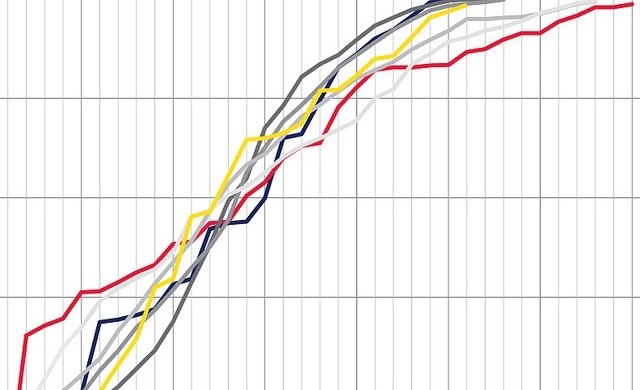

Between 19 September and 24 September the share price of Bumi (LSE:BUMI) dropped 47.7% from 282.00 to 147.60 as tensions mounted between board members, in particular Nat Rothschild, and the Bakrie family over operational irregularities and corporate governance at the company’s Indonesian mining operations.

The last two days have added a new twist to the story as shares have bounced back from 166.00 on 9 October to 283.00 at 13:00 today. So, it seems we are right back where we started on 19 September, right? Technically, yes. But the roller coaster ride that is called “The Big Bumi” isn’t over yet. Azeez Mustapha provided some excellent technical insight for Bumi on the ADVFN site yesterday (See “Go Long on Bumi”), but I would add “caveat emptor”. Technical insight is good, but this is a classic case of where it is just not good enough. Investors need to know more. They need to know the story.

The Bakrie family as now indicated that they want out of the Bumi deal. As is normally the case in ventures of this kind, Bumi has interests in certain Bakrie assets and the Bakrie family owns share in Bumi. The family has made a proposal to the board, although Rothschild has said that their proposal is not a solution to the existing problems. “Rothschild said it would be appropriate to wait until the investigation concludes before commenting on the proposals. “Challenges in implementing appropriate standards of corporate governance … have been a source of friction amongst the board members and shareholders.””

If the board were to accept the family’s proposals in their entirety, Bumi would become a cash shell with about £1.2 billion. Some analysts see that as a good thing. Others do not. I think it could go either way, and that it is way too soon to tell which way it will go. The effect on the share price and the impact on investors is going to be a result of what happens in the board room more than on a fundamentals analysis.

While it sounds pretty good that the £1.2 billion would be equivalent to the amount raised at company’s inception, it takes on an entirely different tone when one considers that there are now twice as many shares in issue as there were in July 2010. Plus, at first blush the offer looks like a boon to individual shareholders as the Bakrie offer was nearly 50% higher than the price as at yesterday’s closing.

But, and it is a BIG BUT, it is not clear that the offer on the table could even come to fruition. First of all, the Bakrie family is strapped for cash, so there is the question of how they will find the money they need to pull off the deal. Second, Rothschild’s opinion has already been stated, but, in addition, he is being asked to completely sacrifice his 6.6% “founder’s bonus” shares in Bumi. Third, Bumi’s chairman, Samin Tan, owns a 23.8% stake in the company. He, and anyone else who bought in initially, would suffer a huge loss. In terms of total investment, Mr. Tan’s loss would be devastating. Fortunately for Mr. Tan, he has enough control to block the entire deal.

While the statistics may indicate getting in and staying in for the long haul, the story suggests not getting in at all. Unfortunately for those who have been in from the beginning, setting an acceptable loss threshold and waiting it out is probably their only viable option. For those folks, I offer my condolences and coin a new phrase: “You win some; you Bumi some.”