Heavy trading of stocks of Orogen Gold plc (LSE:ORE), were seen earlier today after the gold explorer hinted a possibility of new gold veins not previously identified, adding to the prospectivity of its Deli Jovan gold project in Serbia, Eastern Europe.

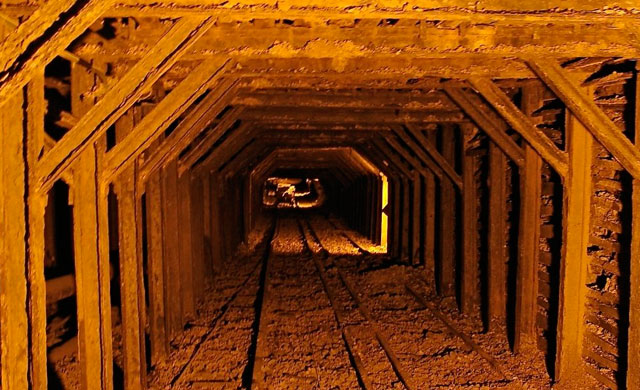

Over 155 million shares swapped ownership by 14:30 GMT, following Orogen Gold’s statement that it has encountered as much as eight metres of gold mineralisation averaging 12.3 grams per tonne (g/t),including three metres having almost an ounce of gold or 29.6 g/t, from an undiscovered zone west of the main zone of the historic Gindusa mine – one of the two mines that comprise the Deli Jovan project.

Orogen Gold holds 55% earn in interest in the said project after spending CDN$1.5 million, in accordance with the Earn-in and Option Agreement with its joint venture partner, Reservoir Minerals Inc., a Toronto-listed mining firm.

Encouraged

Chief Executive, Ed Slowey said the company was “strongly encouraged” of the latest exploration results that discovered new “blind” gold-bearing veins especially in the western section of the Gindusa prospect.

Today’s announcement is the second and latest update of the company’s exploration efforts in what it refers to as a “forgotten” mining district in the Balkan state.

In August 2012, Orogen completed an 18-hole diamond drilling programme, 15 holes of which gold mineralisation at the Gindusa mine at a depth of 280 metres. The results of the remaining three holes, according to the company’s statement today, indicated continuity in the mineralisation and still remain open at depth beyond the previous workings in the mine.

“Our first drilling and trenching at the prospect shows that there are important new discoveries to be made here,” Mr. Slowey commented.

Because of the strongly encouraging results at the Gindusa prospect, Orogen will focus the next phase of its exploration activities in the said sector, as results from the historic Rusman mine, the other portion of the Deli Jovan project, moved the company to downgrade the prospect.

Well-Funded

Mr. Slowey previously said the company intends to secure 20% option interest in the Deli Jovan project and move to the second phase of the exploration.

The company has recently acquired a financing facility worth £5 million (CDN$7.98 million) and raised £1.2 million (CDN$1.9 million), which, together with the company’s cash as at 30th November 2012 of £1.7 million (CDN$2.7 million), will provide the company enough funds to further explore the prospect.

“Orogen is very strongly placed to follow through with a work programme to further test and define the gold potential at Deli Jovan,” the company said in a statement.

Despite the results and the spike in trading, Orogen share price lost its gains earlier and were at the red, losing 3.2% to 0.60 pence at 14:30 PM GMT.