Just one day after Michael Wheatley warned the UK banking sector that they have yet to see below the waterline of the iceberg that is looming before them in the form of the FCA, Royal Bank of Scotland (LSE:RBS) CEO Stephen Hester has taken the high ground, indicating that he intends to steer the titanic bank clear of the berg by righting its course from within.

In a speech prepared for presentation at the London School of Economics, Hester said, “The banking industry, in the decade preceding the crisis, was focused on income, it expanded too fast, prioritised sales over service and failed to properly balance the interests of its customers and shareholders with those of its managers.” He went on to describe RBS as “a British poster child for what went wrong in banking.” He said that to fix it is “probably the largest and most far-reaching company restructuring ever (with) about 15 months of heavy lifting still to do.”

Continuing to say all the right things, he pointed out that the bank needs to be teaching employees what is explicitly meant by things such as customer service as a priority and the ethics of business and banking, (Do you mean that they haven’t been?) instead of posting a code of ethics on company bulletin boards. He also explained that he would be expecting more than treating the symptoms, but digging down to “the root cause of the industry’s failings.”

Still his statement that, “The other enormous sadness is that the misconduct of individuals is bad because it is used to reinforce people’s feelings of what banks are like.” Stephen, Stephen, Stephen. The misconduct was conceived and continually carried on by BANK EMPLOYEES. It is not being used to REINFORCE the people’s feelings. It is the REASON for the people’s feelings.

So far, most of what Hester has said and done seems to indicate that he is serious about bringing reform to his bank. But there is one other thing that ruffles my feathers. He announced a quarterly bonus program for branch-based employee bonuses that would reward excellence in customer service. First of all, if he were to ask my advice (which he won’t), I’d suggest that he not mention bonuses at all. In fact, I would suggest that bonuses be axed completely in favour of the scheme that one of my first employers had. Under his leadership, the bonus you got if you did a good job was that you got to keep the job. He would say, “Bonus? You’ve done everything I have asked you to do, and I have paid you everything we agreed to. What is it you have done that I should pay you extra? Have you how noticed how long the unemployment lines are?”

Considering the tens of thousands of people out of work — many of them former RBS employees dismissed in the name of cost reduction — it would be an excellent time to incentivise those who DO NOT perform to acceptable standards by putting them on notice. Given the experienced labour pool that is available, if the branch level employees can’t “do the math”, they shouldn’t be working in a bank anyway. My guess is that someone who is out of work and is trying to feed a family is also someone who is willing to do whatever is asked of them in return for a paycheck — no bonus necessary.

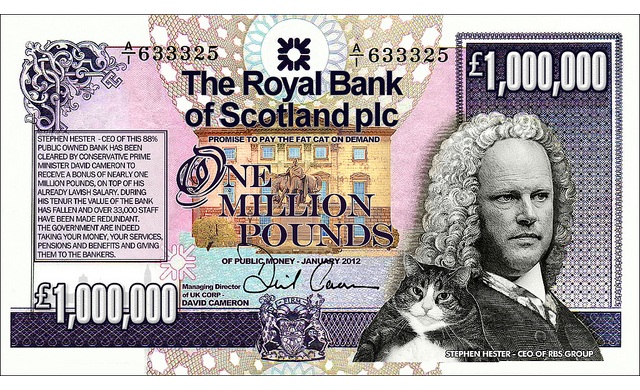

Of course, then you’d probably have to eliminate bonuses all the way up the chain of command. After all, we are the owners of this bank, we are sitting with a £21 billion loss, and we aren’t too keen on paying bonuses until the bank’s business is back in order and profit is being generated as a result of excellent customer service and good business practices. What a concept. To his credit, Hester indicated that bonuses would like be paid in stock instead of in cash. That is an admirable step in the right direction.

Hester reminded his audience that, “All industries can have individuals that are bad apples. All of us need to be clear that this behaviour can’t be tolerated.” We the people agree. That is why we have fruit inspectors. Just remember that, although you may avoid the iceberg, but when you bring that ship into port, our fruit inspectors will be there to be sure the bad apples have been thrown overboard and that everything else at RBS is ship-shape and seaworthy.

Bon voyage!