RBS (LSE:RBS) Group CEO Stephen Hester presented a progress report on the restructuring process of the bank at a conference in London. He concluded that RBS “is nearing the point of becoming a recovered bank, and well on the way to becoming a good bank.”

His PowerPoint presentation demonstrated milestones reached, and objectives yet to reach to achieve the goals of restored reputation; operational integrity, efficiency, and profitability; and privitization. He specifically pointed to the restoration of dividends and the divestment of Direct Line as significant milestones on the way to recovery. Neither of those have happened yet, but Hester speaks with confidence that indicates that they are both imminent. Divesting of Direct Line will satisfy a government mandate for the 82% taxpayer owned bank. Reinstating dividends will provide some level of satisfaction for investors.

He tempered the dividend and divestment milestones, saying that there are still more ahead until the bank can move from “recovered” to “good.” Specifically, he referred to restructuring of markets, completing a turn-around of Ulster Bank, the reducing extraneous, non-core activities. Looking forward to the end of 2013, he is hoping for the bank to be positioned to shed the £130 billion state-supported insurance policy on risk loans and assets. It is at that point that Hester believes the bank will be positioned for the government to begin reducing its stake in RBS. It’s at that point, or somewhere close to that, when Hester will declare that RBS is recovered and on its way to being good.

He realizes that there are going to be obstacles in the way (we avoided saying “bumps in the road” lest readers confuse Mr. Hester’s banking policies with Mr. Obama’s foreign policy). “We have to all deal with the issues of the past and try and reduce the chance of them recurring and that will take a long time and, sadly, a lot of money as well in terms of past restitution.” That represents a lot of belt tightening, shedding of non-essential assets, and additional work force reductions. The pain is not over yet. RBS has set aside £2.0 billion to cover anticipate fines and restitution.

At the moment Hester is contending with two new problems: allegations that RBS managers were complicit in the Libor scandal and a new scheme by the Liberal Democrats to have the government break up the RBS monolith into a covey of much smaller regional banks.

I believe that Mr. Hester has good intentions and, from what I can see so far, a good plan. But I also wonder if good is going to be good enough. Looking beyond the 2013 milestones, Hester in included a “customer centric approach” as leverage for returning to profit normality. He defined the approach as relevant products, helpful banking, and supporting customers. In his final slide, he cited a “huge focus on customer-driven performance and culture.” Those are commendable goals, but my concern is that the words are often no more than lip service and the actions conceived out of those words may be customer-centric, but the are rarely customer-beneficial.

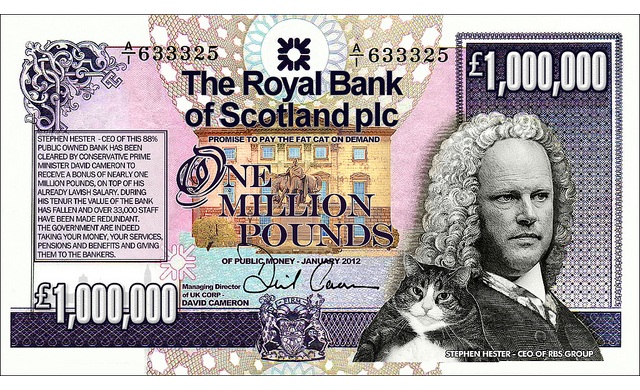

In all due respect, may I suggest that Mr. Hester needs to take the bank from recovered to good, then from good to great. Good is simply not going to be good enough any longer. Good is when the customer-centric and customer driven focus means that the institution will try to determine what it takes to get more of the customers’ money. I humbly submit that a great company will seek their customers’ satisfaction. I’m talking about all the way from the first floor to the top floor. Customers want friendly, courteous service. But they also don’t want that service to be a facade for an institution that they feel is fleecing them every chance it gets. And for the average customer, which the banks need a lot of, seeing exorbitant salaries and bonuses at a bank’s executive level is never going to satisfy customers. For one thing, the bonuses themselves have nothing whatsoever to do with true customer satisfaction. But they sure do have a lot to do with customer irritation.

There is nothing a customer can do to get a bank to change. But Mr. Hester can do plenty. He can develop a culture that sees the customer, not as a source to suck money from, but as an investor in the banks success. He can do it be correlating what his bank does operational to how it is seen and understood by the bank’s customers and how it can reward them as well as the executives. Or, perhaps that’s too radical.

I don’t know about you, but I just can’t get excited about banking at a good bank, although that is currently an admirable goal for Mr. Hester. But I can get excited about doing business with a GREAT bank. And, if by comparison, I recognize a great bank, that’s where I will be banking. Mr. Hester, I encourage you to go beyond good. Do not stop until your customers say, “This is a great bank.”