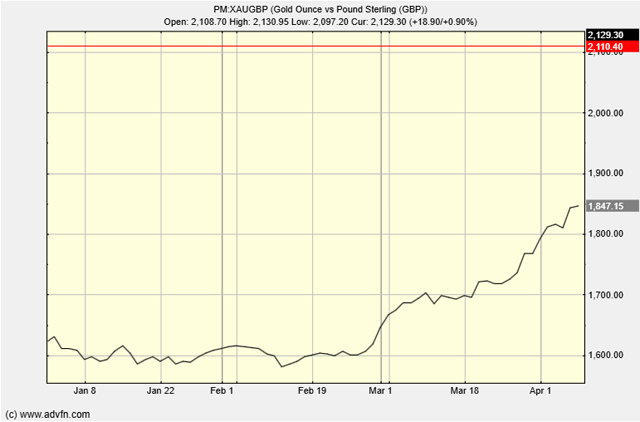

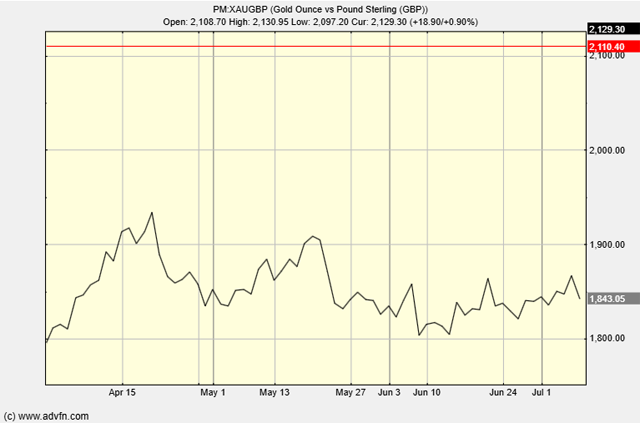

It’s been a record-setting year for the gold price, with the precious metal breaking multiple all-time highs.

In January gold was £1,600, and on 11 December it reached £2,131 – a rise of 33%.

This chart shows its astonishing rise during 2024:

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

What Caused Gold To Rise in 2024?

A number of factors influenced the rise in the gold price during 2024. These include:

| Interest rate cuts | The US Federal Reserve cut the interest rate in September, then again in November, totalling a cut of 75 basis points. |

| Geopolitical instability | The ongoing conflict in Ukraine, unrest in other Eastern European countries, and the continuing tensions in the Middle East, all made gold more appealing to investors seeking stability. |

| Global financial market uncertainty | Volatile markets make it hard for investors to predict future market conditions, so they turn to safe-haven assets such as gold. |

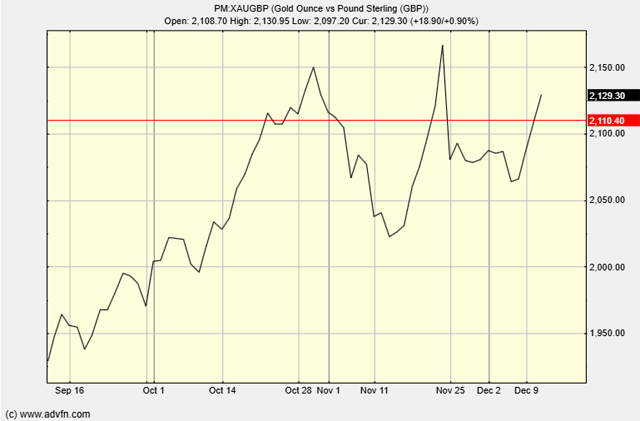

Gold Volatility

The rise in the gold price during 2024 was not a smooth trajectory, and there was considerable volatility at times, particularly in Q4.

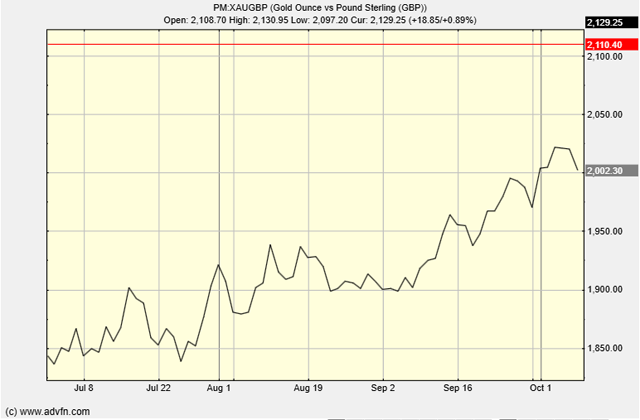

Here is the chart of the gold price during Q4:

At the start of October the price was £1,970. By 3 October it had risen to £2,022, then it fell to £2,002 by 9 October.

However, a surge upwards, fuelled by the September US consumer price index report showing weaker than expected results, saw the gold price set a new record high of £2,150 on 30 October.

This was followed by a retreat at the start of November, with the price dropping to £2,067 on 6 November as Donald Trump celebrated victory in the US presidential election. The following day, the Fed cut interest rates and the price went back up to £2,084. By 11 November, the gold price had fallen to £2,023, but it surged towards the end of the month and on 24 November hit the high for Q4, £2,166. However, this was not sustained and the next day it dropped to £2,080.

At the start of December, the gold price continued to show volatility, but in the last few days it has shot upwards, from £2,064 on 5 December, to an all-time high of £2,130 on 11 December.

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

Geopolitical Factors Affecting The Gold Price in Q4

Some of the geopolitical factors which have affected the gold price in Q4 are:

- Donald Trump’s was re-elected in the US presidential race.

- The US, UK and France authorised Ukraine to use long-range missiles to attack targets deep in Russian territory.

- Russia announced that it was lowering the threshold for nuclear retaliation.

- Russia launched an intermediate-range ballistic missile for the first time which is capable of carrying both conventional and nuclear armaments.

The Gold Price in Other Quarters of 2024

The Gold Price In Q1

For most of Q1 the gold price was relatively stable, but towards the end of March it started to rise, setting a new record price on 31 March of £1,776.

The price was supported by Central Bank buying, in particular the purchase of 22 metric tons of gold by China, and by Turkey, Kazakhstan and India significantly increasing their gold holdings.

Chinese wholesale demand for gold jumped to 271 metric tons in January, the strongest ever recorded, as investors turned to gold as a defence against falling real estate and stock prices, which powered the gold price higher during Q1.

Here is the chart of the gold price during Q1:

The Gold Price In Q2

In Q2 the gold price set a new all-time high on 19 April of £1,934. During Q2 the price was influenced by strong demand from central banks, and a change in investor sentiment towards gold which saw outflows from western exchange-traded funds start to slow.

The Federal Reserve’s announcement at the end of February that it was expecting three or four rate cuts in 2024 was a factor in driving up the gold price during Q2.

Several funds saw increases, including the US-based SPDR Gold Shares (NYSE:GLD), the Sprott Physical Gold Trust (NYSE:PHYS), Ireland’s Royal Mint Responsibly Sourced Physical Gold ETC (LSE:RMAU) and Switzerland’s UBS ETF Gold (SWX:AUUSI).

Here is the chart of the gold price during Q2:

The Gold Price In Q3

During Q3 gold set another record price, hitting £1,938 on 12 August. This came after the Federal Reserve cut the interest rate cut by 50 points.

The People’s Bank of China maintained its pause on gold purchases in the third quarter, but in August it granted several regional banks new import quotas.

There was significant merger and acquisition activity in the gold sector during Q3: South Africa-based Gold Fields (NYSE:GFI) announced plans to acquire Canada’s Osisko Mining (TSX:OSK) for C$2.16 billion, and South African gold miner AngloGold Ashanti (NYSE:AU) agreed to purchase UK-based Centamin (LSE:CEY) for $2.5 billion.

Here is the chart of the gold price during Q3:

The Outlook For Gold In 2025

There are many unknowns which make it hard to predict the gold price for the coming year.

President Trump’s return to the White House could bring in economic policies that cause inflation to start creeping up.

Trump’s foreign policies could create new tensions in the global trade and financial markets, particularly his talk of tariffs.

On the positive side, the inflow into gold ETFs in the latter half of 2024 could reflect long-term sentiment towards gold, and the soaring gold prices during 2024 could attract more retail investors in 2025.

FAQs

1. What makes the gold price go up?

The gold price is affected by many things, including supply and demand, interest rates, economic conditions and geopolitical factors.

2. How does supply and demand make the gold price rise?

Rises in the price of gold occur when demand outstrips supply. Demand for gold comes from jewellery, industry, private investment and central bank reserves. Each sector is affected differently by changes in market conditions.

3. How does supply and demand make the gold price fall?

Falls in the price of gold occur when supply outstrips demand. Demand goes down when investors and central banks divest themselves of gold. This is chiefly because market stability increases confidence that global markets will rise, and investors will accept greater exposure to riskier investments.

4. Is the gold price the same all over the world?

The gold price is usually denominated in US dollars but it is valued against all currencies you can buy or trade it in. If the GBP weakens the £/oz will increase. If the USD weakens or strengthens it will affect the GBP/Gold price but they still move independently to some extent.

5. Does the value of the dollar affect gold prices?

Yes, the gold price is usually inversely correlated with the value of the US dollar. A strong dollar keeps gold prices lower, and a weak dollar is likely to raise gold prices.

Sponsor message – Download your free gold investor guide

In this free investor guide we look at why the price of gold has continued to hit new highs and review the best gold opportunities available to private investors.

Hot Features

Hot Features